Excitement swept through the stock investment community on October 6th as a sea of green dominated the trading board. A surge of capital flooded the market, propelling numerous stocks to soar, with some even hitting the daily limit up, fueled by investor enthusiasm.

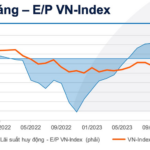

At the close, the VN-Index climbed nearly 50 points (+3.02%) to reach 1,695.5 points, edging closer to its historical peak. Trading volume on HoSE improved compared to recent sessions, with order-matching value exceeding 29.5 trillion VND.

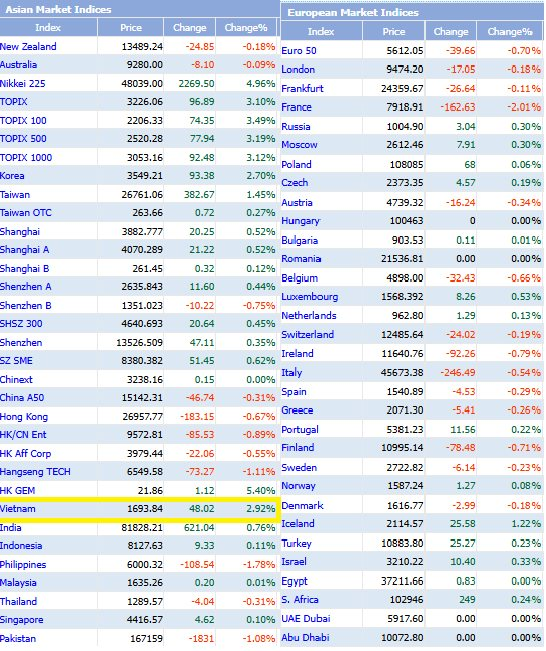

This marked the strongest single-day gain for the VN-Index in over a month, since the historical high set in early September. The 3.02% increase also positioned Vietnam’s stock market among the world’s top performers on October 6th.

The market’s upbeat performance reflects investors’ heightened optimism, particularly as the announcement of the market upgrade decision draws near.

On the morning of October 8th, Vietnam time (following the close of the US market on October 7th), FTSE Russell will release its September 2025 Country Classification Report. Notably, Vietnam is currently on the Watch List and is highly anticipated to be reclassified from Frontier to Secondary Emerging Market status.

At the recent Q3 press briefing by the Ministry of Finance, Deputy Minister Nguyen Duc Chi addressed the market upgrade issue. He stated that regulators have implemented comprehensive measures to ensure the sustainable development of the stock market, aligning with strategic goals.

Over the past period, authorities have collaborated closely to introduce new policies. The Government has enacted amended laws and issued decrees and circulars, while the State Bank has coordinated efforts. Additionally, regulators have engaged with international organizations regarding market classification.

“I believe this process is progressing effectively. While the final decision rests with competent authorities, I affirm that the State Securities Commission will continue to work closely with relevant agencies and international organizations to ensure Vietnam’s stock market is evaluated fairly, objectively, and transparently,” said the Ministry of Finance leader.

Deputy Minister Nguyen Duc Chi added that the upgrade is just the beginning; maintaining this status and striving for higher milestones in the future is essential. “This is a pivotal moment for the stock market’s development, fostering greater transparency to support businesses in capital raising, thereby driving the capital market and economy forward,” he remarked.

Vietcap Securities holds an optimistic view, believing FTSE Russell will deliver a favorable outcome for Vietnam on October 8th. Following the announcement, index funds will initiate account opening procedures (including securities trading code registration) for corresponding funds. Vietcap forecasts the implementation will occur in 4-5 phases at the end of each quarter, with the first portfolio addition expected as early as March 2026.

According to Vietcap, upgrading Vietnam to Secondary Emerging Market status will serve as a positive counterbalance to the substantial net selling pressure from foreign investors, which has exceeded 9 billion USD from 2023 to 2025. International brokerages estimate net foreign inflows could reach 6-8 billion USD, or even 10 billion USD in an optimistic scenario. These projections include both active and passive fund flows, with active funds dominating.

Meanwhile, NHSV Securities estimates that if FTSE upgrades Vietnam to Emerging Market status, the Vietnamese stock market could attract approximately 1.5 billion USD in passive capital and 1.9-7.4 billion USD in active capital (depending on Vietnam’s actual weighting in the index).

Which Stock Codes Were the Heroes Behind VN-Index’s Near 50-Point Surge in the Week’s Opening Session?

Today’s VN30 basket closed with 29 stocks in unanimous ascent, led by SSI, VPB, and VRE hitting their upper limits, firmly bolstering each upward stride of the benchmark index.