Nam Long Investment Corporation (Stock Code: NLG, HoSE) has announced October 20, 2025, as the final registration date for existing shareholders to exercise their preemptive rights to purchase additional shares.

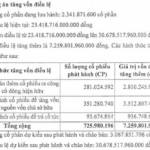

The company plans to offer nearly 100.12 million shares, representing 26% of its current outstanding shares. The rights issue ratio is 100:26, meaning shareholders holding 100 shares are entitled to purchase 26 new shares.

The offering price is set at VND 25,000 per share, with the subscription and payment period scheduled from October 20, 2025, to November 17, 2025.

As of the morning trading session on October 7, 2025, NLG shares were trading at VND 39,500 per share. Consequently, the ESOP offering price is 36.7% lower than the current market price of NLG shares.

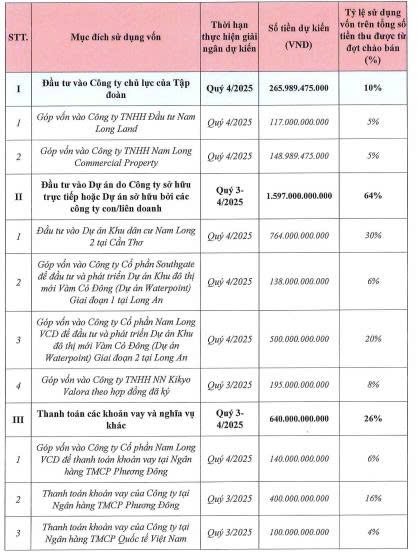

Nam Long estimates that the offering will raise approximately VND 2,503 billion, which will be allocated as follows:

Source: NLG

Upon completion of the offering, Nam Long’s chartered capital will increase from approximately VND 3,851 billion to nearly VND 4,852 billion.

This issuance plan was approved at the Annual General Meeting of Shareholders (AGM) under Resolution No. 01/2025/NQ/ĐHĐCĐ/NLG dated March 19, 2025.

In other developments, Nam Long recently announced a Board of Directors resolution to guarantee a loan for Nam Long VCD (VCD) at Asia Commercial Bank (ACB).

Specifically, Nam Long’s Board approved an irrevocable and unconditional guarantee for VCD’s debt obligations to ACB. The guarantee covers a maximum principal amount of VND 400 billion, interest (both within and beyond the term), fees, and other payable amounts as per the credit agreements between VCD and ACB.

The guarantee period extends until VCD and/or Nam Long fulfill all obligations to ACB under the credit agreement signed between VCD and ACB.

In terms of business performance, Nam Long reported cumulative net revenue of VND 2,064 billion and after-tax profit of VND 207 billion for the first six months of 2025, marking a fourfold and threefold increase, respectively, compared to the same period last year, driven by strong first-quarter results.

For 2025, Nam Long targets net revenue of VND 6,794 billion and after-tax profit of VND 701 billion. Thus, the company has achieved 30.4% of its revenue target and 29.6% of its profit goal in the first half of the year.

Hải An Logistics to Issue Nearly 2.5 Million ESOP Shares

Hải An Port Services (HAH) is set to launch an ambitious Employee Stock Ownership Plan (ESOP), offering approximately 2.5 million shares to its employees at a price of 10,000 VND per share. This represents an astonishing 81% discount compared to the current market price of HAH shares, providing employees with a unique opportunity to invest in the company’s future at an exceptionally favorable rate.

PV Power to Issue Nearly 726 Million Shares, Boosting Capital Beyond 30 Trillion VND

PV Power is set to simultaneously execute three capital increase strategies by issuing and offering a combined total of nearly 726 million shares, thereby boosting its chartered capital beyond 30,000 billion VND.