In the audited report submitted to the Hanoi Stock Exchange (HNX), Trung Nam Thuan Nam Solar Power reveals that as of June 2025, the company carries an accumulated loss of nearly VND 723 billion. However, it managed to turn a profit of VND 126.5 billion in the first half of this year, a slight decrease from the VND 128 billion recorded in the same period last year.

Total liabilities stand at approximately VND 9,001 billion. Bank loans account for nearly VND 1,723 billion, marking an 18% increase year-over-year. Bond issuance debt exceeds VND 4,372 billion, down by 5%. Other payables amount to nearly VND 2,906 billion, rising by almost 5%.

Liquidity ratios indicate a short-term coverage ratio (current assets/current liabilities) of 0.78, up from 0.49 in the previous year. The interest coverage ratio (EBIT/interest expense) stands at 1.37.

The total bond debt-to-equity ratio is 2.61, compared to 3.0 last year. ROA and ROE are 1% and 7%, respectively.

On HNX, Trung Nam Thuan Nam Solar Power has 10 outstanding bond series, coded from TRUNGNAMSOLAR_BOND2020_1 to TRUNGNAMSOLAR_BOND2020_10, with issuance rates ranging from 10.1% to 10.5% per annum. The total face value outstanding is over VND 4,320 billion. These bonds were issued in May, June, July, and August 2020, all maturing on May 29, 2029.

Trung Nam Thuan Nam Solar Power was established in 2018 under the initial name of Phuoc Minh Solar Power JSC, headquartered in Ninh Thuan province. Its initial charter capital was VND 10 billion, with Trung Nam Hydropower JSC holding 5%, Trung Nam Construction Investment JSC (Trungnam Group) holding 92%, and Mr. Do Hai Nam holding 3%. The company is chaired by Mr. Nguyen Tam Thinh, who also serves as its legal representative.

In April 2020, coinciding with the issuance of the aforementioned 10 bond series, the company rebranded to its current name, Trung Nam Thuan Nam Solar Power LLC. Simultaneously, its charter capital was increased to over VND 2,411 billion. As of May 2025, the charter capital remains unchanged, and ownership shifted from Trung Nam Tra Vinh Solar Power JSC to Trung Nam Tra Vinh Investment JSC. The legal representatives are Mr. Thinh (Chairman) and Mr. Vu Dinh Tan (Director).

Within Trungnam Group’s solar power portfolio, the Trung Nam Thuan Nam 450MW solar power project in Ninh Thuan boasts a total investment of nearly VND 10.8 trillion.

Trung Nam Thuan Nam 450MW Solar Power Project in Ninh Thuan.

|

– 12:21 08/10/2025

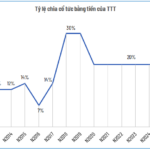

TTT Sustains 5 Consecutive Years of 20% Cash Dividend Payouts

Tay Ninh Tourism and Trading Joint Stock Company (HNX: TTT) has announced the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for October 28, with the payment expected to commence on November 25.

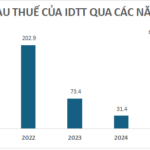

Industrial Park Investor Thu Thua Raises $100 Billion Through Bond Issuance

On September 30, 2025, Thu Thua Industrial and Urban Development Joint Stock Company (IDTT) issued a bond tranche IDT12501 with a total value of 100 billion VND.