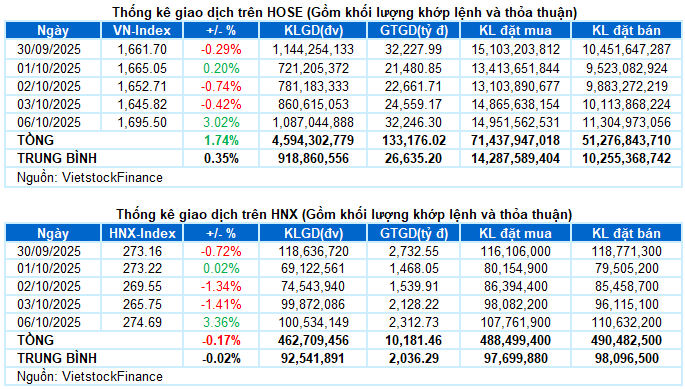

I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON OCTOBER 6, 2025

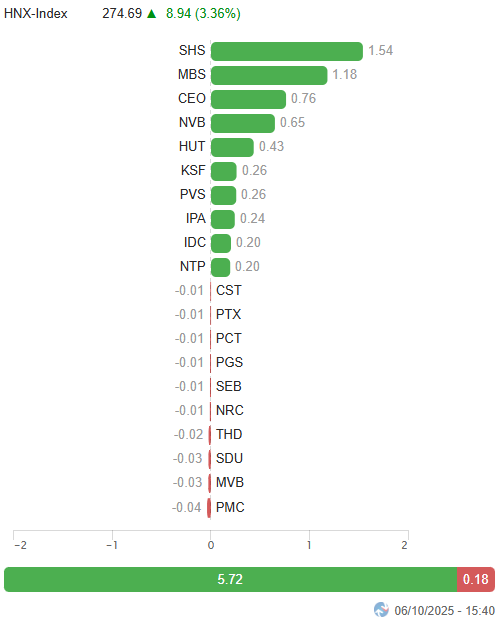

– Major indices surged strongly during the October 6 trading session. Specifically, the VN-Index reached 1,695.5 points, up 3.02%; the HNX-Index also rose by 3.36%, closing at 274.69 points.

– Matching volume on the HOSE increased by 23.4%, reaching 1 billion units. The HNX recorded over 95 million matched units, up 14.2% from the previous session.

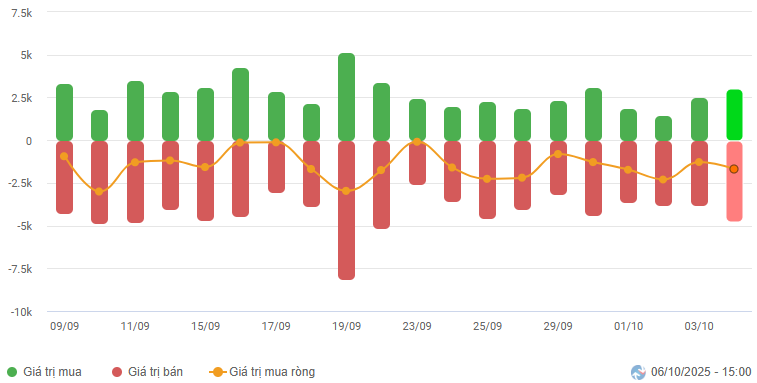

– Foreign investors continued to net sell with a value of over VND 1.6 trillion on the HOSE and over VND 38 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

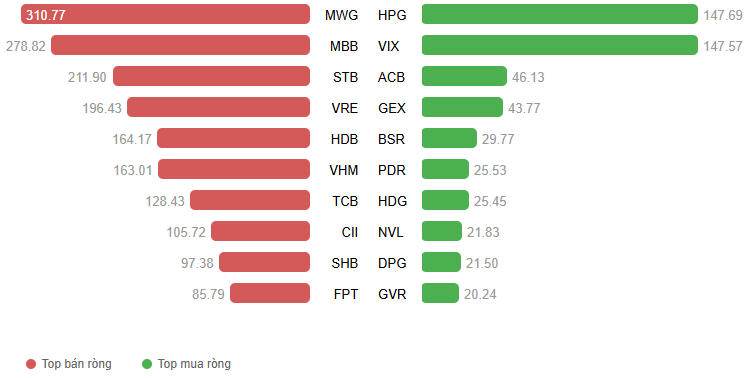

Net Trading Value by Stock Code. Unit: Billion VND

– Vietnam’s stock market exploded strongly in the October 6 session. After a slight shake-up at the beginning, buying pressure quickly dominated, especially in large-cap stocks, helping the VN-Index accelerate and maintain a steady green throughout the morning session. In the afternoon session, liquidity spread wider, pushing the index up strongly towards the end, with many blue-chip stocks widening their margins. At the close, the VN-Index gained nearly 50 points, closing at 1,695.5 points.

