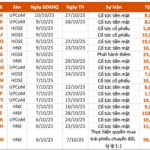

This week, 19 companies announced dividend record dates. Among them, 14 firms will pay cash dividends, 3 will issue stock dividends, 1 will conduct a share issuance, and 1 will execute a rights offering.

SGP Divests Stake

The Ho Chi Minh City Stock Exchange (HoSE) announced the suspension of trading for VMD shares of Vimedimex Pharmaceutical JSC due to non-compliance with information disclosure regulations.

HoSE will suspend trading of VMD shares as per regulations.

On September 16, HoSE issued a warning for VMD due to a delayed submission of the 2025 semi-annual audited financial report, exceeding the 15-day grace period. HoSE requested VMD to disclose measures and a timeline to address the warning. However, as of October 2—15 days past the deadline—VMD failed to comply, leading to the trading suspension.

In July, Vimedimex requested a three-month extension from the State Securities Commission and HoSE to submit its 2025 semi-annual report, citing force majeure.

Saigon Port JSC (ticker: SGP) approved the divestment of its entire stake in Saigon Port Logistics JSC (SPL).

SGP will offer 1.1 million SPL shares, representing 74.13% of equity, via a private placement to domestic investors. The starting price is set at VND 27,926 per share (valuation-based), totaling over VND 31 billion per lot, with a minimum bid increment of VND 1 million.

This divestment aligns with SGP’s 2024 restructuring plan to focus on core projects, including equipment upgrades at Saigon-Hiep Phuoc Port and Can Gio Port development. As of June 2025, SGP’s investment in SPL had a book value of VND 11.1 billion, with VND 1.5 billion provisioned for impairments.

Previously, SGP announced plans to sell its entire 5.15 million-share stake in Maritime Bank (MSB) to optimize its financial portfolio.

Vinamilk’s Generous Dividend

On October 17, Chuong Duong JSC (ticker: CDC) set the record date for a bonus share issuance of nearly 8.8 million shares at a 100:20 ratio. Shareholders will receive 20 bonus shares for every 100 held.

The issuance, valued at nearly VND 88 billion (par value), will be funded from retained earnings per the 2024 audited financials. Post-issuance, CDC’s charter capital will rise from VND 439 billion to VND 527 billion.

Vinamilk allocates nearly VND 5.96 trillion for dividend payments.

Additionally, CDC approved a rights issue of nearly 53 million shares at VND 10,000 per share, with a 1:1 subscription ratio.

Transimex JSC (ticker: TMS) will pay a 10% cash dividend for 2024 (VND 1,000 per share) on October 9. With 169 million shares outstanding, the payout totals over VND 169 billion.

Eight major shareholders will benefit most. Ryobi Vietnam Logistics (20.96% stake) leads with VND 35.5 billion, followed by Prosper Logistics (17.31% stake) at VND 29.3 billion.

On October 17, Vinamilk (ticker: VNM) set the record date for a 28.5% cash dividend: 3.5% for 2024 and 25% as an advance for 2025. With 2.09 billion shares, the payout totals nearly VND 5.96 trillion. Earlier, VNM paid 40% in interim dividends for 2024.

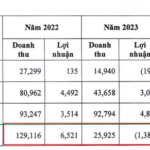

From Business Efficiency to Brand Power: Vinamilk Maintains Its Leadership Position

Recently, Vinamilk (HOSE: VNM) was honored as one of the Top 10 Strongest Vietnamese Brands in 2025. This prestigious recognition is part of the Vietnam Strong Brand Program, initiated in 2003 by VnEconomy – Vietnam Economic Times, a leading Vietnamese economic magazine.

Saigon Port to Fully Divest from Member Logistics Company

The Board of Directors of Saigon Port (UPCoM: SGP) has approved the divestment of its entire stake in Saigon Port Logistics JSC (SPL). This strategic move aims to restructure the investment portfolio and focus resources on key projects, including the Hiep Phuoc Port and Can Gio Port.

Unlock Profitable Returns Through Strategic Investor Relations

Investing in Investor Relations (IR) isn’t an expense—it’s a strategic move that can save your business money. Once trust is established, maintaining investor loyalty and attracting new capital becomes more cost-effective. A robust IR strategy is the key to achieving this. Think of IR as a profitable investment, not a cost.