I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON OCTOBER 8, 2025

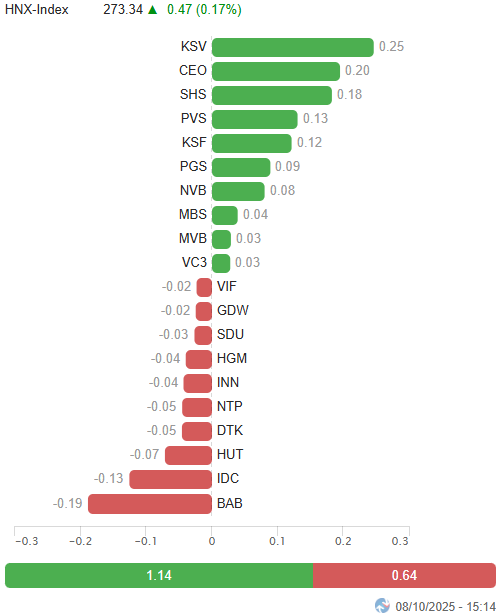

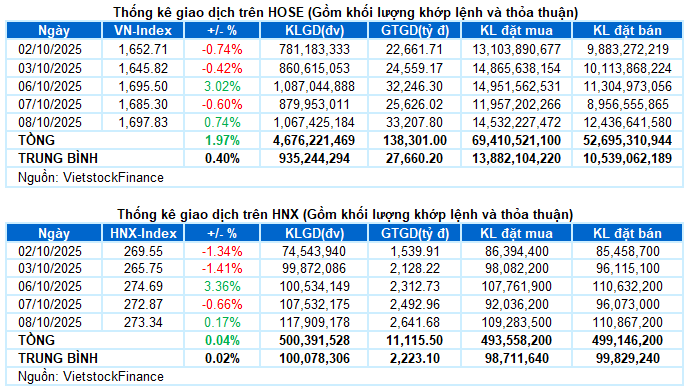

– Key indices rebounded during the October 8 trading session. Specifically, the VN-Index rose by 0.74%, reaching 1,697.83 points, while the HNX-Index also saw a slight increase of 0.17%, closing at 273.34 points.

– Trading volume on the HOSE floor surged by 27.2%, exceeding 1 billion units. The HNX floor recorded over 98 million matched units, a 23.9% increase compared to the previous session.

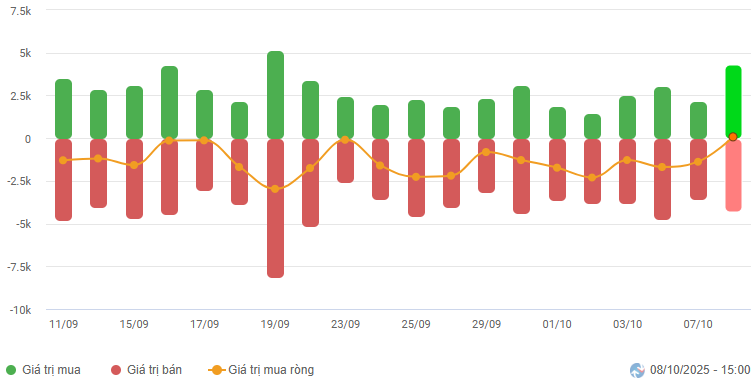

– Foreign investors resumed net buying on the HOSE floor, with a value of over 154 billion VND, but continued net selling on the HNX floor, totaling more than 62 billion VND.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

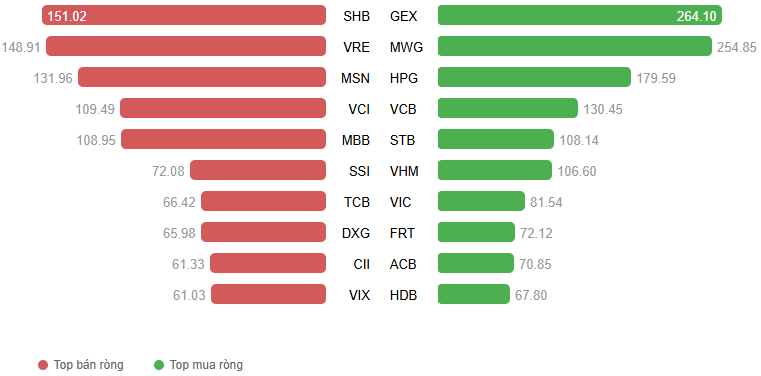

Net Trading Value by Stock Code. Unit: Billion VND

– The market opened the October 8 session with high expectations, fueled by FTSE Russell’s announcement to upgrade Vietnam from a Frontier Market to a Secondary Emerging Market. This positive sentiment propelled the VN-Index to quickly approach the 1,700-point mark at the opening bell. However, the momentum faded as blue-chip stocks weakened, causing the index to cool down and dip below the reference level by midday. In the afternoon, the VN-Index regained its upward trajectory, fluctuating around 1,690 points before a late surge in buying pressure. The VN-Index closed with a 12.53-point gain, settling at 1,697.83 points.

