At the “Q3/2025 Real Estate Market Overview” event hosted by Batdongsan.com.vn, speakers discussed the land plot market in leading provinces such as Hanoi, Ho Chi Minh City, Da Nang, and Hai Phong.

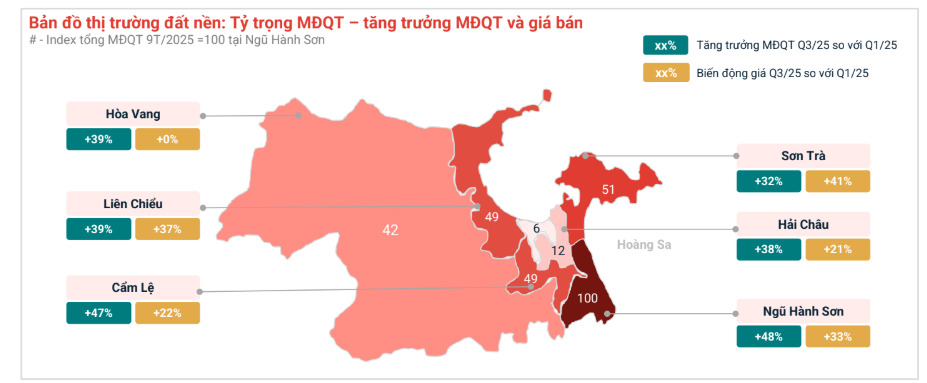

Specifically, land plots in Da Nang saw a boom. In Q3/2025, prices surged by +68% compared to Q1/2023. Q3 also highlighted Ngu Hanh Son (+33% in price; +48% in interest) and Son Tra (+41% in price; +32% in interest) as hotspots.

Da Nang’s land plot market heated up in Q3 with significant growth in both prices and interest.

In former Quang Nam, land plots remain the dominant segment, capturing 83% of interest. Dien Ban (+36% in price) and Nui Thanh (+22%) are emerging, fueled by investment waves tied to industrial zones and border economic areas.

According to Mr. Ha Nghiem, Director of Batdongsan.com.vn’s Da Nang branch, the merger of Da Nang and former Quang Nam has created a new and robust development space. Leveraging Da Nang’s modern infrastructure and Quang Nam’s vast land reserves, this integration has become a powerful driver for socio-economic growth. Real estate has significantly benefited, as evidenced by the strong growth in interest and prices over the past nine months, outpacing other regions.

Despite a strong price increase in 2025, land plot prices in Da Nang have only surpassed the 2019 peak by less than 15% after six years. With the post-merger development trend and attractive pricing, Da Nang’s land plots still have room for growth.

In Hai Phong, the real estate market is entering a clear recovery phase, supported by a strong economy and merger strategy. The city has solidified its role as a northern industrial, commercial, and logistics hub, with a post-merger GRDP of 658 trillion VND and consistently high FDI rankings.

While interest in land plots has not fully recovered, a 38% price increase indicates healthy growth in the central area. Notably, the proportion of searches from Hanoi is rising rapidly, highlighting increasing inter-regional appeal.

Ms. Nguyen Thi Ngoc Thuong, Director of Batdongsan.com.vn’s Hai Phong branch, stated: “The merger of Hai Phong and Hai Duong has created the country’s third-largest economy, forming a new growth pole with national impact. This coastal megacity model integrates production, logistics, urban development, ports, commerce, and services into a unified, large-scale administrative structure. This attracts domestic and international investors and new residents, fostering diverse real estate growth—from industrial and commercial properties to residential and rental segments.”

