In reality, according to statistics from the Vietnam Association of Realtors, individuals under 35 are increasingly prioritizing early homeownership to meet both their housing needs and long-term asset accumulation goals.

The financial mindset of the younger generation is evolving

While the younger generation once prioritized spending on experiences, a significant portion is now shifting toward asset accumulation—a strategy focused on building long-term wealth through appreciating assets to ensure financial security and sustainability.

Among investment channels, real estate stands out due to its tangible nature, lower volatility compared to financial markets, and strong inflation-hedging capabilities. According to CBRE data, over the past decade, housing prices in Ho Chi Minh City have increased by an average of 8–10% annually, while inflation has averaged only 3–4%.

Owning an apartment can also generate passive income. CBRE statistics show that rental yields for apartments in Ho Chi Minh City currently range between 5–8% per year, surpassing the average savings interest rate of 4–5% expected by 2025. Notably, projects with prime locations and comprehensive amenities often attract stable tenants, ensuring consistent cash flow for owners.

Beyond being a financial asset, a home serves as a form of “asset discipline.” Taking out a mortgage early compels young individuals to develop saving habits, manage expenses, and plan for the long term—fundamental aspects of financial freedom.

Lastly, homeownership offers social and psychological benefits. Research from Harvard University indicates that having a home provides young people with peace of mind, enabling them to focus on career growth while enhancing their sense of financial and emotional security.

For these reasons, buying a home is not just a housing solution but a smart wealth-building strategy, laying a solid foundation for a sustainable financial future. Dr. Dinh The Hien, a financial and real estate expert, affirms: “In Vietnam, real estate is a safe and profitable investment channel. Therefore, young people purchasing a home for both living and wealth accumulation is a sound approach.”

Opportunities for young individuals to own their first home

Amid rapid urbanization, Vietnam is witnessing a decade of robust infrastructure development and growing housing demand. According to the National Master Plan, by 2030, the urbanization rate is expected to surpass 50%, with 1,000–1,200 urban areas nationwide contributing up to 85% of GDP.

This trend is driving up property prices in central areas but also unlocking significant growth potential in satellite cities. In the former Long An region (now part of Tay Ninh), the urbanization rate is projected to reach 55% by 2030, a clear indicator of this shift.

Transportation infrastructure is a key driver of urbanization. Major projects such as the Ho Chi Minh City – Trung Luong – My Thuan Expressway, Ring Road 3, and Ring Road 4 are reducing travel times and enhancing regional connectivity. Consequently, real estate values are being redefined along transportation corridors: land and properties in satellite cities remain affordably priced but offer high growth potential as infrastructure improves. This presents an opportunity for young buyers to access housing more easily while capitalizing on long-term price appreciation.

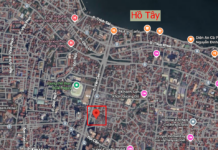

In this landscape, Solaria Rise stands out as a prime choice. Located in the heart of the integrated Waterpoint mega-urban area spanning 355 hectares—developed by Nam Long and Japan’s Nishi Nippon Railroad—Solaria Rise benefits fully from a strategic regional transportation network: the Ho Chi Minh City – Trung Luong Expressway, Ben Luc – Long Thanh Expressway, and Ring Roads 3 and 4.

Solaria Rise is situated in the heart of the integrated Waterpoint mega-urban area.

The project features nearly 700 diverse housing units, including studios, 1-bedroom + 1, 2-bedroom, 3-bedroom, and duplex apartments, catering to various living and long-term investment needs. Most units boast airy designs and expansive views of Central Park and the freshwater bay, infusing living spaces with natural energy.

Designed in a “resort living” style, Solaria Rise sets a high standard of living with comprehensive on-site amenities. From swimming pools, gyms, yoga studios, saunas, multi-sport courts, BBQ areas, and indoor/outdoor workspaces, residents can effortlessly recharge daily.

Resort-style swimming pool at Solaria Rise.

Notably, the project offers competitive pricing starting from 1.39 billion VND per unit, with a 5% down payment upon signing the purchase agreement and the remainder divided into multiple installments. This flexible financial solution enables young buyers to manage cash flow effectively and own their first home without excessive financial pressure. For those using loan packages, customers can borrow up to 65% of the property value, with the developer offering interest support for up to 27 months.

According to financial experts, with a stable job and at least three years of savings, young individuals can afford a home through salary income by leveraging favorable loan packages and early planning, thereby building a foundation for their future.

Real Estate Capital Flow Shifts from Urban Centers to Outskirts: Hanoi and Ho Chi Minh City Cool Down as a New Livable City Emerges as the Market’s “Promised Land”

As the central market cools, Da Nang – Quang Nam real estate emerges as a shining beacon, attracting significant investment capital with its rapidly developing infrastructure and rapidly appreciating asset values.

Why Do Property Prices Keep Rising? Exploring Effective Solutions to Curb the Trend

In recent years, the relentless surge in real estate prices, particularly in housing and condominiums, has far outpaced the average income of the majority of workers. Despite numerous aggressive and continuous solutions being implemented, the challenge of stabilizing property prices remains a complex puzzle yet to be solved.

Lotte Advances $870 Million Thu Thiem Project as Ho Chi Minh City Resolves Key Obstacles

At the meeting held on the afternoon of October 3, 2025, Ho Chi Minh City’s Chairman of the People’s Committee, Nguyễn Văn Được, affirmed that city leaders will collaborate closely with investors. They will also incorporate Lotte’s recommendations into proposals submitted to the Government to address existing challenges.

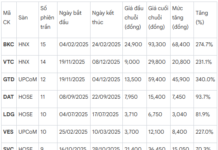

Successive Bank Auctions of Real Estate Properties

Recently, banks have been consecutively auctioning off real estate assets, notably reducing the listing prices compared to previous sales.