According to the newly released report, GELEX Electric’s consolidated net revenue in Q3/2025 reached over VND 6,444 billion, a 14.7% increase compared to the same period in 2024. Semi-finished product sales accounted for 97% of this figure, totaling VND 6,246 billion, nearly a 15% rise year-over-year.

Consolidated pre-tax profit for Q3/2025 hit VND 2,202 billion, surging 317% compared to the same quarter last year. This remarkable growth is attributed to the expansion of core business segments, enhanced cost management in production, and restructuring of investment portfolios, all contributing to an improved gross profit margin.

For the first nine months, GELEX Electric recorded VND 18,235 billion in revenue, a 25% increase year-over-year. Pre-tax profit reached VND 3,532 billion, up 162%. Core business segments generated VND 2,059 billion in pre-tax profit during this period, a 93% increase compared to the same period last year (VND 1,067 billion).

As of Q3/2025, the company has achieved 76.6% of its annual revenue target and exceeded its pre-tax profit goal by 101%.

-thumb.jpg)

GELEX Electric owns nine subsidiaries, manufacturing and supplying a comprehensive range of electrical products across the value chain, from transmission to distribution and consumer goods.

|

The company’s impressive performance is driven by strong contributions from its subsidiaries, including CADIVI (cables), THIBIDI (transformers), and EMIC (electrical measuring instruments). Their focus on core business areas, adaptive sales strategies, and commitment to R&D have been key growth drivers. Additionally, cost optimization through technology integration in management, operations, and production has further enhanced efficiency.

As of September 30th, GELEX Electric’s total assets reached VND 15,141 billion, a 17% increase since the beginning of 2025, primarily due to a 49% rise in current assets. Cash and cash equivalents stood at VND 835 billion, up 21%.

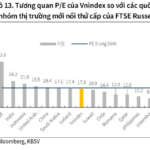

Financial ratios, including debt-to-equity, remain stable and within safe limits, reflecting the company’s robust business performance and management practices. This has bolstered investor confidence in GELEX Electric.

Capitalizing on industry potential and favorable macroeconomic conditions, GELEX Electric is guiding its subsidiaries to focus on producing high-tech, environmentally friendly electrical equipment for smart grids. The company is also exploring partnerships to develop innovative products such as fire-resistant cables, fire prevention solutions, security systems, and monitoring equipment.

Services

– 12:00 08/10/2025

82.5% of Manufacturing Businesses Anticipate Improved Business Conditions in Q4 2025

In the fourth quarter of 2025, a survey on business trends within the manufacturing and processing industry reveals optimistic projections. Approximately 40.8% of businesses anticipate an improvement in trends compared to the third quarter of 2025, while 41.7% expect stable production and operations. Conversely, 17.5% of enterprises foresee more challenging conditions ahead.

VN30-Listed Firm Projects 90% Annual Profit Target Achievement in Q3

Leading securities firms SSI, BVSC, VDSC, and VCBS have released their Q3/2025 earnings forecasts for a range of companies. Notably, several businesses are projected to achieve double-digit growth. In the retail and consumer sector, Masan Group Corporation (HOSE: MSN) stands out with an estimated profit of VND 1,700 billion, marking a 31% year-on-year increase. The company itself anticipates even higher figures, driven by sustained growth across multiple business segments.

Vietnam’s Q3 GDP Growth Hits Record High Since 2011: What Does This Mean for 2025’s First Nine Months?

The latest report from the General Statistics Office (Ministry of Finance) on the socio-economic situation highlights that Vietnam’s economy in the third quarter and the first nine months of 2025 has achieved remarkably positive results, with each month and quarter showing continuous improvement. This progress is particularly notable given the ongoing uncertainties in the global and regional economic landscape.

Thuận An Timber Estimates 27% Decline in Pre-Tax Profit for First Nine Months

On September 25th, Thuan An Wood Processing JSC (HOSE: GTA) announced its estimated business results for the first nine months of 2025. The company reported total revenue exceeding 197 billion VND and pre-tax profit of 5.5 billion VND, representing a 7% and 27% decline year-over-year, respectively.