Garmex’s Board of Directors has approved the transfer of land use rights for a 50,173m² plot, along with all structures on the land, located in Tan Thanh Ward, Ho Chi Minh City (formerly known as Hac Dich Commune, Tan Thanh District, Ba Ria – Vung Tau Province). The transaction, valued at VND 313 billion (excluding VAT), will be conducted through a designated process with a 1% brokerage fee.

The asset is owned by Tan My Garment Company Limited, a wholly-owned subsidiary of Garmex with a chartered capital of VND 15 billion. The sale of this land was previously approved by shareholders in a written survey conducted in April 2024, alongside the proposed transfer of assets in Garmex Quang Nam.

Tan My Garment Factory, the venue for Garmex’s Annual General Meeting in late June 2024 – Photo: The Manh

|

Unsold Assets at Auction

On April 19, 2024, Garmex’s Board of Directors approved the transfer of land use rights and construction works at Lot B/B2, Ha Lam – Cho Duoc Industrial Cluster, Thang Binh District, Quang Nam Province. The 26,000m² plot, owned by Garmex Quang Nam (a 100% subsidiary), has a usage term until May 2063 and an initial price of VND 156 billion. Despite two auction attempts, the sale was unsuccessful.

Additionally, Garmex faces challenges in resolving asset agreements with Phu My Joint Stock Company, a 32.47%-owned affiliate. The Tan My Garment Worker Housing project, invested in 2007-2008 with a total cost of over VND 11 billion (remaining value: VND 6.2 billion), has a proposed liquidation value of VND 35 billion. However, Phu My only agrees to VND 11 billion, a discrepancy rejected by shareholders at the 2024 Annual General Meeting.

Tan My Garment Factory and Phu My Company within the Hac Dich Industrial and Handicraft Cluster – Photo: Google Maps

|

Liquidating Assets: A Daunting Task

At the 2024 Annual General Meeting, Garmex’s leadership explained the difficulties in liquidating large-scale assets like land and factories, despite public auctions, brokerage fees, and multi-channel partner searches. Garmex only sells assets no longer in use, while maintaining operational factories.

As of late June 2025, the company still holds over VND 13 billion in unfinished construction costs, primarily for land at 213 Hong Bang (District 5, Ho Chi Minh City). This site was once earmarked for a VND 300 billion high-rise medical service center in collaboration with the University of Medicine and Pharmacy Hospital. The project stalled for years, and the partnership was terminated in 2015. Currently, Garmex operates a pharmacy here, generating VND 177 million in revenue for the first half of 2025.

Garmex Saigon Joint Stock Company Branch – Hong Bang Logistics Center at 213 Hong Bang, former District 5, Ho Chi Minh City. Photo: The Manh

|

From Leading Garment Manufacturer to Prolonged Losses

Once boasting five factories and over 4,000 employees at its peak, Garmex now employs only 29 staff after halting all garment operations in May 2023 due to a lack of orders. Legal disputes between Gilimex, Garmex’s primary contractor, and Amazon have disrupted operations, leaving Garmex with VND 109 billion in inventory, including VND 15 billion in provisions.

The company now relies on leasing space and operating a pickleball sports facility, earning VND 508 million in the first half of 2025. However, this revenue is insufficient to cover expenses, resulting in a reviewed loss of VND 14.3 billion and accumulated losses exceeding VND 118 billion.

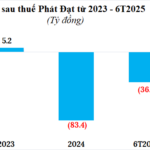

| Garmex’s Business Results from 2016 to H1 2025 |

Plans to resume garment operations at the Quang Nam factory in March 2025 with 1,200 workers remain unrealized. The company will continue monitoring Phu My Joint Stock Company to advance the worker housing project while relying on leasing as its primary revenue source.

After being delisted from HOSE, GMC shares resumed trading on UPCoM on February 12, 2025, under restricted conditions. Currently, the stock trades at VND 4,500 per share, down 44% year-over-year and nearly 80% from its September 2022 peak.

| GMC’s Three-Year Downward Trend |

– 15:30 07/10/2025

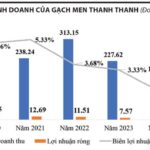

The End of an Era: Vietnam’s Construction Industry Icon Ceases Production After Decades of Dominance

This historic decision marks the culmination of a decade-long downward spiral of business fortunes and insurmountable relocation pressures. Notably, the parent company, the First Construction Materials Corporation (FICO), is also grappling with a challenging year in terms of financial performance.

The Textile Business: Market Rebound Yields Fruitful Exports

According to the Chairman of Vitas, the global scale growth for the textile industry in 2024 showed no significant transformation or remarkable growth. However, Vietnam witnessed a surge in growth by successfully riding the wave of order diversification.