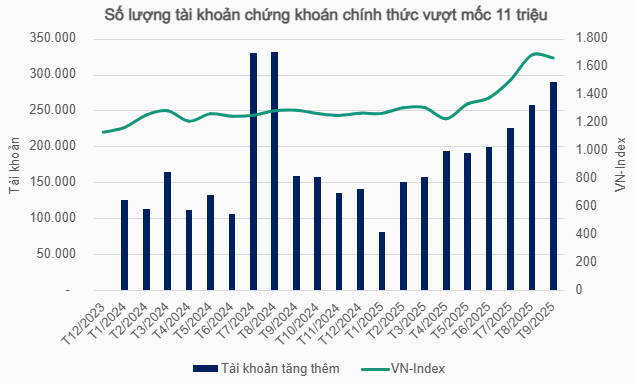

Source: VSDC, compiled by the author

|

By the end of September, over 11 million accounts were recorded, marking an increase of more than 1.7 million accounts since the beginning of the year. This milestone surpasses the target of 11 million accounts set by the Government-approved Securities Market Development Strategy in late 2023.

In September alone, the market saw an addition of over 290,000 accounts, the highest in the past 13 months. This growth was primarily driven by domestic individual investors, with nearly 289,700 new accounts, while domestic organizations added 105 accounts. Foreign investors contributed 268 new accounts, including 246 individual and 22 organizational accounts.

Despite the overall increase in September, the growth rates for domestic organizations, foreign individuals, and organizations slowed compared to August. Domestic individual investors, however, maintained their strong account growth momentum.

The stock market witnessed robust account growth despite less favorable market conditions. After a significant rally toward 1,700 points, the VN-Index entered a consolidation phase, closing September at 1,661.7 points. Average trading value also decreased to over 34 trillion VND per session, down from 49.6 trillion VND in August, amidst persistent net selling by foreign investors.

– 15:29 07/10/2025

Is the “King” Stock Still a Magnet in the Final Quarter?

Despite bank stocks no longer being as undervalued as they were earlier this year, securities firms maintain that current price levels remain reasonably attractive.

Market Hits Short-Term Warning Signal

The market is experiencing delicate fluctuations near its peak, making every decision increasingly challenging. “Riding the waves” has never been easy for Vietnamese stock investors, especially as anticipated milestones—such as market upgrades and third-quarter earnings results—begin to reveal their outcomes.

Vietstock Daily 08/10/2025: Caution Prevails Ahead of Potential Upgrade Announcement

The VN-Index retraced as buying momentum proved insufficient to surpass the September 2025 peak (1,700-1,711 range). Sustaining a position above the Bollinger Bands’ Middle Line remains critical for maintaining the index’s short-term recovery outlook. Currently, the Stochastic Oscillator has generated a fresh buy signal, while the MACD is narrowing its gap with the Signal Line, potentially triggering a similar indication in upcoming sessions.

![[IR AWARDS] December 2024: A Month of Revealing Insights](https://xe.today/wp-content/uploads/2024/12/Screenshot_01-100x70.png)