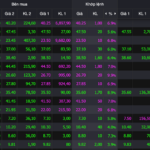

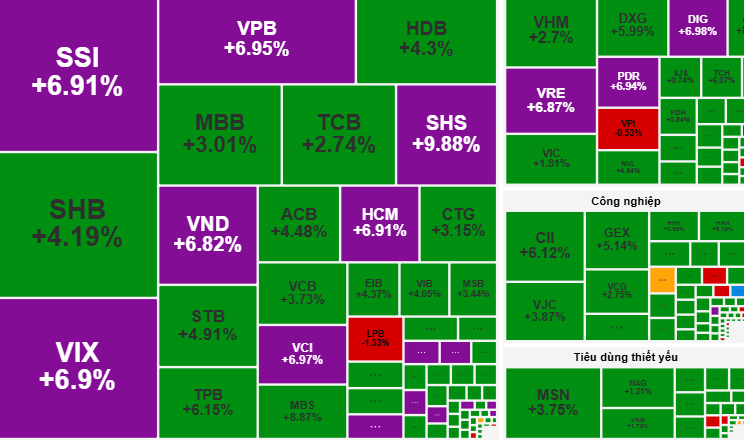

On October 6th, the VN-Index surged significantly, driven by large-cap stocks such as VCB, VPB, HPG, and VIC.

Vietnam’s stock market witnessed a remarkable rally on October 6th, with the VN-Index opening nearly 30 points higher at 1,690, fueled by strong performance from large-cap stocks. Key sectors like banking, retail, and steel led the uptrend, dominating the market with widespread gains.

Mid-cap stocks, representing companies with market capitalizations between VND 1,000 billion and 10,000 billion in securities and real estate, showed impressive recovery, attracting significant investor interest.

In the afternoon session, the VN-Index maintained steady growth, fluctuating narrowly around 1,680 before breaking past 1,690 to close at the session high of 1,695—a 49.6-point (3.02%) increase. Market liquidity improved notably, reflecting robust investment activity. However, foreign investors continued to net sell VND 1,856 billion, focusing on stocks like MWG, MBB, and FPT, counterbalancing domestic buying pressure.

VCBS Securities highlighted the October 6th rally as a positive signal, driven by large-cap leaders such as VCB, VPB, HPG, and VIC, alongside enhanced liquidity. “Investors should hold stocks with strong upward trends while seeking opportunities in banking, securities, and real estate sectors, which are currently attracting speculative capital,” VCBS advised.

According to Dragon Capital Securities (VDSC), the market benefited from positive Q3/2025 GDP data. Increased liquidity compared to the previous session indicates favorable investor sentiment. The upward momentum may propel the VN-Index toward the 1,710 resistance level (previous peak). However, heightened supply-demand tension at this level could trigger significant volatility.

VDSC recommends investors capitalize on rallies to secure short-term profits, avoid chasing high prices, and consider investing in stocks with solid accumulation foundations.

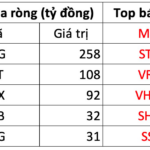

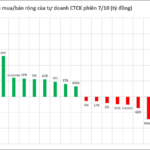

Foreign Investors Extend Sell-Off Streak, Net Selling Over $43 Million, While Countering with $11 Million Buy on Blue-Chip Stock

Foreign investors’ net selling activities have significantly impacted the market, with a substantial net outflow of 1.393 trillion VND across the board.

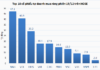

Vietnamese Stock Accounts Surpass 11 Million, Exceeding 2030 Target

As of September 2025, Vietnam’s stock market has surpassed expectations, boasting over 11 million trading accounts—a milestone originally targeted for 2030 under the government-approved Securities Market Development Strategy unveiled in late 2023, according to data from the Vietnam Securities Depository and Clearing Corporation (VSDC).

Is the “King” Stock Still a Magnet in the Final Quarter?

Despite bank stocks no longer being as undervalued as they were earlier this year, securities firms maintain that current price levels remain reasonably attractive.