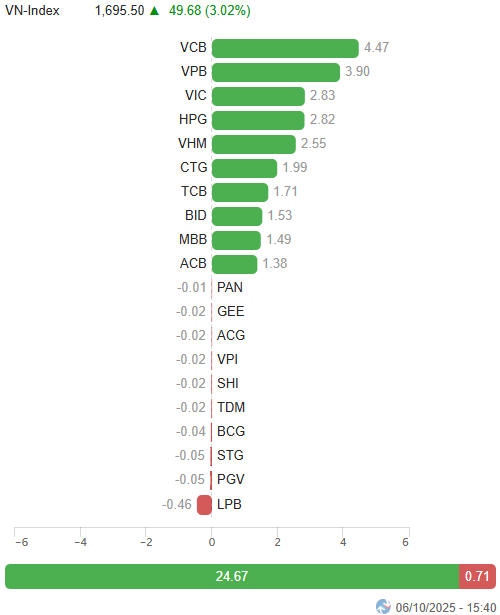

– In terms of impact, VCB and VPB were the two pillars contributing most positively to the VN-Index, adding 4.5 points and 3.9 points, respectively. Following were VIC, HPG, and VHM, which collectively added over 8 points to the index. The total impact of the 10 most negative stocks only subtracted 0.7 points from the index, reflecting the dominance of buyers.

Top Stocks Influencing the Index. Unit: Points

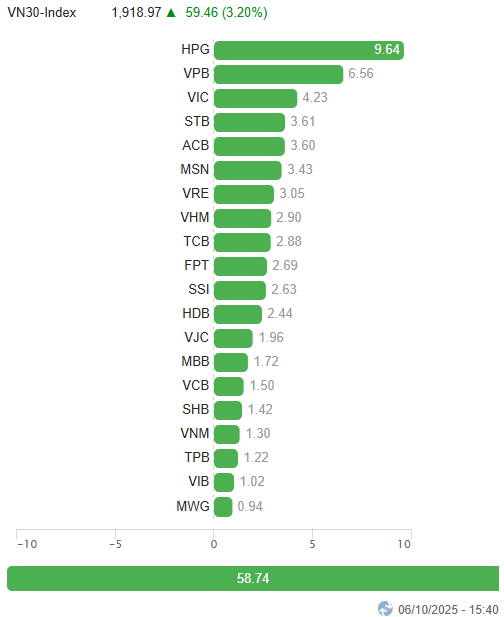

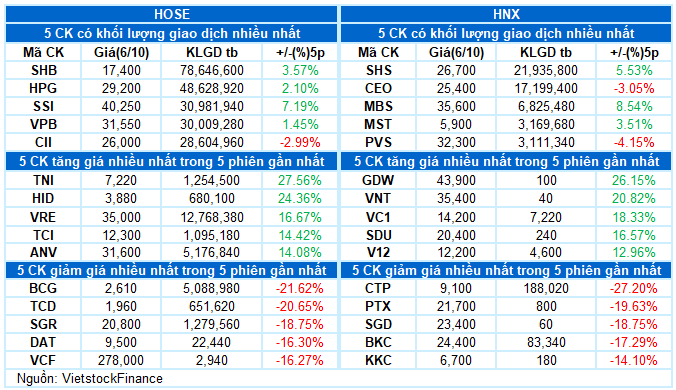

– The VN30-Index closed with a strong surge of nearly 60 points, equivalent to 3.2%, reaching 1,918.97 points. Buyers dominated with 29 gainers and only 1 loser, LPB, down 1.3%. On the upside, SSI, VPB, and VRE stood out with impressive gains. Additionally, TPB, HPG, STB, ACB, HDB, SHB, and VIB all rose over 4%.

Green returned across all sectors. The financial sector became the market’s main driver, with strong breakouts in banking and securities stocks. Numerous stocks turned purple, including SSI, VPB, SHS, VND, VIX, HCM, VCI, CTS, VDS, DSE, ORS, and AGR, along with many others rising over 4%, such as STB, ACB, HDB, SHB, VIB, TPB, MBS, and EIB.

