According to the announced resolution, Taseco Airs will execute an interim dividend payment for 2025 in cash at a rate of 25%, equivalent to VND 2,500 per share. With 45 million outstanding shares, the company is expected to disburse approximately VND 112.5 billion for this interim dividend.

The capital for this dividend will be sourced from the accumulated undistributed after-tax profit as of June 30, 2025. The final registration date for shareholders is October 17, 2025, with the expected payment date being October 24, 2025.

Lucky Cafe & Fastfood at Tan Son Nhat Airport Terminal T3.

Taseco Airs is a diversified airport service provider, offering a wide range of services including souvenirs, food and beverages, duty-free goods, VIP lounges, telecommunications, transportation, and travel services through over 120 outlets nationwide as of the end of 2024.

The company holds a 29.29% stake in Vietnam Airlines Catering Services Joint Stock Company (VINACS), which operates two catering facilities at Noi Bai and Cam Ranh international airports, providing in-flight meals with a total designed capacity of 20,000 meals per day.

Additionally, Taseco Airs manages the 4-star À La Carte Hotel located on My Khe Beach, Da Nang.

As the parent company holding 51% of Taseco Airs’ capital, Taseco Group is expected to receive approximately VND 57.4 billion from this dividend payment.

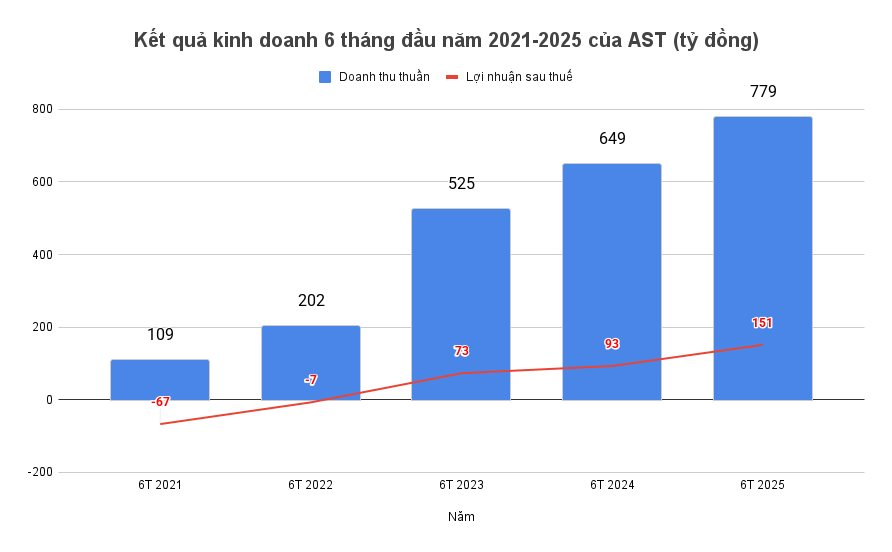

The decision to pay dividends is based on the positive consolidated business results for the first half of 2025. Specifically, Taseco Airs recorded consolidated net revenue of VND 778.6 billion, a 20% increase compared to the same period last year. Notably, consolidated after-tax profit reached VND 151.3 billion, a 163% growth compared to the first six months of 2024.

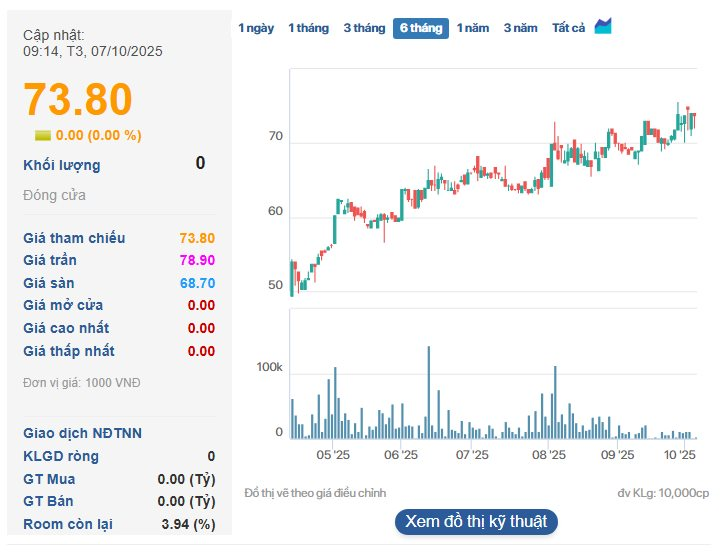

According to the company’s explanation, this growth is attributed to increased passenger traffic, expanded business locations, and optimized operational models. This positive development is also reflected in the AST stock price, which has seen a nearly 50% increase over the past six months, rising from VND 50,000 per share to VND 73,800 per share.