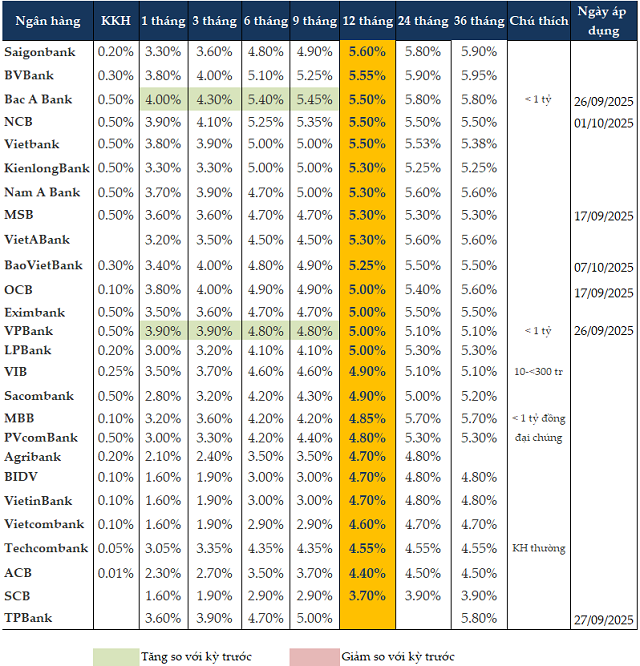

In early October, several banks slightly increased deposit interest rates for terms under 12 months.

At Bac A Bank, the bank raised deposit interest rates by 0.1 – 0.2 percentage points for terms under 12 months, effective from September 26, 2025. Specifically, the 1-month deposit interest rate was increased to 4%/year, the 3-month term to 4.3%/year, and the 6-month term to 5.4%/year, while the 12-month term remained unchanged at 5.5%/year.

On the same day, September 26, VPBank also increased deposit interest rates by 0.3 percentage points for terms under 12 months, raising the 1-3 month term to 3.9%/year and the 6-9 month term to 4.8%/year.

As of October 7, 2025, savings deposit interest rates for 1-3 months were maintained by banks in the range of 1.6-4.3%/year, 6-9 months in the range of 2.9-5.45%/year, and 12 months in the range of 3.7-5.6%/year.

For the 12-month term, Saigonbank offered the highest deposit interest rate at 5.6%/year. Next was BVBank at 5.55%/year, followed by NCB, Bac A Bank, and Vietbank, all at 5.5%/year.

For the 6-month term, Bac A Bank maintained the highest interest rate at 5.4%/year, followed by NCB at 5.25%/year.

For the 3-month term, Bac A Bank offered the highest interest rate at 4.3%/year, followed by NCB at 4.1%/year. A 4%/year rate was applied by BVBank, OCB, and BaoVietBank.

|

Personal savings deposit interest rates at banks as of October 7, 2025

|

According to the Statistics Bureau, in the first nine months of 2025, the State Bank of Vietnam (SBV) continued to maintain key interest rates while promoting credit growth solutions, directing capital into production, business, and priority sectors to drive economic growth.

The average deposit interest rate in Vietnamese Dong for domestic commercial banks was 0.2%/year for non-term and under 1-month deposits; 3.3-4.1%/year for 1-month to under 6-month deposits; 4.6-5.5%/year for 6-12 month deposits; 4.9-6.1%/year for over 12-24 month deposits; and 6.8-7.3%/year for over 24-month deposits.

The average lending interest rate for domestic commercial banks for new and existing loans was 6.5-8.8%/year. The average short-term lending rate in Vietnamese Dong for priority sectors was approximately 3.9%/year, lower than the maximum short-term lending rate set by the SBV (4%/year).

According to Mr. Nguyen Quang Huy – CEO of the Department of Finance and Banking, Nguyen Trai University, the SBV’s commitment to maintaining low interest rates to support businesses and the economy is a consistent policy, reflecting the goal of macroeconomic stability and growth recovery.

However, recent slight adjustments to short-term mobilization rates (under 12 months) by some commercial banks are not indicative of a policy shift but rather a flexible response to capital demand fluctuations and seasonal market factors.