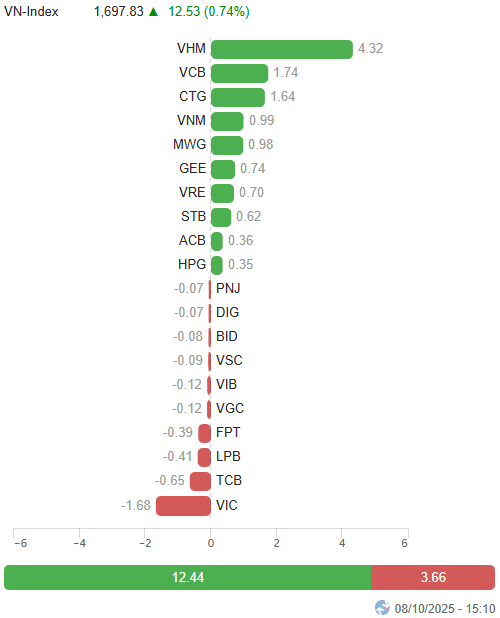

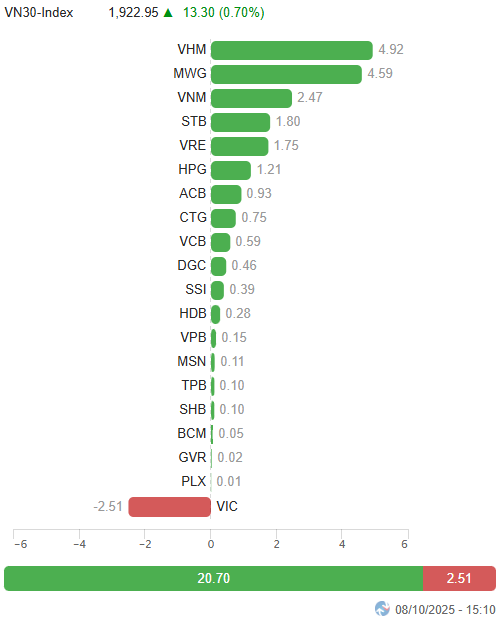

– In terms of influence, VHM led the charge, contributing 4.3 points to the VN-Index. Following closely were VCB, CTG, and VNM, adding a combined 4.4 points. Conversely, VIC exerted the most downward pressure, subtracting 1.7 points from the index.

Top Stocks Impacting the Index. Unit: Points

– The VN30-Index closed with a 13.3-point gain, reaching 1,922.95 points. The basket’s breadth favored buyers, with 19 gainers, 7 losers, and 4 unchanged stocks. VHM led the rally with a notable 4.3% increase, followed by VRE, MWG, and VNM, each surging over 3%. On the downside, VIC, LPB, TCB, and FPT faced significant pressure, declining more than 1%.

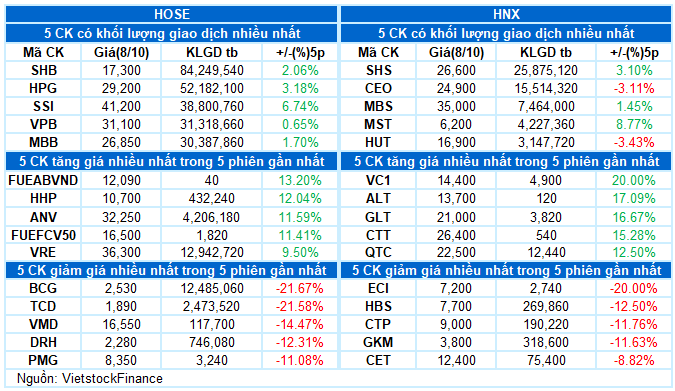

Green dominated most sectors, with non-essential consumer goods leading the market, up 1.12%. Key contributors included MWG (+3.59%), FRT (+2.38%), HHS (+4.09%), VGT (+0.83%), STK (+1.21%), and TLP (+4.23%).

