|

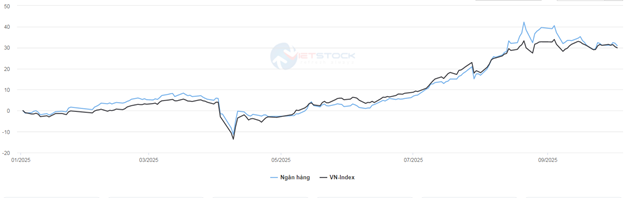

Trends in the VN-Index and Banking Sector Index

Source: VietstockFinance

|

After reaching consecutive new highs, the stock market showed signs of fatigue and entered a short-term correction. By the end of September, the VN-Index dropped by 1.2% compared to late August, closing at 1,661.7 points. Notably, the banking sector index fell more sharply, losing 6.1% to 1,020.21 points, putting significant pressure on the overall market.

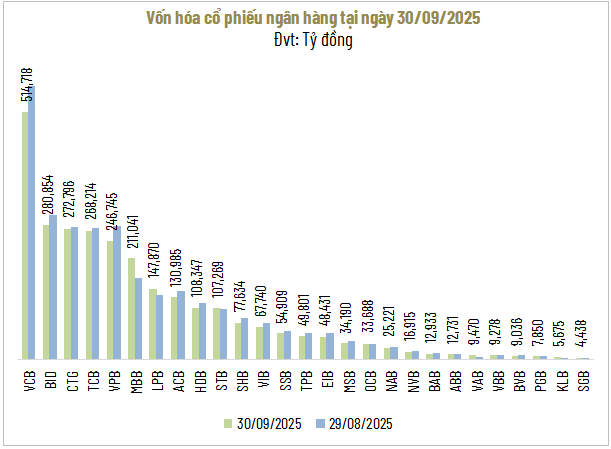

Banking Capitalization Evaporates by Over 120 Trillion VND

Source: VietstockFinance

|

After four consecutive months of growth, the banking sector’s total capitalization reversed and slowed in September. As of the session on September 30, capitalization reached nearly 2.8 million billion VND, a decrease of 121,998 billion VND (or 4.2%) compared to late August.

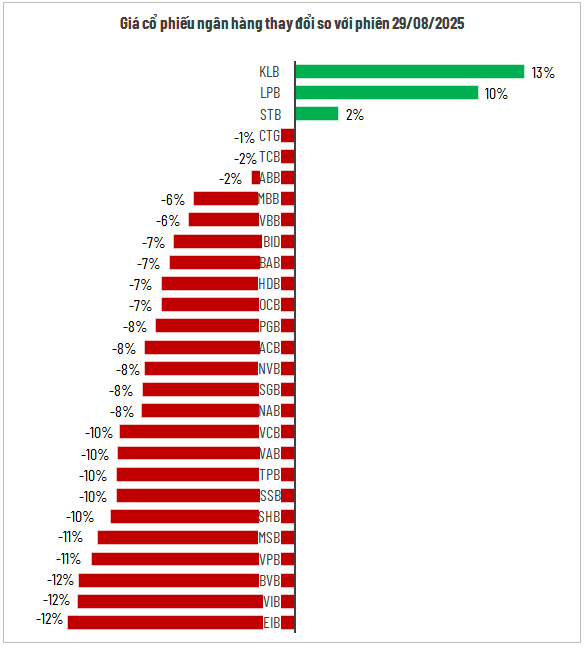

Selling pressure was widespread across most banking stocks. State-owned banks saw a collective decline: VCB lost 10%, BID dropped 7%, and CTG edged down 1%. Conversely, some private banks maintained gains, such as KLB (+13%), LPB (+10%), and STB (+2%). However, other stocks plunged by up to 12%, including EIB, VIB, and BVB.