These factors are not contradictory; instead, they reflect a healthy monetary market mechanism where macroeconomic policy provides a “soft” direction, and the banking system self-regulates local liquidity to meet real demands.

Factors Supporting the Rise in Mobilization Interest Rates

First, mobilization pressure due to rapid credit growth. Since the third quarter, credit growth has significantly improved, driven by increased borrowing demand from manufacturing and export enterprises, public investment, and domestic consumption. As credit rises quickly, banks need to proactively supplement mobilization capital to ensure liquidity safety ratios and balance mobilization-lending terms.

Thus, slight increases in mobilization interest rates by some banks are natural moves to anticipate capital needs for the year-end peak period.

Second, seasonal factors and capital preparation for the year-end cycle. The period from October to December is always a peak disbursement phase for Tet orders, raw material imports, production costs, and year-end consumer demand.

Banks, especially those with small and medium-sized enterprise clients, typically prepare capital early to ensure sufficient “ready cash” for lending during the peak period.

Therefore, slight increases in input mobilization rates are proactive, seasonal steps reflecting cautious liquidity management, not a tightening policy signal.

Third, short-term system liquidity fluctuations. Amid the SBV’s flexible open market operations (OMO, treasury bills), system liquidity has been less abundant compared to the first half of the year. With slightly higher interbank capital costs, some banks opt to raise short-term mobilization rates to secure more stable capital, reducing over-reliance on interbank funds.

Fourth, mobilization competition and bank strategies. Some joint-stock or digital banks aiming to expand their retail customer base proactively offer rates slightly above the market to attract new deposits, especially through online channels.

Interest Rates Fluctuate Slightly Within Reasonable Range

According to Mr. Huy, in the baseline scenario (highly likely), the SBV’s policy rates will likely remain stable to support businesses and the economy.

Short-term mobilization rates (3-12 months) may rise slightly by 0.1-0.3 percentage points, primarily among joint-stock banks or those needing short-term capital. Major banks, especially state-owned ones, will likely maintain stability, continuing to lead the overall rate environment.

In the risk scenario (tight liquidity, credit overheating), if credit demand exceeds expectations, mobilization rates could rise locally by 0.5-1 percentage point, but the SBV has sufficient tools to control and prevent widespread increases.

In the favorable scenario (low inflation, strong Fed easing), if the international environment is positive and foreign capital flows remain stable, mobilization rates may stabilize or decrease slightly, especially after Tet when seasonal pressures ease.

Overall, recent slight increases in input mobilization rates by some banks are seasonal, reflecting proactive liquidity reserve preparations for the year-end credit peak. This is not a policy reversal signal but a normal manifestation in a healthy financial market cycle.

In general, the SBV’s policy direction remains supportive, stable, and flexible, ensuring both growth encouragement and system safety. Therefore, interest rates from now until the end of 2025 are expected to fluctuate slightly within a reasonable range, with localized and temporary adjustments—aligning with the spirit of “flexibility in stability, proactiveness in support.”

– 12:00 08/10/2025

Skyrocketing Credit Growth Forecast Sparks Inflation Concerns: 15-Year High Predicted

As of the end of September, the economy’s credit growth has reached 13.37% compared to the beginning of the year. It is estimated that credit growth for this year could hit 19-20%, the highest level in 15 years. The State Bank of Vietnam emphasizes ongoing monitoring to ensure both economic growth and inflation control.

Appointment of the Director of the State Bank’s Transaction Department

On October 3rd, the State Bank of Vietnam (SBV) held a conference to announce the Governor’s decision regarding the appointment of the Director of the SBV Transaction Department. Deputy Governor Pham Thanh Ha attended the conference, presented the decision, and delivered a speech outlining the new director’s responsibilities.

Credit Growth Reaches 13% by September 25, Deposits Surge to 9.74%

Interest rates for deposits and loans remain stable, while proactive and flexible exchange rate management contributes to macroeconomic stability. The insurance market continues to grow steadily, and the stock market is vibrant, with significant improvements in market liquidity.