Following were the materials and energy sectors, which also surged over 3%, with standout performers including HPG (+5.61%), GVR (+3.18%), MSR (+2.6%), DCM (+4.15%), DPM (+2.29%), HSG (+4.16%), NKG (+5.69%); BSR (+4.61%), PLX (+2.09%), PVS (+2.54%), PVD (+2.88%), and PVT (+2.54%).

Additionally, real estate stocks had an impressive trading session, with strong gains across the board, notably VRE, DIG, and PDR hitting their ceilings, VHM (+2.7%), DXG (+5.99%), NVL (+4.64%), CEO (+8.09%), NLG (+5.76%), and HDC (+5.58%).

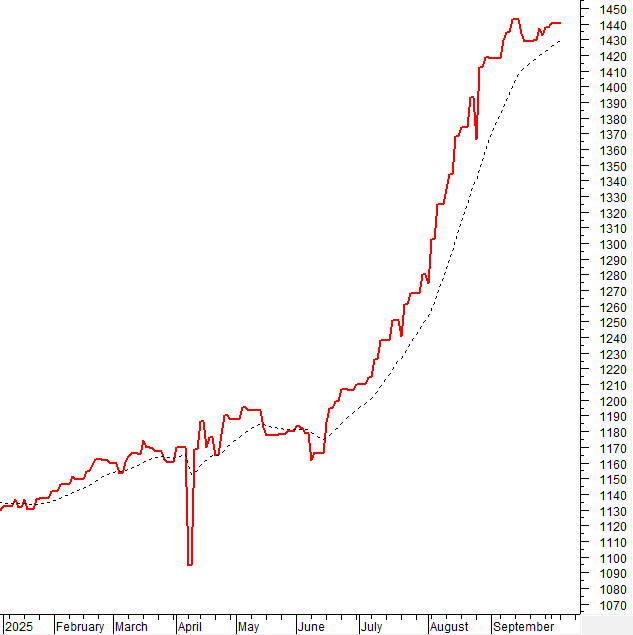

The VN-Index surged past the Middle line of the Bollinger Bands. Trading volume exceeded the 20-day average, and the Stochastic Oscillator gave a buy signal, reducing short-term risks.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Breaking Through the Middle Line of Bollinger Bands

The VN-Index recovered strongly and broke through the Middle line of the Bollinger Bands, with volume exceeding the 20-day average.

The Stochastic Oscillator reversed and gave a buy signal, reducing short-term risks.

The August 2025 low (equivalent to the 1,600-1,630 point range) held firm during recent corrections.

HNX-Index – August 2025 Low Holds Firm

A Big White Candle pattern appeared in the October 6, 2025 session, indicating a return of positive sentiment.

The August 2025 low (equivalent to the 265-270 point range) provided strong support for the HNX-Index.

The short-term outlook for the index will continue to improve if the MACD and Stochastic Oscillator give buy signals in upcoming sessions.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this continues in the next session, the risk of a sudden downturn (thrust down) will be limited.

Foreign Investors’ Liquidity Flow: Foreign investors continued to net sell in the October 6, 2025 session. If foreign investors maintain this action in upcoming sessions, market volatility may increase.

III. MARKET STATISTICS ON OCTOBER 6, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 17:08 October 6, 2025

Peter Lynch’s Simple Secret to Beating the Market Revealed

“If you don’t understand what you own, you’re bound to fail miserably.” This timeless advice comes from Peter Lynch, the legendary investor who once overshadowed even Warren Buffett in fame during his era. Lynch made this mantra the cornerstone of his approach while managing Fidelity Investment’s Magellan Fund from 1977 to 1990, cementing his legacy as one of history’s most successful fund managers.

Market Pulse 06/10: Green Dominates as VN-Index Surges Nearly 50 Points

At the close of trading, the VN-Index surged by 49.68 points (+3.02%), reaching 1,695.5 points, while the HNX-Index climbed 8.94 points (+3.36%) to 274.69 points. Market breadth was overwhelmingly positive, with 542 advancing stocks and only 194 declining ones. Similarly, the VN30 basket saw a dominant green trend, with 29 gainers and just 1 loser.

Why Investors Must Stay Patient Despite Continuous Stock Market Erosion

Contrary to the anticipated positive market upgrades, stock investors are grappling with the dilemma of whether to cut their losses or hold onto their shares.