According to BIDV Securities (BSC), Vietnam’s stock market stands an 80% chance of being upgraded to “Secondary Emerging” status by FTSE Russell during the October 2025 review. This upgrade would mark a significant milestone for the country’s financial landscape.

The transition process is expected to unfold in two phases, spanning 6–12 months, allowing global investment funds to adjust their portfolios accordingly. In a more conservative scenario, where foreign investors require additional time to assess Vietnam’s reforms, the approval could be delayed until March 2026, with a 20% probability.

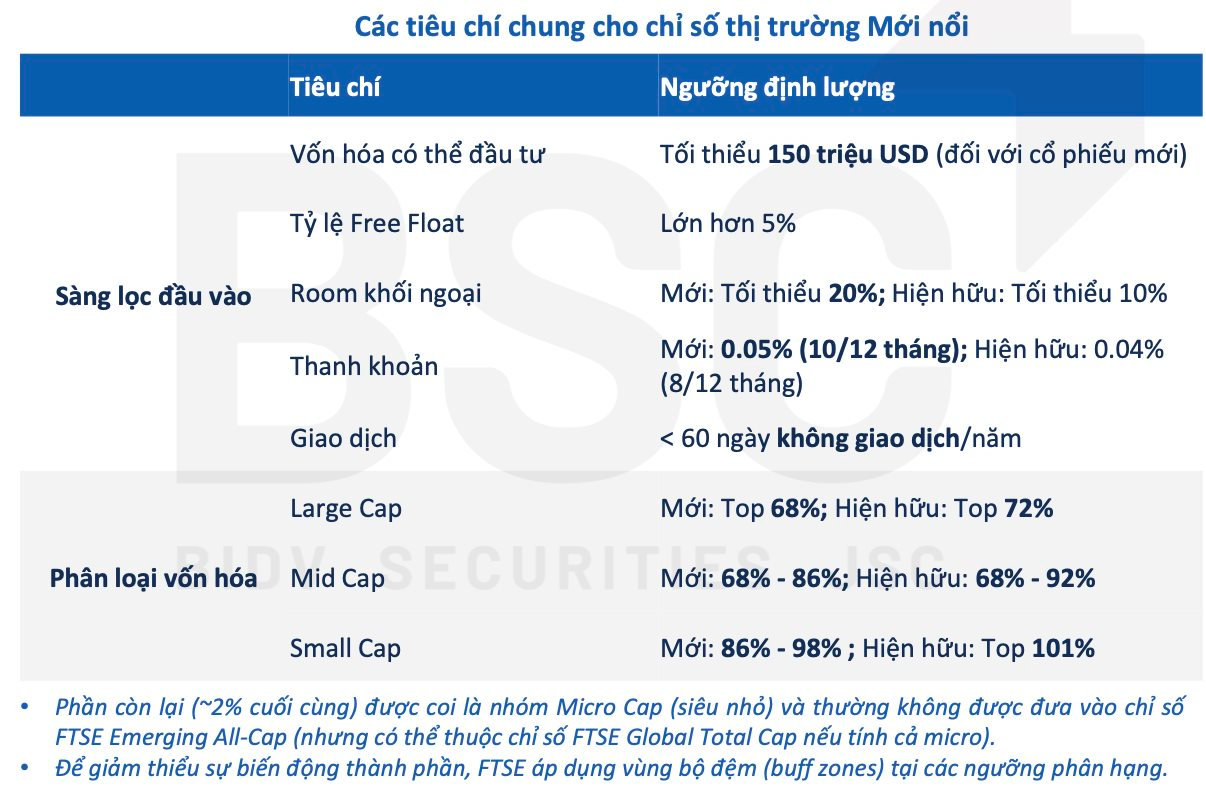

FTSE’s criteria for stock inclusion mandate a minimum market capitalization of $150 million, a free-float ratio exceeding 5%, and a remaining foreign ownership limit of at least 20% for new stocks. For existing index constituents, the minimum foreign ownership retention is set at 10%. Additionally, stocks must maintain consistent liquidity, with a minimum trading value of 0.05% of total market capitalization in at least 10 out of 12 months, and no month should have more than 60 days without trading activity.

Market reclassification impacts not only the upgraded country but also other markets. When a country moves from Frontier to Emerging status, its stocks are removed from the Frontier index, prompting the purchase of remaining stocks to maintain index weightings. Conversely, in the new Emerging index, stocks from the upgraded country may face initial selling pressure as funds rebalance their portfolios, followed by gradual inflows during subsequent rebalancing periods.

