Australia anticipates gold to become its second most valuable export resource, surpassing liquefied natural gas (LNG), due to geopolitical uncertainties driving demand for this safe-haven metal.

The Department of Industry’s September quarterly report forecasts Australia’s gold exports to surge by AUD 12 billion (USD 7.9 billion) to AUD 60 billion (USD 39.68 billion) in the current fiscal year ending June 2026. This growth is attributed to increased gold exports at higher prices.

This would overshadow Australia’s LNG exports, projected to decline to AUD 54 billion this fiscal year and further to AUD 48 billion next year, reflecting falling oil prices.

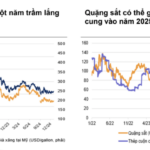

The report highlights that lower U.S. interest rates are expected to sustain gold prices above USD 3,200 per troy ounce over the next two years. Gold reached a record high on October 6 and is currently trading near USD 4,000 per ounce, bucking the trend of most other Australian resource export revenues.

Total resource and energy export earnings for Australia are forecasted to drop by 5% to AUD 369 billion in the current fiscal year, followed by a further decline to AUD 354 billion in the subsequent year.

“Commodity markets are factoring in slower global growth due to heightened trade barriers and monetary conditions remaining restrictive or neutral in the U.S.,” the report stated.

Iron ore remains the cornerstone of Australia’s resource export earnings, accounting for over 25% of total resource and energy revenue in the next two years.

The report revised iron ore price forecasts upward by 10%, to an average of USD 87 per tonne this fiscal year compared to June projections, driven by steel demand supported by a proposed hydroelectric dam in Tibet and China’s efforts to curb steel overcapacity.

Overall, Australia faces a downward trend in iron ore revenue, expected to decrease by AUD 3.9 billion to AUD 113 billion in 2025-2026, and further to AUD 103 billion in 2026-2027.

Source: Reuters

The Next Big Gas Supplier: Europe’s New 5.6 Million Tonnes/Year Project

The country’s factory output is expected to surge to 14 million tons per annum with the completion of these production lines.

Commodity Prices in 2025: Gold to Hit $3,000/ounce, While Oil and Iron Ore Remain Lackluster?

In 2025, Goldman Sachs predicts gold prices will soar to $3,000 per ounce by year-end, as the Fed is expected to cut interest rates twice. This forecast is influenced by the uncertainty surrounding Trump’s policies and their potential impact on the global economy.