Vietnam-Japan Medical Investment and Development JSC (stock code: JVC) has recently approved a private placement plan to issue 25 million shares to VII Holding JSC, a company associated with a member of JVC’s Board of Directors.

Accordingly, JVC plans to offer shares at VND 10,000 per share, approximately 22% higher than the market price of VND 8,210 per share at the close of the session on October 6. The total expected proceeds amount to VND 250 billion, with VND 150 billion allocated for capital contribution to Vietnam-Japan Medical Technology Investment JSC and VND 100 billion for supplier payments and raw material procurement.

VII Holding is the sole investor in this offering. Currently, the company does not own any shares in JVC, but if it successfully acquires the entire allotment, VII Holding will hold 18.2% of the charter capital, becoming a major shareholder of JVC. The issued shares will be subject to a one-year transfer restriction from the end of the offering period.

Mr. Vu Dinh Do.

Mr. Do is also the husband of Ms. Nguyen Thi Hanh, a member of JVC’s Board of Directors, highlighting the direct relationship between the two companies.

Previously, VII Holding gained attention by acquiring over 302 million shares of Tasco (stock code: HUT), equivalent to 28.32% of the charter capital, becoming the largest shareholder.

At Tasco’s 2024 Annual General Meeting, shareholders approved a resolution allowing VII Holding to receive share transfers from existing shareholders without a public tender offer. Mr. Vu Dinh Do stated that VII Holding aims to restructure Tasco’s ownership towards transparency. He also resigned from his position as Chairman of DNP Holding to focus on Tasco’s strategic development.

Regarding JVC, on October 2, 2025, the company closed its shareholder list for an extraordinary general meeting in 2025; the specific time and venue will be announced later.

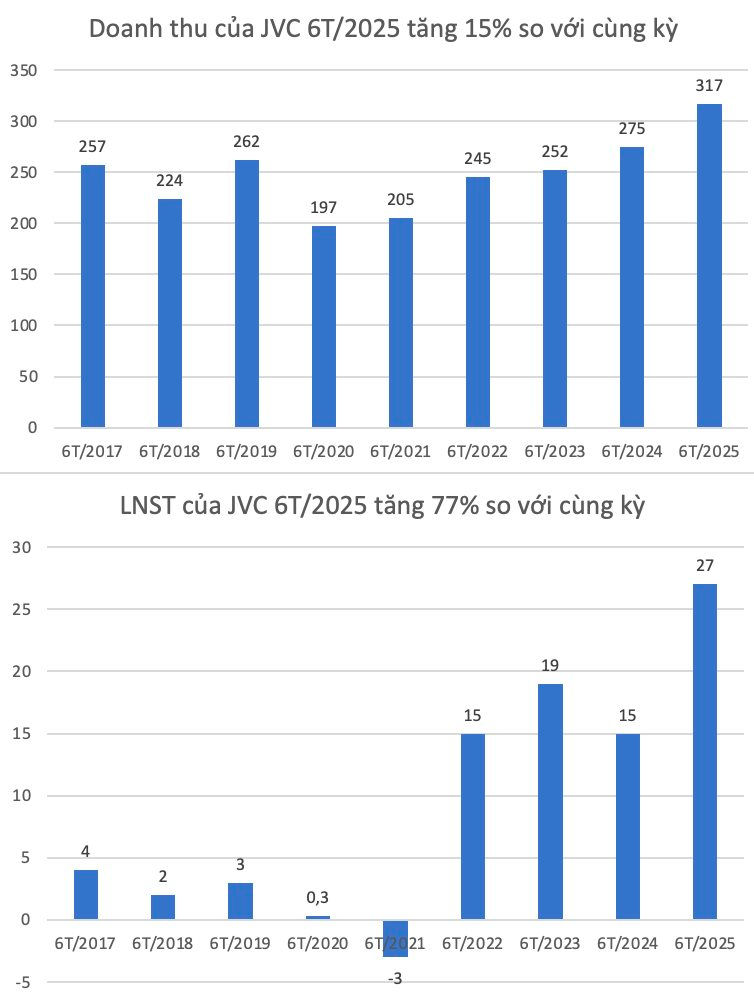

In terms of business performance, in the first six months of 2025, JVC achieved net revenue of VND 317 billion and after-tax profit of VND 27 billion, up 15% and 77% respectively compared to the same period last year. However, as of the end of Q2/2025, JVC still has accumulated losses of nearly VND 980 billion.

Established in 2001 with a charter capital of VND 5 billion, Vietnam-Japan Medical primarily distributes medical equipment from Japan. The company has been listed on HOSE since 2011 under the code JVC and currently has a charter capital of VND 1,125 billion.

The leadership of Vietnam-Japan Medical stated that due to the need for additional capital to expand business operations for both the parent company and its subsidiary, the company considered and decided to propose a private placement plan in 2024. However, due to unfavorable market conditions, the share offering has not been implemented this year.

For 2025, the company sets an ambitious target of VND 1,200 billion in consolidated revenue and VND 100 billion in after-tax profit. These goals are based on the company’s strategy to strengthen its focus on hospital investment, services, and public-private partnerships (PPP).

On the stock market, JVC shares closed the October 6 session at VND 8,210 per share, hitting the upper limit. Since August 28, JVC shares have surged by nearly 60%.

JVC Unveils Long-Awaited Capital Increase Plan, Stock Surges to Daily Limit

On October 3rd, the Board of Directors of Vietnam-Japan Medical Equipment Joint Stock Company (HOSE: JVC) passed a resolution to implement a private placement of 25 million shares, scheduled for execution in Q4 2025. This plan, initially approved by JVC shareholders in 2024, has yet to be finalized.

Stock Skyrockets on News of Quadrupled Capital Increase

The surge in stock prices followed the company’s approval of a private placement plan to issue 100 million shares, aiming to raise VND 1,000 billion.

Dragon Capital Group Joins Taseco Land’s Private Placement, Emerging as a Major Shareholder

On September 24th, Dragon Capital-managed funds announced their new status as major shareholders in Taseco Land (HOSE: TAL), a leading real estate investment company. This milestone was achieved through a combination of acquiring shares from a private placement and purchasing additional shares on the open market.

Dragon Capital Emerges as Major Shareholder in Taseco Land

Dragon Capital, through its member funds, has acquired 20.58 million TAL shares, elevating its ownership stake to 6.3555% and establishing itself as a major shareholder in Taseco Land.