Once synonymous with affordable ice cream cones priced at just 5 yuan, Mixue is venturing beyond its comfort zone into uncharted territory: fresh beer—a market even major beverage conglomerates approach with caution due to its colossal operational and preservation costs.

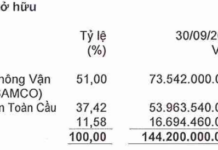

According to disclosed data, Mixue Group has invested approximately 300 million yuan (equivalent to $40 million) to acquire a 51% stake in Fulujia Enterprise Management Co., Ltd., thereby making Fulujia a non-wholly owned subsidiary of Mixue. Founded in 2021, this fresh beer brand has rapidly expanded to over 1,200 stores across 28 provinces in China within just four years. A 500ml glass of fresh beer is priced between 6 to 10 yuan (approximately $0.85 to $1.40)—a surprisingly affordable rate in a market where major beer brands focus on premium segments.

With this move, Mixue isn’t merely acquiring a beer company; it’s redefining the concept of “everyday beverages.” From milk tea and ice cream to now fresh beer, Mixue is building a low-cost refreshment empire that caters to every consumption window—coffee in the morning, milk tea at noon, and fresh beer in the evening. In this strategy, Fulujia is the missing piece of the puzzle.

Unlike mass-produced bottled beer, Fulujia’s fresh beer is brewed and poured on-site, offering a “craft, fresh” experience that resonates with younger consumers. In 2024, the company reported pre-tax profits of only 1 million yuan, but revenue is surging exponentially, particularly in second- and third-tier cities where drinking culture is shifting toward lighter, more convenient, and less alcoholic options.

Mixue’s strategic move leverages its existing infrastructure—cold supply chains, warehousing, and extensive logistics networks—while expanding profit margins in an oversaturated beverage market. With over 53,000 stores globally, Mixue recognizes that the milk tea market is nearing saturation. Pivoting to fresh beer—a product distinct yet aligned with fast-moving consumer goods—could sustain the group’s double-digit growth trajectory.

Notably, Fulujia shares Mixue’s philosophy of “high quality at low prices,” making it accessible to young consumers, students, and office workers—the same demographic that forms Mixue’s loyal fanbase. As analyzed by 36Kr, this model promises a “synergistic effect”: shared logistics, suppliers, and even co-located storefronts in certain areas to reduce costs.

However, the $40 million deal isn’t without risks. Fresh beer is far more complex than milk tea: it demands stringent cold storage, has a short shelf life, and requires advanced technical infrastructure to maintain consistent quality. Despite its rapid growth, Fulujia remains a young company with thin profit margins, reliant on store expansion for survival.

Yet, this move reflects Mixue’s long-term vision to evolve from a milk tea brand into China’s “all-in-one beverage hub.” With China’s beverage market valued at over $19 billion (CaproAsia), profit margins increasingly favor companies offering diverse products within a unified supply chain.

Source: Caproasia, Nikkei Asia

The Milk Tea Conundrum: Why is TocoToco Struggling to Turn a Profit Despite Strong Revenue?

The Vietnamese bubble tea market is a tale of two contrasting fortunes for its leading businesses. On one hand, Mixue has witnessed phenomenal growth in both revenue and profits, while on the other, Toco Toco has sunk deeper into losses for three consecutive years. This divergent performance paints a vivid picture of the dynamic and competitive nature of the industry.

Mixue becomes the 4th largest F&B chain in the world, threatening to dethrone Starbucks with its under $1 bubble tea.

Mixue is regarded as the first Chinese brand to enter the Top 5 largest F&B chains in the world – a realm traditionally dominated by American brands.