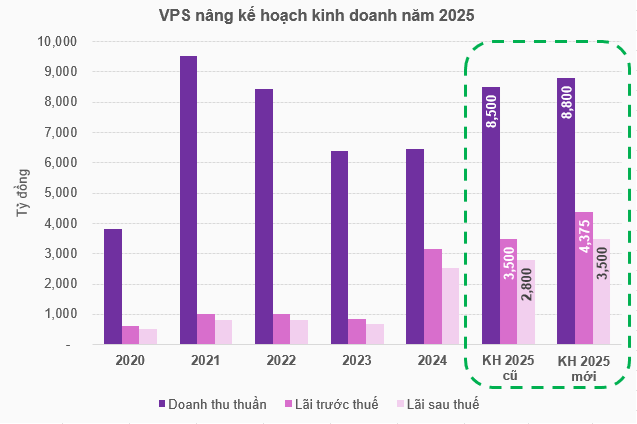

Specifically, adjusted net revenue was revised from VND 8.5 trillion to VND 8.8 trillion, a slight increase of 3.5%; pre-tax profit from VND 3.5 trillion to nearly VND 4.4 trillion, up 25%; and after-tax profit from VND 2.8 trillion to VND 3.5 trillion, also up 25%.

Source: VietstockFinance

|

In the first half of 2025, VPS generated nearly VND 3.2 trillion in net revenue, a slight decrease of nearly 3% compared to the same period last year. However, VPS ultimately reported pre-tax and after-tax profits of nearly VND 1.8 trillion and over VND 1.4 trillion, respectively, both surging by 40%.

Key activities such as proprietary trading saw a 57% profit growth, reaching VND 430 billion; lending revenue increased by 21%, surpassing VND 1 trillion. Additionally, financial activities yielded a modest profit of nearly VND 19 billion, compared to a loss of over VND 179 billion in the same period last year. Conversely, the brokerage segment’s profit declined by 44%, recording only nearly VND 207 billion.

Compared to the newly set plan, the leading securities company achieved 36% of its revenue target and 41% of its profit target.

In a recent development, on September 24, VPS held its second extraordinary shareholders’ meeting of 2025, approving several significant items, notably three capital increase plans to raise the charter capital to a maximum of over VND 16.4 trillion.

Accordingly, the company plans to issue 710 million bonus shares in Q4/2025 and 2026; offer up to 202.31 million shares in an initial public offering (IPO) from Q4/2025 to Q1/2026; and issue 161.85 million shares privately in 2025 or 2026.

If all three capital increase plans are completed, the company’s share count will rise from over 570 million to over 1.64 billion, corresponding to a charter capital increase from VND 5.7 trillion to over VND 16.4 trillion, nearly tripling in size.

The IPO plan has garnered significant attention, with an offering price of no less than VND 22,457 per share—the book value per share as per the audited semi-annual financial statements of 2025. The company also announced plans to list its shares on the HOSE following the IPO. If the offering is completed but listing conditions are not met, the company commits to registering its shares for trading on UPCoM.

Recently, VPS launched its IPO microsite, outlining the implementation roadmap.

Source: VPS Website

|

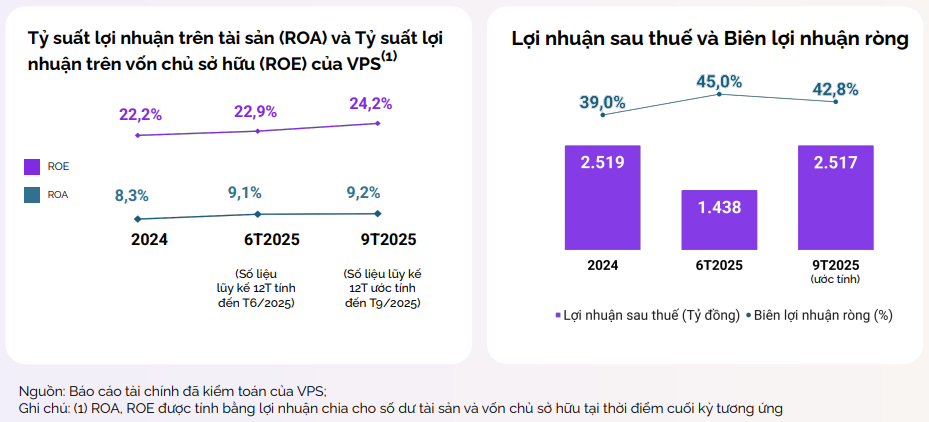

Notably, according to updated materials sent to investors on September 29 ahead of the IPO, VPS estimates an after-tax profit of over VND 2.5 trillion for the first nine months of 2025. With a reported after-tax profit margin of 42.8%, the company’s net revenue is projected at nearly VND 5.9 trillion. These figures represent 67% and 72% of the newly set revenue and profit targets, respectively.

|

VPS estimated business results for the first nine months of 2025

Source: VPS

|

At the recent extraordinary shareholders’ meeting, VPS shareholders also approved another notable item: the cancellation of the private convertible bond issuance previously approved at the first extraordinary meeting held earlier this year.

“Based on market conditions, the Board of Directors deems that issuing bonds at this time is no longer appropriate,” stated the VPS Board of Directors.

– 11:15 07/10/2025

PV Power to Issue Nearly 726 Million Shares, Boosting Capital Beyond 30 Trillion VND

PV Power is set to simultaneously execute three capital increase strategies by issuing and offering a combined total of nearly 726 million shares, thereby boosting its chartered capital beyond 30,000 billion VND.