Source: VietstockFinance

|

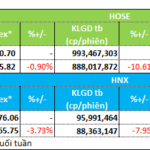

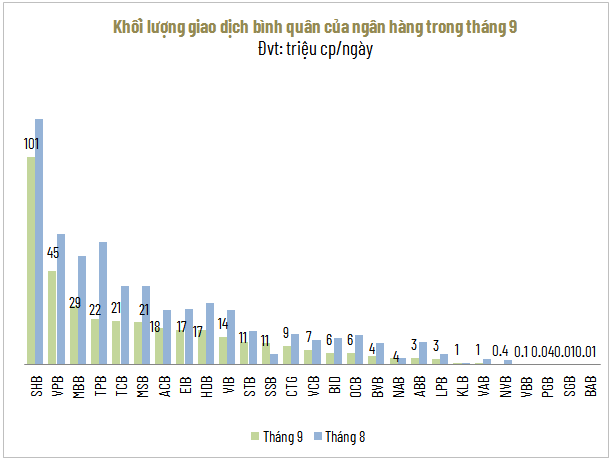

Liquidity Weakens

Source: VietstockFinance

|

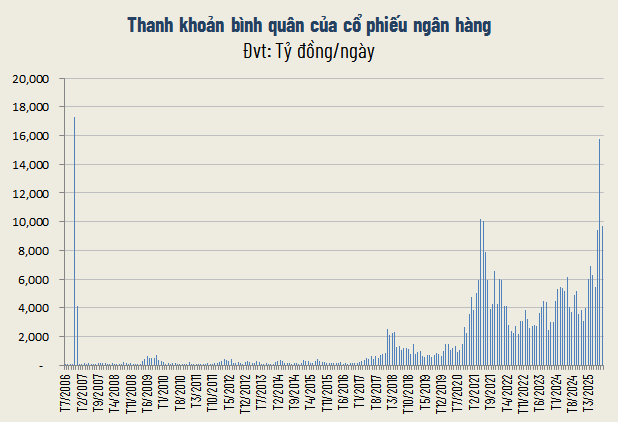

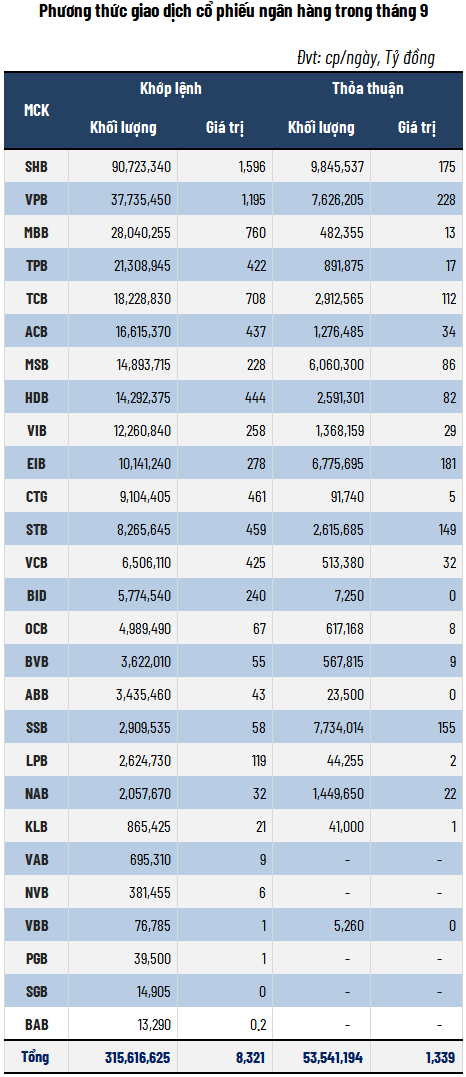

Not only did prices fall, but liquidity in banking stocks also declined significantly. In September, average trading volume reached over 369 million shares per session, a 38% decrease from the previous month. Average trading value was over 9,660 billion VND per session, down 39% but still the second-highest level in 52 months.

Source: VietstockFinance

|

SSB was a rare bright spot, with liquidity doubling from the previous month to approximately 11 million shares per day. Meanwhile, many stocks saw sharp declines, such as SGB (-86%), NVB (-83%), VAB (-76%), and BAB (-75%). SHB retained its top liquidity position with an average of 101 million shares per session, despite a 15% drop from the previous month.

