According to YKVN LLC, SonKim Land Corporation has successfully secured a $200 million loan, marking one of the most significant capital transactions in the real estate market recently.

This $200 million private credit facility is designed to support SonKim Land’s long-term strategy of expanding its real estate project portfolio.

The advisory team for SonKim Land in this transaction has been confirmed. Jefferies, a multinational investment bank headquartered in New York, served as the financial advisor.

Jefferies is renowned for its involvement in massive global M&A deals. Notably, they advised on landmark transactions such as VillageMD’s acquisition of Summit Health (valued at $8.9 billion) and Bain Capital’s takeover of Guidehouse (valued at $5.3 billion).

Legally, SonKim Land collaborated with the team at YKVN LLC, led by Partner Nguyen Thu Hang. The identities of the investors involved in the deal remain undisclosed.

In 2019, SonKim Land raised $121 million from investors EXS Capital, ACA Investments, and Credit Suisse.

This marks SonKim Land’s largest international fundraising effort to date. Previously, the company successfully raised capital from foreign investors such as EXS Capital, ACA Investments, Credit Suisse, and Skymont Capital, with investments totaling $121 million in 2021, $46 million in 2016, and $37 million in 2013.

This international fundraising initiative comes as SonKim Land actively engages with domestic financial institutions to meet its capital needs. Recently, the company has used equity in its subsidiaries as collateral for loans.

Notably, SonKim Land pledged over 90% of its shares in Berkley Real Estate Company to secure a payment obligation of more than VND 5.5 trillion at Vietcombank. Additionally, it pledged 83% of its shares in GWC Real Estate Company at OCB to guarantee debt obligations.

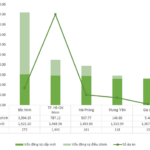

Unveiling the Top FDI Magnet in the First 9 Months of 2025: Outshining Ho Chi Minh City, Hanoi, and Hai Phong

As of September 30, 2025, Vietnam’s total registered foreign direct investment (FDI) reached an impressive $28.54 billion, according to the Foreign Investment Agency (Ministry of Finance). This figure includes newly registered capital, adjusted capital, and the value of foreign investors’ capital contributions and share purchases, marking a 15.2% increase compared to the same period last year.

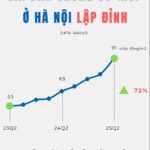

Emerging Northern Market Attracts Real Estate Giants Like Vingroup, Sun Group, and BRG to Establish Their Presence

Hai Phong is emerging as a magnet for leading real estate developers, according to Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association. Major players such as Vingroup, Sun Group, and BRG are converging on the city to launch new projects, solidifying its status as a focal point in the property market.

State-Managed Real Estate Trading Center Set to Launch: Homebuyers to Receive Land Titles in Just 2 Days

The Ministry of Construction is finalizing a pilot project for a Real Estate and Land Use Rights Trading Center, managed by the state, with operations expected to commence in 2026. Once implemented, this model will enable citizens to obtain land ownership certificates (red books) within just two business days.

Real Estate Firms Frozen by Land Use Fee Uncertainty

In addition to the developer of Empire City petitioning the Ho Chi Minh City People’s Committee to reconsider the additional land use fee of up to VND 8,819 billion, and Lotte Properties HCMC terminating its contract for the Thu Thiem Eco Smart City project, approximately 100 other projects in Ho Chi Minh City are awaiting financial obligation notices, which may include additional fees.