Exceeding the Scope of Litigation and Showing Signs of Procedural Violations

Shortly after the People’s Court of District 7 rejected VPBank’s lawsuit, declaring the credit agreement between the plaintiff and defendant void, the court ordered Novareal Joint Stock Company to pay VPBank 3.65 billion VND after deducting 900.6 million VND. The bank has filed an appeal against the first-instance judgment, arguing that the ruling allowing the borrower to “escape debt” has several procedural and legal irregularities that need re-examination at the appellate level.

Commenting on this high-profile case, Lawyer Nguyễn Hồng Bách, Chairman of the Board of Directors of Hong Bach & Associates Law Firm, noted that the lawsuit primarily revolves around VPBank’s debt claim under the credit agreement. However, the court’s decision has “exceeded the scope of litigation.”

“The defendant did not file a counterclaim, but the trial panel declared both the loan agreement and the mortgage contract void and ordered Novareal to repay the loan to the bank. This ruling may exceed the scope of litigation, violating the principle outlined in Clause 1, Article 5 of the Civil Procedure Code,” as the law clearly states: “Parties have the right to decide on filing a lawsuit, requesting the competent court to resolve a civil case. The court shall only accept and resolve a civil case when there is a petition or request from the parties and shall only resolve within the scope of such petition or request.“

Lawyer Bách also pointed out that the case involves multiple parties, but the court did not summon all of them, despite the Procuracy’s recommendation to gather additional evidence. “When all parties have not fully participated, and evidence has not been comprehensively collected, the ruling may lack objectivity and could contain errors in judgment or procedural violations. If there are serious procedural violations, this is grounds for the appellate court to overturn the entire first-instance judgment,” Lawyer Bách emphasized.

Additionally, the lawyer noted that the trial panel’s assertion of “fraud” signs from Novareal in a civil judgment was hasty and seemed to exceed its authority. “If there are criminal signs, the court must transfer the case to the competent authorities for investigation. The civil case should be temporarily suspended pending the investigation and conclusion by the authorities,” he said.

Independent Effect of Credit Agreements and the Risk of Setting a Bad Precedent

The trial panel dismissed VPBank’s lawsuit, declaring the credit agreement between the plaintiff and defendant void. The reason given was that the loan disbursed by the bank to Mr. and Mrs. Sơn was intended to pay the second deposit under the agreement signed on November 5, 2020, with Novareal for consulting and introducing the purchase of a semi-detached villa.

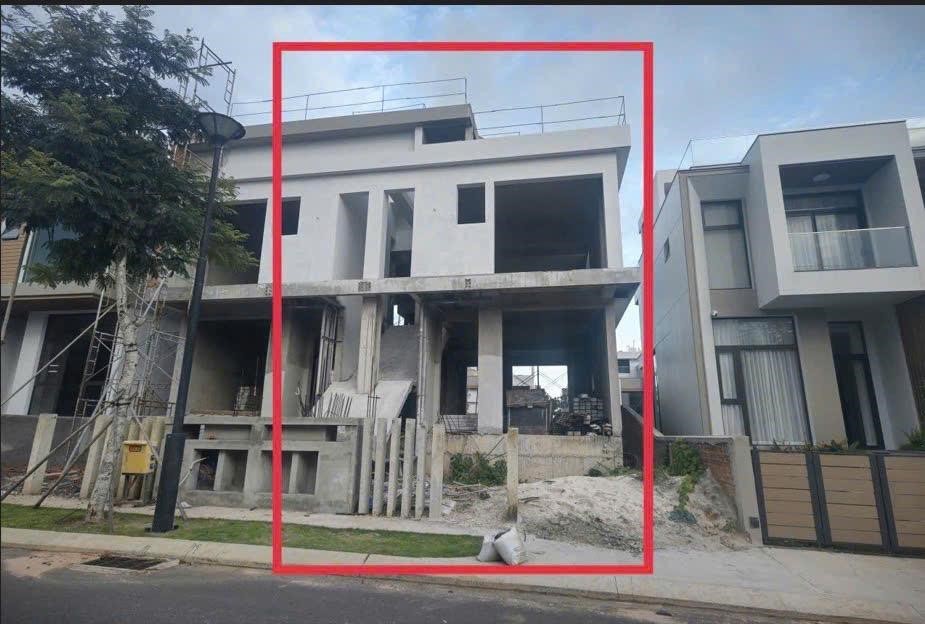

The semi-detached villa for which Mr. Sơn made a deposit for consulting and introduction services is under construction. Photo: Novareal.

From a contractual perspective, Lawyer Phan Hoàng Lâm, Head of the Saigon Branch of DT LAW Law Firm and MCAC Arbitrator, affirmed that the credit agreement and mortgage contract must be considered independently of the agreement between the customer and Novareal. “These are independent civil transactions under Article 117 of the Civil Code, established on the principle of voluntariness. In this case, neither the plaintiff nor the defendant disputed the validity of the agreement, so the court’s decision to link these three transactions is legally unfounded,” the lawyer analyzed. In banking operations, this agreement is merely one of the documents proving the customer’s loan purpose, provided by the customer to the bank during the appraisal and approval process. The customer is responsible for the legality and authenticity of the provided documents.

According to Lawyer Lâm, the 2015 Civil Code stipulates that a civil transaction is only void if it violates prohibitions, contravenes social morality, or fails to meet the conditions in Article 117. “In this case, if the loan agreement and mortgage contract between VPBank and the customer were signed voluntarily, the court’s decision to invalidate the loan agreement based on Novareal’s agreement lacks basis and is unconvincing. Meanwhile, with the available information, the transaction between Novareal and the customer involves the provision and use of consulting and real estate brokerage services. Under Clause 3, Article 74, and Clause 5, Article 66 of the 2014 Law on Real Estate Business, enterprises providing real estate consulting and brokerage services may perform agreed-upon tasks with the customer under the contract. Therefore, if Novareal and the customer established a deposit relationship to ensure the performance of consulting and brokerage services, it complies with Article 328 of the 2015 Civil Code. The trial panel should respect the parties’ agreement under Clause 2, Article 3 of the 2015 Civil Code,” the lawyer emphasized.

The lawyer also cited the principle of freedom and voluntariness, noting that Mr. and Mrs. Sơn have full civil capacity and freely entered into the loan agreement with the bank. They acknowledged their debt repayment obligation. The court should respect this intent instead of negating it by linking the loan agreement to another transaction.

Another point of contention is the trial panel’s citation of Clause 2, Article 8 of Circular 39/2016 by the State Bank to declare the loan agreement void. Lawyer Lâm disagreed, stating: “This regulation prohibits lending for transactions prohibited by law. In this case, Novareal only received a deposit to secure consulting and brokerage services. This is a legal civil transaction, not prohibited. The first-instance court lacks a clear legal basis to consider lending for depositing to ensure the performance of such obligations as illegal.”

Regarding debt repayment obligations, Lawyer Lâm stressed that judicial precedent is clear: Credit agreements are independent relationships. Borrowers must still repay the received amount, including accrued interest, unless they prove that the lending transaction itself is void.

According to Novareal, Mr. Trần Hồng Sơn’s villa is over 90% complete, and the brokerage firm has invited the customer to sign a sales contract with the developer.