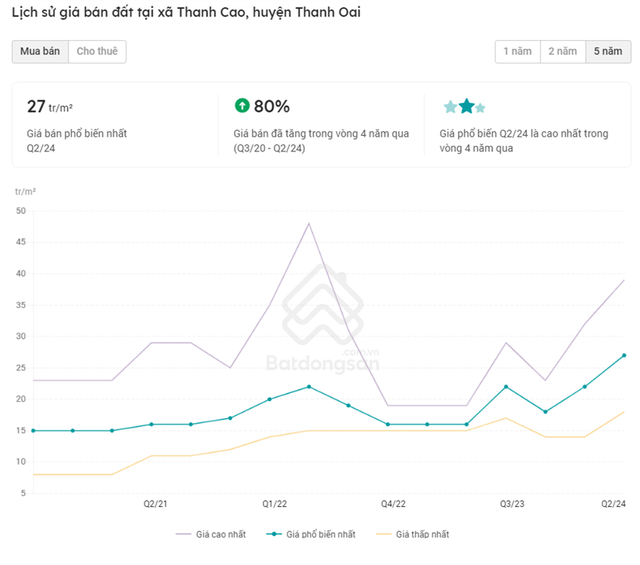

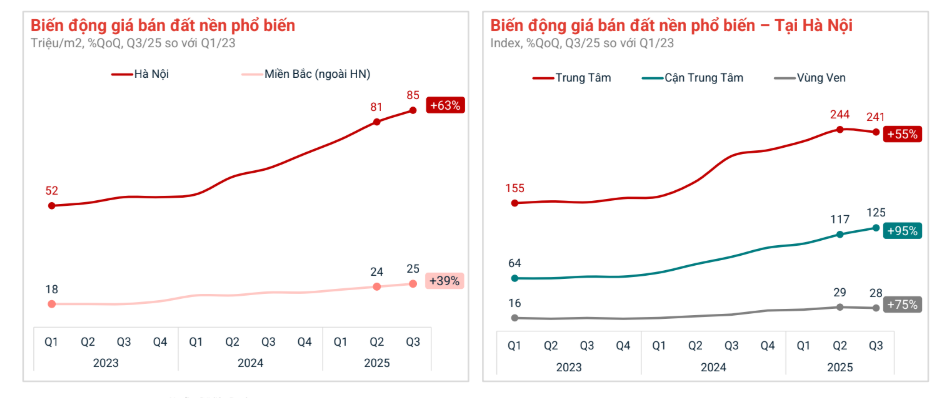

In Hanoi, the 2025 real estate market shows signs of recovery in interest, with prices continuing to rise but at a slower pace. Specifically, 2025 listing prices increased by 13%, down from the 39% growth recorded in 2024.

Land plots rose by 50%, with significant increases in near-central and suburban areas (+95% and +75%). Despite rising prices, land plots remain sensitive to macroeconomic fluctuations due to their speculative nature, and interest has yet to recover.

Hanoi’s land plots have seen strong price increases over the past two years.

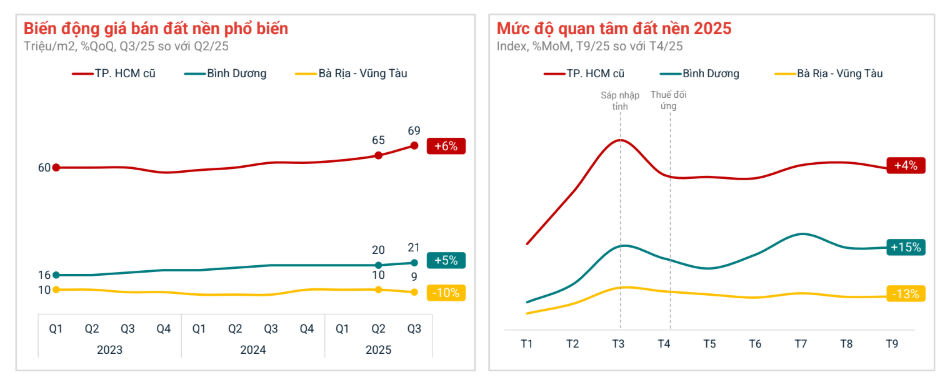

In Ho Chi Minh City, the land plot market in former HCMC and Binh Duong has rebounded after several stagnant quarters. Average land prices in former HCMC rose by 6%, reaching 69 million VND/m², while former Binh Duong saw a 5% increase to 21 million VND/m² compared to Q2/2025.

Land plots in former Ba Ria – Vung Tau remain quiet, with prices dropping by 10%.

In contrast, former Ba Ria – Vung Tau remains quiet, with prices falling by 10% and interest declining by 13%. This disparity highlights a trend where capital flows favor areas with ample land, developed infrastructure, and convenient connectivity to city centers. Former Binh Duong stands out as the fastest-recovering “satellite” area, benefiting directly from Ring Road 3.

National Average Real Estate Price Surpasses 100 Million VND per Square Meter

According to Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, the average property price nationwide has surged from VND 74 million/m² in Q1 2023 to VND 101 million/m² in Q3 2025, marking a 36% increase. Meanwhile, rental prices have remained stagnant during this period.

Prime Hanoi, Ho Chi Minh City Condos Surpass $4,300/sqm, Projects Sell Out on Launch Day

Numerous projects in Hanoi and Ho Chi Minh City have reported “sold-out” status on the day of their launch, indicating genuine market demand and a consistent flow of investment capital.