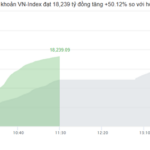

After weeks of sideways movement and adjustment pressures, Vietnam’s stock market rebounded strongly in the first trading session of the week on October 6th. The benchmark index, VN-Index, opened with a gap up and maintained positive momentum throughout the day, driven by improved liquidity and robust performance in the financial sector. At the close, the VN-Index surged 49.63 points (+3.02%) to 1,695.50.

Market breadth favored buyers, with 259 advancing stocks (including 22 at the upper limit) versus only 68 decliners on the Ho Chi Minh City Stock Exchange (HOSE). Trading volume also rebounded significantly, reaching nearly VND 32 trillion.

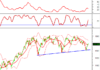

The VN30 basket saw 29 out of 30 constituents closing in the green, led by SSI, VPB, and VRE hitting their ceiling prices. Sector-wise, the resurgence of securities, real estate, and banking stocks propelled Vietnam’s market to become one of the world’s top performers.

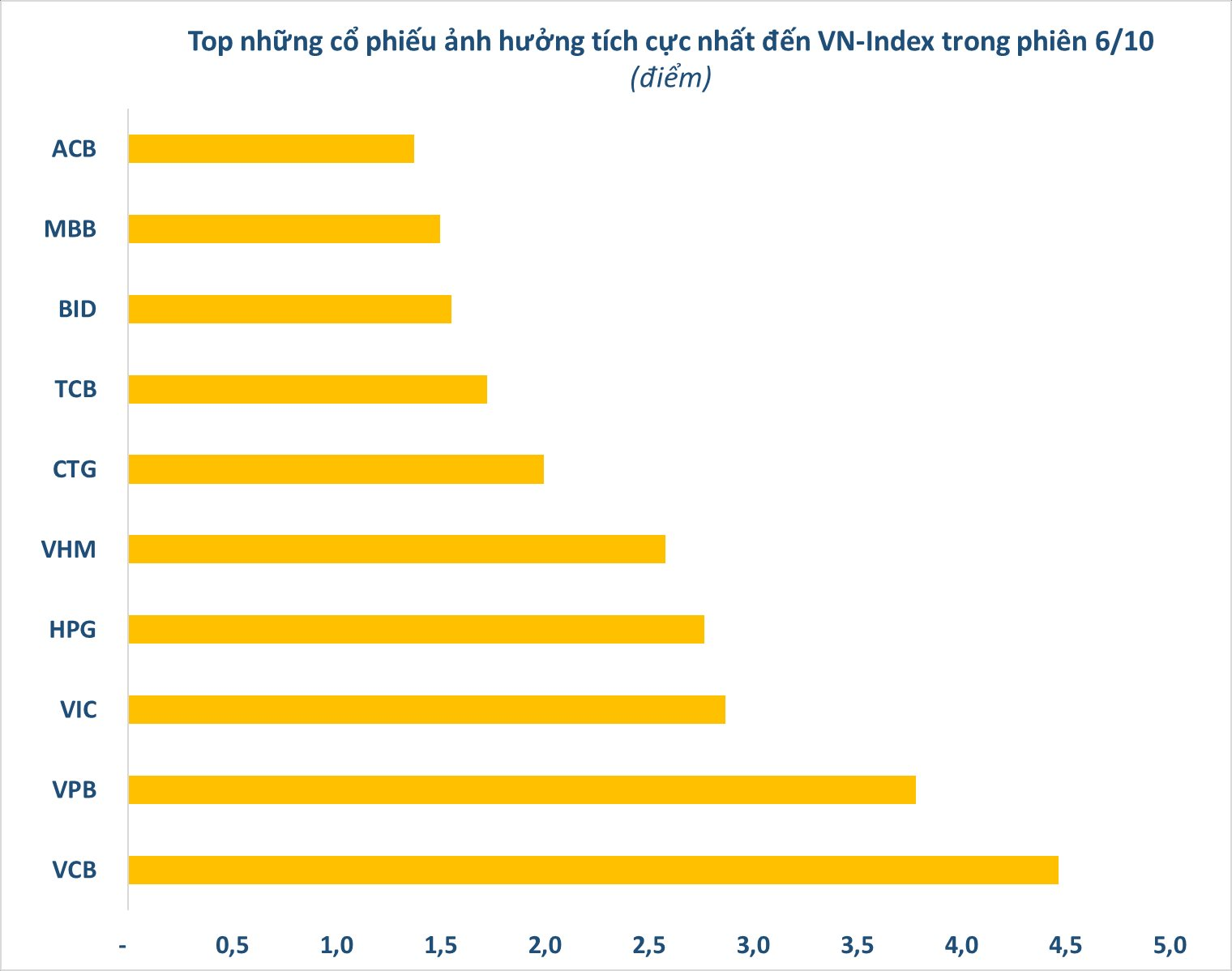

Among individual stocks, banking heavyweights VCB and VPB were standout contributors, adding 4.7 and 3.8 points to the VN-Index respectively. VCB climbed 3.7% to VND 64,000, while VPB hit its ceiling at VND 31,550 with no sell orders.

Other banking stocks like CTG, TCB, BID, MBB, and ACB also rallied, acting as key drivers of the market’s upward trend.

Vingroup’s VIC and VHM rose approximately 2%, collectively contributing 5.4 points to the index. Steel giant HPG gained 5.6% to VND 29,200, adding 2.8 points to the VN-Index.

On the downside, stocks like LPB, STG, PGV, BCG, and TDM somewhat restrained the VN-Index’s gains, though their impact was limited.

The market’s breakout occurred amid positive domestic macroeconomic news. According to the General Statistics Office, Q3 2025 GDP grew an estimated 8.23% year-on-year. For the first nine months, GDP expanded 7.85%—the highest in 11 years, excluding the post-Covid rebound in 2022.

Investors are eagerly awaiting a crucial announcement: FTSE Russell will release its September 2025 Country Classification Report on October 8th (Vietnam time). Vietnam is on the Watch List for potential reclassification from Frontier to Secondary Emerging Market status.

Vietcap Securities remains confident FTSE will deliver a positive verdict. They expect Vietnam to meet requirements for Delivery versus Payment (DvP) and failed trade-related costs, both critical for the upgrade.

A successful upgrade could attract $6-8 billion in foreign investment, or even $10 billion under optimistic scenarios. This includes both active and passive fund flows, with active funds dominating.

Vietcap estimates Vietnam would represent 0.3% of the FTSE Emerging Markets All Cap China A Inclusion Index, with approximately 30 stocks added to index funds. Passive inflows alone could reach $1 billion during implementation.

Pinetree Securities’ analyst Nguyen Tan Phong believes an upgrade is likely, fueling VN-Index gains. However, he notes sustainable rallies require strong banking sector inflows and broader market participation.

Market Pulse 07/10: A Divided Market with Cautious Capital Flows

The vibrant red hue intensified, exerting significant pressure on the index. By the close of the morning session, the index settled at 1,694.87 points, experiencing a slight decline of 0.6 points. Meanwhile, the HNX-Index dipped by 0.2 points, concluding near the 275-point mark.

Market Pulse 06/10: Green Dominates as VN-Index Surges Nearly 50 Points

At the close of trading, the VN-Index surged by 49.68 points (+3.02%), reaching 1,695.5 points, while the HNX-Index climbed 8.94 points (+3.36%) to 274.69 points. Market breadth was overwhelmingly positive, with 542 advancing stocks and only 194 declining ones. Similarly, the VN30 basket saw a dominant green trend, with 29 gainers and just 1 loser.