On the morning of October 7th, Tien Phong Newspaper and the National Payment Corporation of Vietnam (NAPAS) co-hosted the Vietnam Card Day 2025 seminar, themed “One Touch, Endless Trust – Shaping the Future of Digital Payments.”

Speaking at the event, Deputy Governor of the State Bank of Vietnam (SBV), Pham Tien Dung, expressed gratitude to the organizers for their partnership with the SBV and the banking sector over the past five years through the Vietnam Card Day initiative.

He emphasized, “Without the support of the media, Vietnam would not have achieved the current rate of 87% of adults using bank accounts. This is crucial because without an account, nothing can be accomplished. To encourage account openings, the banking sector must provide excellent and convenient services, while the public needs to understand, support, and participate. The media plays a vital role in helping the SBV achieve this.”

Mr. Pham Tien Dung – Deputy Governor of the State Bank of Vietnam.

Addressing public payment services, the Deputy Governor reflected, “Regardless of how advanced banking services, particularly payment services, become, if commuters still need to wear multiple cards around their necks on different train lines, we have not fulfilled our responsibility to the public.”

He urged banks to enhance collaboration to integrate existing payment methods for use in public transportation, especially trains and other transit systems.

Since 2017, China has implemented mobile payments for subway travel. In Japan, mobile apps are used not only for train tickets but also for bus fares and even everyday purchases.

Today, we can proudly assert that Vietnam’s payment services, especially automated payments, are on par with those of developed nations. With a large population using public transit, this presents a significant opportunity for the banking sector to address this issue.

Solutions must ensure convenience, benefits, and reasonable costs. It’s unacceptable for a 15,000 VND train ticket to incur a 1,000 VND transaction fee.

Attendees at the seminar.

Deputy Governor Pham Tien Dung acknowledged that the seminar provided a comprehensive overview of the banking and payment services sector, offering practical solutions for future challenges. The banking and payment services industry is significantly contributing to socio-economic development, with rapid growth. For instance, NAPAS processes transactions worth up to 120 trillion VND daily, equivalent to 6 billion USD—a previously unimaginable figure.

In closing, he urged banks and related entities to continue working together to ensure the public enjoys the best possible services. Ultimately, the goal is to provide citizens and businesses with convenient and cost-effective banking services. If services are not utilized, even the most eloquent words hold no value.

Tech Trends Reshaping Finance: Insights from Expert Nguyen Xuan Thanh

Mr. Nguyen Xuan Thanh, from Fulbright University, asserts that the banking sector is entering the era of artificial intelligence, and those who lag in innovation risk being left behind.

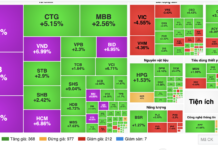

Skyrocketing Credit Growth Forecast Sparks Inflation Concerns: 15-Year High Predicted

As of the end of September, the economy’s credit growth has reached 13.37% compared to the beginning of the year. It is estimated that credit growth for this year could hit 19-20%, the highest level in 15 years. The State Bank of Vietnam emphasizes ongoing monitoring to ensure both economic growth and inflation control.

SHB Joins Vietnam Card Day 2025, Accelerating Cashless Payments

As the official sponsor of Vietnam Card Day 2025, Saigon-Hanoi Commercial Joint Stock Bank (SHB) is set to deliver cutting-edge, secure payment experiences and exclusive rewards to its customers, particularly the Gen Z demographic. This initiative aims to promote a cashless lifestyle within the community, fostering a seamless and modern financial ecosystem.

Appointment of the Director of the State Bank’s Transaction Department

On October 3rd, the State Bank of Vietnam (SBV) held a conference to announce the Governor’s decision regarding the appointment of the Director of the SBV Transaction Department. Deputy Governor Pham Thanh Ha attended the conference, presented the decision, and delivered a speech outlining the new director’s responsibilities.