Source: VietstockFinance

|

Foreign Investors Continue Net Selling

Source: VietstockFinance

|

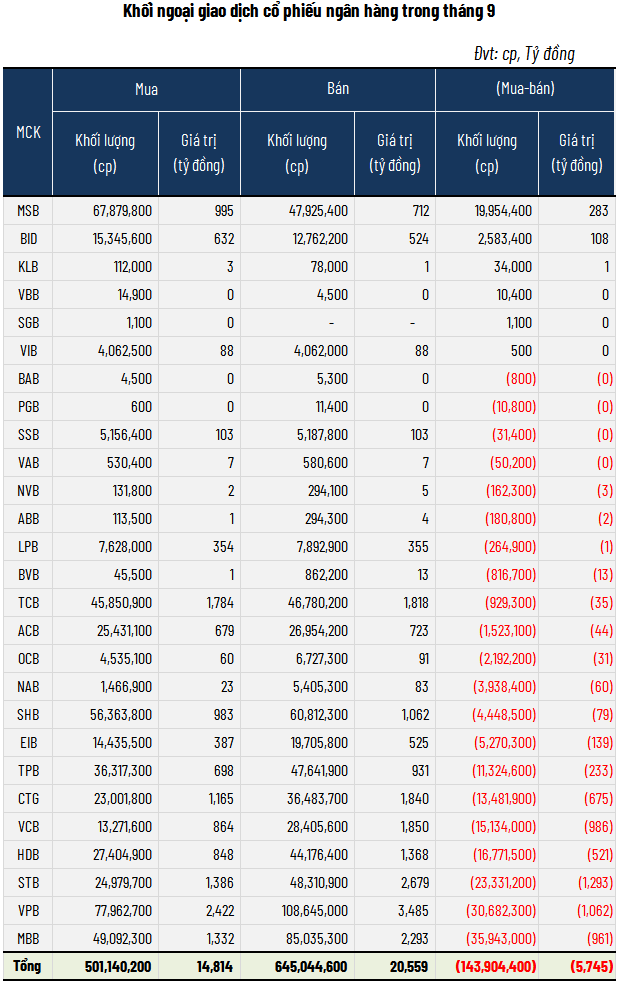

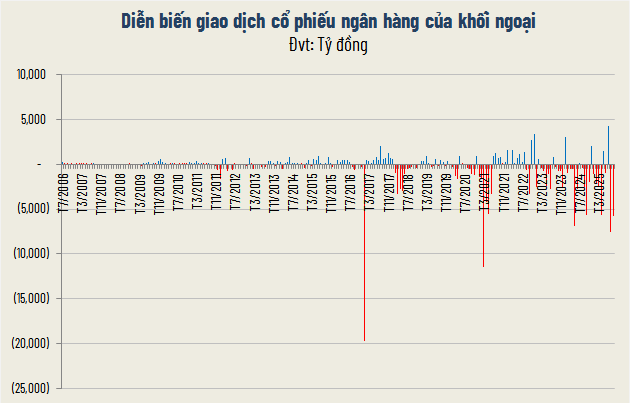

Selling pressure from foreign investors also contributed to the weakness in the banking sector. In September alone, foreign investors net sold nearly 144 million banking shares, equivalent to 5,745 billion VND – marking the second consecutive month of capital outflows.

The most heavily net-sold stocks were STB, VPB, and MBB (each with approximately 1,000 billion VND in net sales). In contrast, MSB and BID were the rare stocks seeing net buying, but the value was only a few hundred billion VND.

Source: VietstockFinance

|

Opportunities in the Correction?

According to MB Securities (MBS), as of August 29, 2025, the entire banking system’s credit grew by 11.82% compared to the end of 2024 and by 20% year-on-year. The low-interest-rate environment continues to support credit growth, particularly in retail, as demand for housing and consumer loans recovers.

MBS forecasts that credit growth in private commercial banks will remain stronger than in state-owned banks, reaching 18% and 12% respectively compared to the beginning of the year. After-tax profits in Q3/2025 are expected to improve, while the non-performing loan ratio may drop below 2%, and the NPL coverage ratio will remain around 80%.

However, MBS maintains a neutral stance on the sector, as the current P/B ratio is slightly above the three-year average, while the expected profit growth for 2025 is only around 15%.

Meanwhile, Yuanta Securities Vietnam assesses that the banking sector’s outlook remains stable in the second half of 2025, driven by strong credit growth and accommodative monetary policy. The U.S. Federal Reserve’s rate cut in September eased exchange rate pressure, providing room for the State Bank to continue supporting the economy.

However, Yuanta believes that net interest margins (NIM) will remain under pressure as banks maintain low interest rates. The sector’s P/B ratio has returned to its 10-year average, reaching nearly 1.6 times for 2025 compared to 1.2 times earlier in the year. Projected ROE for 2025 is around 17%.

According to Yuanta, while valuations are no longer as attractive as at the beginning of the year, the current correction presents an opportunity for investment, especially as the real estate market shows signs of recovery – a factor that could continue to drive growth for “king stocks” in the coming period.

– 07:00 07/10/2025

Market Hits Short-Term Warning Signal

The market is experiencing delicate fluctuations near its peak, making every decision increasingly challenging. “Riding the waves” has never been easy for Vietnamese stock investors, especially as anticipated milestones—such as market upgrades and third-quarter earnings results—begin to reveal their outcomes.

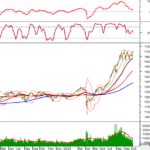

Vietstock Daily 08/10/2025: Caution Prevails Ahead of Potential Upgrade Announcement

The VN-Index retraced as buying momentum proved insufficient to surpass the September 2025 peak (1,700-1,711 range). Sustaining a position above the Bollinger Bands’ Middle Line remains critical for maintaining the index’s short-term recovery outlook. Currently, the Stochastic Oscillator has generated a fresh buy signal, while the MACD is narrowing its gap with the Signal Line, potentially triggering a similar indication in upcoming sessions.

Technical Analysis for the Afternoon Session of October 7th: Re-testing the September 2025 Peak

The VN-Index is currently retesting its September 2025 peak (around 1,700-1,711 points). The outcome of this test will determine the short-term trend. Meanwhile, the HNX-Index is also retesting the Middle Bollinger Band, leading to intense volatility.