On October 2, the People’s Committee of Quang Ninh Province approved the investment policy and designated Hai Phat Land Investment and Real Estate Business Corporation (Hai Phat Land) as the developer for a social housing project (SHP) on the 20% land fund of the resort, commercial service, and residential complex in Ha Phong Ward (now Ha Tu Ward).

Spanning over 1.4 hectares, the project will feature 4 residential towers, each 18 stories high, including 3 SHP towers and 1 commercial tower, offering approximately 1,400 apartments. Of these, 1,116 are SHP units for sale, 268 are commercial units, and 16 are mixed-use residential and commercial units available for sale, rent, or rent-to-own. The project is expected to accommodate nearly 2,800 residents.

With a total investment of over VND 1.7 trillion, the developer’s equity contribution exceeds VND 342 billion. Construction is slated to begin in December 2025, with handover expected in Q4 2029.

|

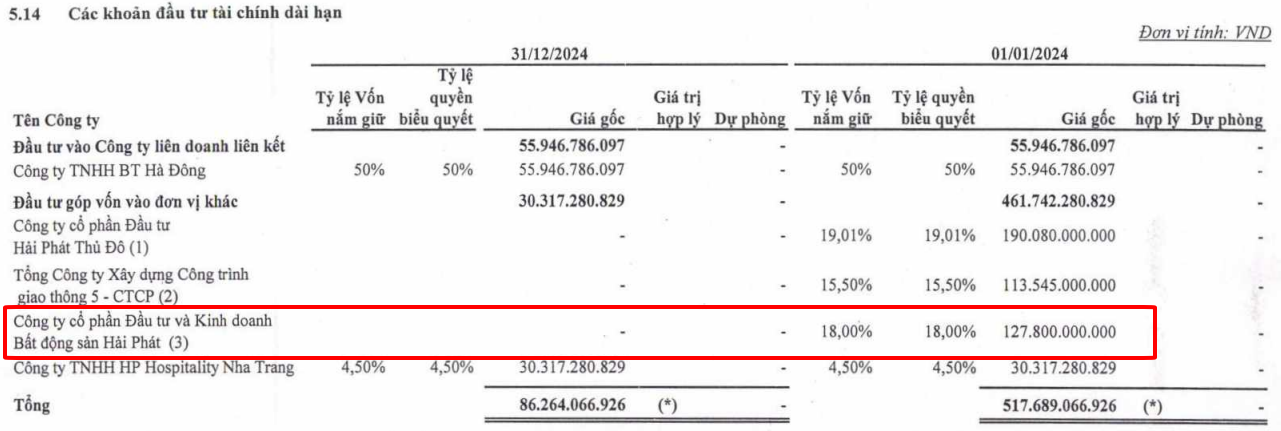

Established in late 2018, Hai Phat Land is headquartered in Hanoi and operates in the real estate sector with an initial charter capital of VND 100 billion. Mr. Vu Kim Giang serves as both the CEO and legal representative. According to the 2018 annual report, Hai Phat Investment Corporation (HOSE: HPX) held 70% of Hai Phat Land’s capital. By March 2019, Hai Phat Land increased its capital to VND 710 billion, with HPX’s ownership rising to 95.78%. Subsequently, HPX gradually divested from Hai Phat Land: in 2020, it sold 20%, reducing its stake to 75.78%; by late 2021, it further sold to individual investors, lowering its ownership to 48.8%; in 2022, it held only 18%; and by 2024, it had fully exited Hai Phat Land.

As of August 2025, Hai Phat Land has increased its capital to VND 1.01 trillion, with its shareholder structure undisclosed. Mr. Vu Kim Giang remains the legal representative and Chairman of the Board since its inception. |

Previously, on September 22, the Quang Ninh People’s Committee assigned the consortium of My Quyen Trade and Investment Corporation and Global Financial Investment Consulting Corporation to develop an SHP on plot AOM-72, located in Zone 2 of Ha Khanh Ward, Ha Long City (now Cao Xanh Ward, Quang Ninh Province).

Covering nearly 2.6 hectares, the project includes a 25-story residential building with 1,750 SHP units and 39 low-rise townhouses. With a total investment of VND 2.266 trillion, completion is expected in Q4 2028.

Also in Cao Xanh Ward, the Quang Ninh People’s Committee assigned the joint venture between Gland Real Estate Corporation and Global Financial Investment Consulting Corporation to develop an SHP on the 20% land fund of the residential project northwest of Tran Thai Tong Street. With a total investment of VND 592 billion, the project will construct 2 SHP buildings, each up to 10 stories high, offering 300 apartments for sale. Completion is anticipated in Q4 2027.

On September 30, Tu Liem Urban Development Corporation (HOSE: NTL) commenced construction on an SHP project on plot OXH-01 in Cao Xanh and Ha Lam Wards, with a total investment of VND 968 billion. Spanning 1.5 hectares, the project features a 19-story residential building providing 850 apartments for 3,400 residents. It is expected to be operational by Q4 2027.

Rendering of the SHP project on plot OXH-01 in Cao Xanh and Ha Lam Wards. Source: Quang Ninh People’s Committee

|

Under the 2025-2030 plan, Quang Ninh aims to complete 17,588 SHP units, with 2,201 units targeted for 2025. To date, the province has completed 1,758 units, achieving nearly 80% of this year’s goal, and has started 2 additional projects with 1,540 units. The province aims to complete 2,288 units by Q4 2025, surpassing the government’s target.

– 09:52 07/10/2025

Over 9,200 Social Housing Units Approved for Sale in September

Local construction departments’ statistics reveal that 26 projects, comprising over 12,600 units, are eligible for the sale of future housing across 14 provinces and cities in September 2025. Social housing dominates this landscape, accounting for more than 9,200 units.

The 21-Year Odyssey of Billionaire Pham Nhat Vuong: Pursuing the World’s Tallest Sea-Reclaimed Tower

Vinhomes Green Paradise stands as the pinnacle of 2025’s real estate achievements, boasting a sprawling expanse three times the size of the former District 1 and a staggering investment of over $9 billion. To bring this visionary project to life, Vingroup dedicated 21 years to navigating intricate legal frameworks and meeting stringent environmental impact assessments, ensuring a development that redefines luxury and sustainability.

New York Investment Bank Advises Luxury Real Estate Giant in Ho Chi Minh City on $200 Million Funding

A leading luxury real estate firm in Ho Chi Minh City has successfully secured a $200 million loan, with financial advisory services provided by a prestigious New York-based multinational investment bank.

Unveiling the Top FDI Magnet in the First 9 Months of 2025: Outshining Ho Chi Minh City, Hanoi, and Hai Phong

As of September 30, 2025, Vietnam’s total registered foreign direct investment (FDI) reached an impressive $28.54 billion, according to the Foreign Investment Agency (Ministry of Finance). This figure includes newly registered capital, adjusted capital, and the value of foreign investors’ capital contributions and share purchases, marking a 15.2% increase compared to the same period last year.