Ho Chi Minh City Stock Exchange (HOSE) building located at 16 Vo Van Kiet Street, Ho Chi Minh City.

|

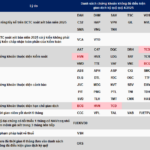

According to the announcement, the VNDIVIDEND index is expected to include 10-20 stocks selected from the VNAllshare index constituents.

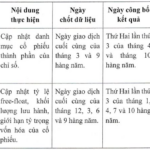

Regarding the screening criteria, eligible stocks for the VNDIVIDEND basket must meet the following conditions: a listing period of at least 5 years; a market capitalization exceeding 2 trillion VND; daily trading value between 8-10 billion VND; and positive after-tax profits in the last four quarters.

From the list of stocks meeting these criteria, the system will further select those with a dividend payout ratio compared to the 3-year average (DIVIDEND_RATIO) exceeding 80% if already in the previous index basket, or above 100% if not previously included. Specifically, DIVIDEND_RATIO is calculated as the dividend payout ratio of year T-2 (two years prior to the review period) compared to the average of the three preceding years (T-3, T-4, T-5).

Subsequently, depending on the number of eligible stocks, the official index basket will comprise up to 20 stocks with the highest DIVIDEND_RATIO and trading value, or a minimum of 10 stocks if the selection pool is limited.

The launch of VNDIVIDEND comes shortly after HOSE introduced two new indices in August 2025: VNMITECH, tracking modern industrial and technology enterprises, and the Vietnam Growth 50 Index (VN50 Growth), reflecting prominent growth companies in the market.

– 2:21 PM, October 7, 2025

63 Stocks Face Margin Cuts on HOSE in Q4 2025

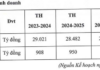

The list of stocks ineligible for margin trading in Q4/2025 on the Ho Chi Minh City Stock Exchange (HOSE) comprises 63 securities.