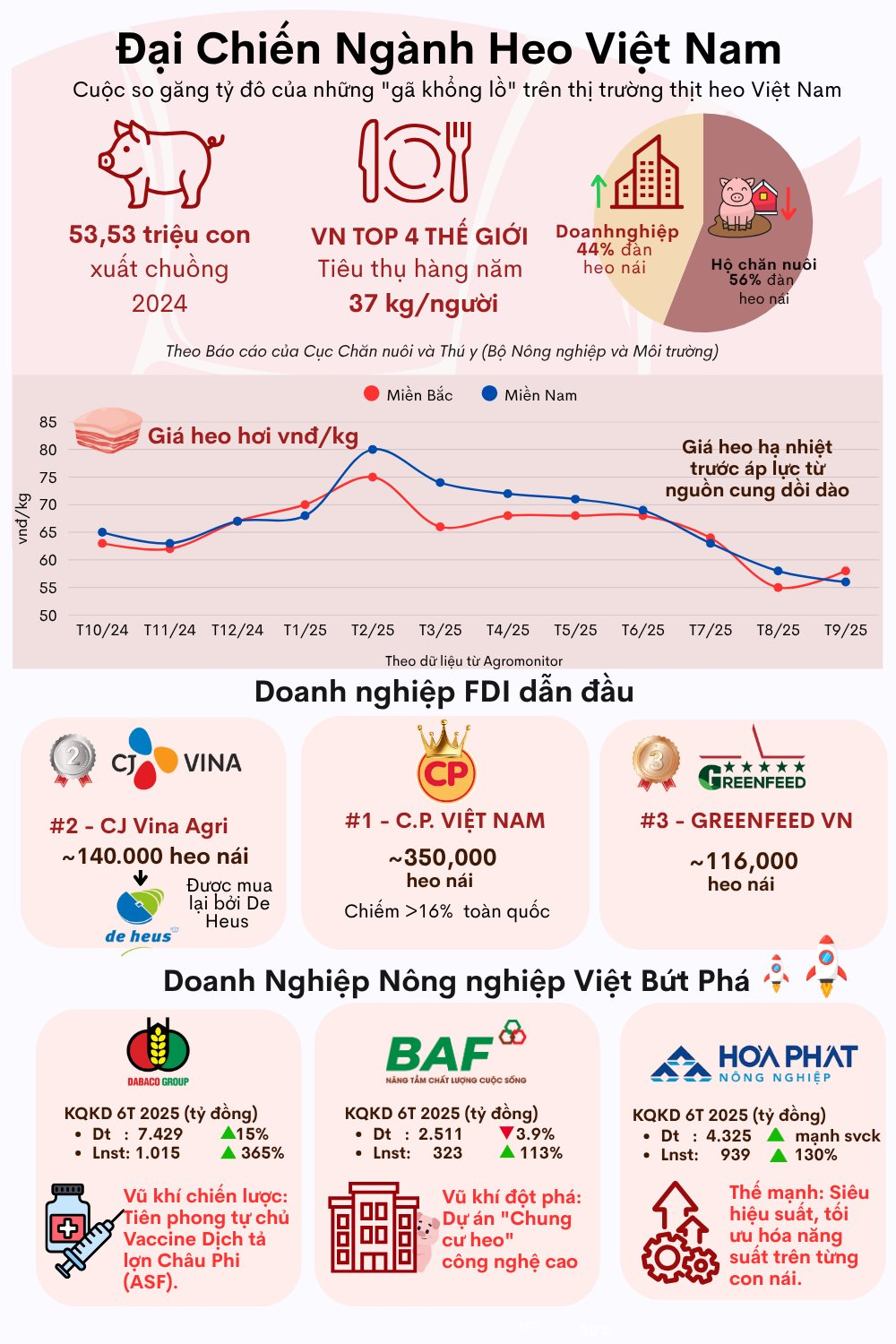

With Vietnam’s pork consumption ranking among the top four globally, industrial livestock farming trends are being driven by major corporations. Under the Livestock Law, these companies now control 44% of the nation’s total sow population.

In this competitive landscape, foreign-invested enterprises (FIEs) dominate in scale. AgroMonitor’s June 2025 data reveals C.P. Vietnam (Thailand) leads with approximately 350,000 sows, capturing over 16% of the national market share. CJ Vina Agri (South Korea) and Greenfeed Vietnam follow closely behind.

Notably, De Heus Group’s (Netherlands) recent $850 million acquisition of CJ Feed & Care underscores Vietnam’s appeal to FIEs.

Domestic firms, however, are implementing unique strategies to enhance competitiveness. Dabaco Group leverages its self-sufficiency in African Swine Fever (ASF) vaccines.

BAF Vietnam focuses on high-tech “pig condominium” models, while Hoa Phat Agriculture prioritizes efficiency optimization. This ambition is further solidified by Hoa Phat Agriculture’s recent IPO filing, with a planned listing by late 2025.

These strategies are yielding results. First-half 2025 financials show Dabaco, BAF, and Hoa Phat Agriculture all posting profit growth compared to 2024. This shift indicates that market share competition will increasingly hinge on technological integration and value chain optimization, beyond mere scale.