The Ho Chi Minh City Stock Exchange (HOSE) has recently announced the Decision to Issue Regulations for the Construction and Management of the Vietnam Dividend Growth Index (VNDIVIDEND). This index tracks the performance of dividend-paying growth stocks.

Specifically, the VNDIVIDEND comprises a minimum of 10 and a maximum of 20 constituent stocks, selected from the VNAllshare Index. These stocks must meet specific screening criteria.

The VNDIVIDEND price index is calculated based on adjusted free-float market capitalization, with caps applied to individual stock and sector weights, as well as growth rate limits for constituent stocks.

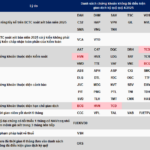

In the initial two steps, stocks are selected from the VNAllshare Index and must meet the following criteria: listed on HOSE before year T-5 (where T is the review year), a free-float market capitalization (GTVH_f) exceeding VND 2,000 billion, average daily trading value (GTGD KL) above VND 8 billion, and average daily trading volume (KLGD KL) over 100,000 shares (for stocks in the previous index basket); or average daily trading value above VND 10 billion and average daily trading volume over 200,000 shares (for stocks not in the previous basket). Additionally, net profit in the last four quarters must be positive.

After meeting these conditions, in Step 3, HOSE further filters stocks that have consistently paid cash dividends for three consecutive fiscal years prior to the review year (T-5, T-4, and T-3).

In Step 4, stocks must satisfy one of the following conditions: a dividend payout ratio (DIVIDEND_RATIO) of at least 80% (for stocks in the previous basket) or at least 100% (for stocks not in the previous basket).

DIVIDEND_RATIO – Dividend Payout Ratio (3-year average)

represents the cash dividend paid in fiscal year T-2 relative to the average dividend paid over the three preceding fiscal years (T-5, T-4, and T-3). Dividend data is based on the Final Registration Date Announcement.

From the list of stocks meeting all criteria, if more than 20 stocks qualify, the top 20 with the highest DIVIDEND_RATIO (prioritizing stocks from the previous basket and higher GTVH_f in case of ties) will be included in the final index basket.

If 10 to 20 stocks qualify, all will be included in the final index basket.

If fewer than 10 stocks qualify, all will be included, and additional stocks with the highest DIVIDEND_RATIO (prioritizing higher GTVH_f in case of ties) from the list of stocks meeting Step 3 criteria will be added until the basket contains 10 stocks.

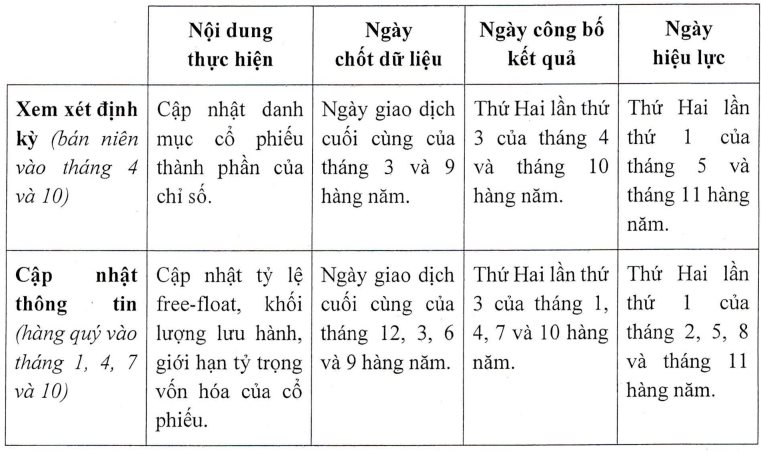

Periodic Review Schedule of the Index Basket

Vietnam’s stock market has seen the emergence of funds focused on high-dividend-paying companies. In late 2023, Dragon Capital’s DCBC fund was renamed the “DC Dividend Focused Equity Fund – DCDE”. Its new strategy allocates 100% of its assets to stocks of companies with a consistent dividend payment history across all sectors. The revised strategy excludes investments in listed bonds, public offerings, and private placements.

Previously, on August 11, 2025, HOSE introduced regulations for the VNMITECH Index (tracking modern industrial and technology stocks) and the Vietnam Growth 50 Index (VN50 Growth), derived from the VN50 Index.

Two Stocks Suspended from Trading on HOSE

BCG and TCD have been suspended from trading on HoSE, escalating from their previous restricted trading status. This decision stems from violations related to the disclosure of financial reports.