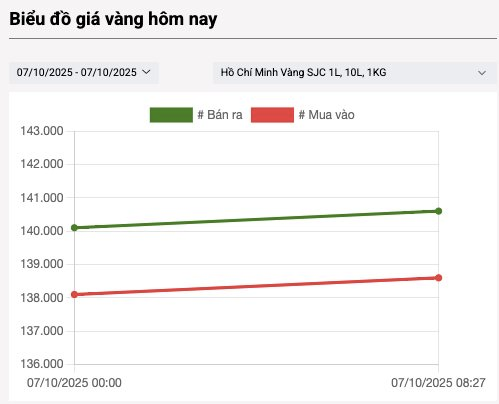

This morning, gold prices at major brands like PNJ, DOJI, and SJC Company continued to rise, averaging an additional VND 500,000 per tael compared to yesterday’s closing session. Currently, gold prices at these enterprises are widely listed between VND 138.6 – 140.6 million per tael.

Gold price trends recorded at SJC Company.

Mi Hồng Gold in Ho Chi Minh City recorded a listed price of VND 139.6 – 140.6 million per tael, an increase of VND 700,000 per tael compared to yesterday’s closing session.

Gold ring prices at gold trading enterprises also rose uniformly, with an average increase of around VND 500,000 per tael compared to yesterday. After adjustments, gold ring prices at PNJ and DOJI are listed at VND 134.5 – 137.5 million per tael; SJC Company at VND 135 – 137.7 million per tael; while Mi Hồng recorded VND 136.2 – 137.2 million per tael.

In the global market, gold is currently trading at USD 3,957 per ounce. Earlier, gold prices surged during the mid-day trading session on Monday in the U.S. December gold futures on the Comex exchange soared to a new record high of USD 3,983 per ounce. Safe-haven demand continues to be the primary driver supporting precious metals. In the latest session, December gold rose USD 65.30 to USD 3,974.20 per ounce.

Expectations that the U.S. Federal Reserve (FED) will cut interest rates this year, coupled with the risk of a prolonged U.S. government shutdown, are boosting demand for gold as a safe haven. Gold prices have already risen by about 50% since the beginning of the year, marking the strongest increase in decades.

Gold ETFs continued to see inflows last week, as individual investors increased their purchases, pushing total gold holdings by these funds to their highest level in over three years.

Meanwhile, there are no signs that the political impasse in Washington will be resolved soon.

As gold prices approach the USD 4,000 per ounce mark, many forecasts remain cautious about this precious metal.

The commodities analysis team at Bank of America (BofA) – one of the first to set a USD 4,000 per ounce target earlier this year – stated that just a new wave of investment could easily push gold to this price level.

However, with the target now within reach, BofA technical analyst Paul Ciana believes the precious metal has nearly exhausted its upward potential and is showing signs of being “overbought.”

“Multiple technical signals and conditions across various timeframes are warning that gold’s upward trend may be nearing exhaustion as prices approach USD 4,000 per ounce,” he said. “If so, gold could enter a consolidation or correction phase in Q4. Trend-following traders or risk managers should raise stop-loss levels, hedge, or reduce long positions. For contrarian traders, consider buying put options over the next 4–6 weeks.”

This assessment was made when spot gold was at USD 3,960 per ounce, up nearly 2% for the day, and has risen 50% since the beginning of the year, the strongest increase since 1979.

Mr. Ciana noted that this rally is comparable to major historical price cycles, but pointed out that previous “bull markets” were often accompanied by deep corrections. He highlighted that from the 2015 low to 2020, gold prices rose 85% before plunging 15% in 2022; and from then until now, gold has increased by another 130%. However, the current cycle is still smaller compared to the surges in the early 2000s or the 1970s.

“The 1970–1980 boom saw a 1,725% increase, with a correction in between. This was followed by a 59% drop from 1980 to 1999,” Mr. Ciana explained. “From 1999 to 2011, gold rose 640%, also with a mid-cycle correction, then fell 38% from 2011 to 2015.”

In terms of potential, he suggested that if the current cycle replicates the 400% increase after 2015, gold could surpass USD 5,000 per ounce; if it mirrors the 2000s surge, gold could reach USD 7,000 per ounce. However, he warned that the current cycle is already quite “mature” and vulnerable to mid-cycle corrections, similar to previous strong rallies.

One technical indicator Mr. Ciana is closely watching is gold’s seven consecutive weeks of gains, a rare occurrence. However, he noted that in the 11 previous instances, gold prices fell in the following four weeks.

Additionally, he is monitoring long-term moving averages. According to Ciana, gold is currently about 21% above its 200-day moving average, a level where “price peaks often occur.” Gold is also 70% above its 200-week moving average, a condition that has only occurred three times (September 2011, March 2008, and May 2006). Finally, gold is 140% above its 200-month moving average.

On the flip side, Mr. Ciana identified the first support level around USD 3,790 per ounce and warned of the risk of a deeper decline to USD 3,525 per ounce.

Technical Analysis Afternoon Session 06/10: Positivity is Making a Comeback

The VN-Index staged a robust recovery, with the Stochastic Oscillator signaling a buy opportunity. Meanwhile, the HNX-Index found solid support at its August 2025 lows.