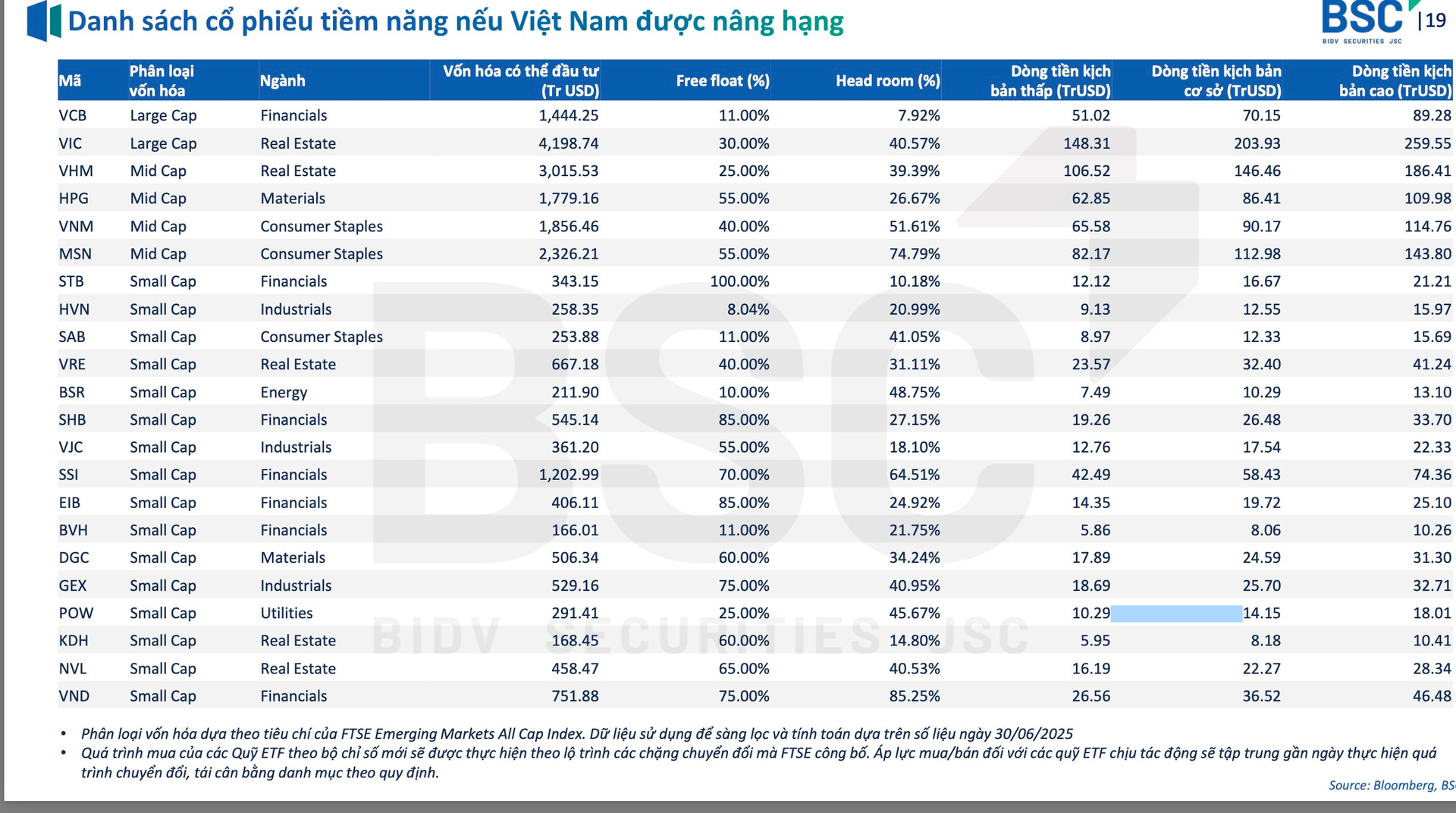

BSC’s calculations suggest that an upgrade could result in substantial passive inflows, with hundreds of millions of USD directed towards large-cap Vietnamese stocks. Leading the pack are VIC (Vingroup) and VHM (Vinhomes), which could attract over $200 million and $146 million, respectively, in the base scenario.

VCB (Vietcombank), the sole banking representative in the Large Cap group, is estimated to draw $70–90 million, depending on fund allocation ratios. As a sector leader with substantial market capitalization, Vietcombank is well-positioned to attract foreign investment upon Vietnam’s upgrade.

Consumer staples are also poised to benefit, with VNM (Vinamilk) and MSN (Masangroup) expected to see net purchases of $90–115 million and $110–145 million, respectively.

Notably, HPG (Hoa Phat), a materials sector stock with a 55% free-float ratio, could attract over $86 million, thanks to its leadership in the steel industry and compliance with FTSE’s stringent liquidity requirements.

BSC emphasizes that these estimates are preliminary, based on global ETF allocation models. Nonetheless, they underscore the potential for billions of USD in inflows should Vietnam’s upgrade materialize, signaling a new era of growth and opportunity for the nation’s capital markets.

Which Stock Codes Were the Heroes Behind VN-Index’s Near 50-Point Surge in the Week’s Opening Session?

Today’s VN30 basket closed with 29 stocks in unanimous ascent, led by SSI, VPB, and VRE hitting their upper limits, firmly bolstering each upward stride of the benchmark index.

Vietnam’s Stock Market Maintains Long-Term Outlook Despite October Upgrade Results

FTSE Russell is set to announce the results of its review on upgrading Vietnam’s stock market to Secondary Emerging status. Regardless of the outcome, experts predict that the market’s long-term positive trajectory remains unwavering.