Real estate and industrial sectors also showcased notable performers such as VHM (+4.27%), VRE (+3.71%), BCM (+1.21%), VPI (+3.12%), TCH (+5.43%), CEO (+2.05%), HDC (+2.31%), KHG (+2.8%), GEX (+1.1%), GMD (+1.5%), CII (+1.39%), DPG (+4.27%), and GEE hitting the upper limit.

Meanwhile, the information technology sector lagged, adjusting nearly 1%, primarily due to FPT (-1.05%), ITD (-1.12%), and VEC (-8.89%).

The VN-Index gained after a session of tug-of-war, forming a Long Lower Shadow candlestick pattern. Currently, the MACD indicator has signaled a buy as it crosses above the Signal line, while the Stochastic Oscillator continues upward, reinforcing the recovery momentum.

II. TREND AND PRICE VOLATILITY ANALYSIS

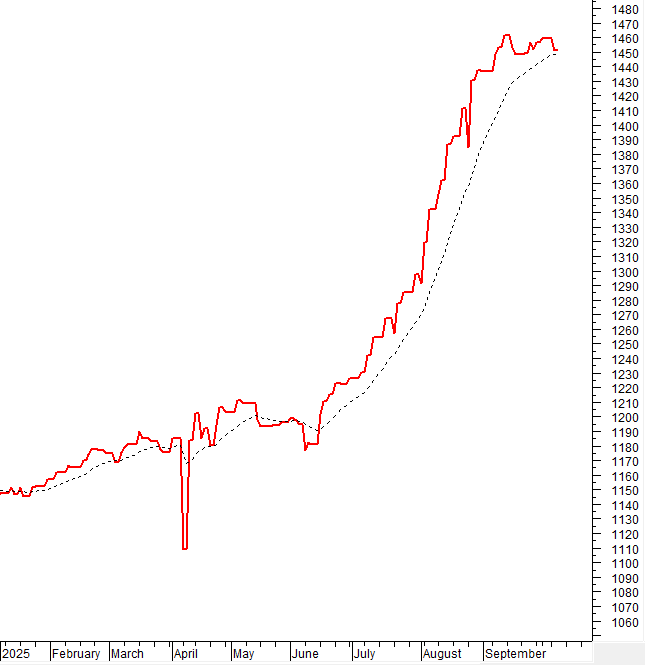

VN-Index – MACD Signals Buy

The VN-Index rose after a session of tug-of-war, forming a Long Lower Shadow candlestick pattern.

Currently, the MACD indicator has signaled a buy as it crosses above the Signal line, while the Stochastic Oscillator continues upward, reinforcing the recovery momentum. If these signals persist, the likelihood of surpassing the September 2025 high (around 1,700-1,711 points) will increase in upcoming sessions.

HNX-Index – Tug-of-War Around Bollinger Bands’ Middle Line

The HNX-Index continued to tug-of-war around the Bollinger Bands’ Middle Line. The index needs to break through this level soon, accompanied by improved liquidity, to solidify the recovery.

The Stochastic Oscillator continues upward after signaling a buy, while the MACD is narrowing its gap with the Signal line.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this state continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors resumed net buying in the October 8, 2025 session. If foreign investors maintain this action in upcoming sessions, the outlook will become even more positive.

III. MARKET STATISTICS ON OCTOBER 8, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:17 October 8, 2025

Hot News: FTSE Russell Upgrades Vietnam to Emerging Market Status

After more than seven years of anticipation, investors have finally witnessed a historic moment as FTSE Russell officially upgraded Vietnam to emerging market status.

Elevating Market Status: A Catalyst for Vietnam’s Stock Market Ascendancy

According to Tran Hoang Son, Director of Stock Market Strategy at VPBank (VPBankS), FTSE Russell’s confirmation of Vietnam’s stock market upgrade to Secondary Emerging status brings significant benefits. These include increased foreign investment inflows, enhanced market liquidity and efficiency, elevated economic reputation and standing in the region, and accelerated economic and corporate growth.

Vietnam’s State Securities Commission: Market Upgrade Marks the Beginning of a New Development Phase

According to the State Securities Commission (SSC), this event marks a significant milestone, showcasing the robust growth of Vietnam’s stock market. It reflects the comprehensive reform efforts undertaken by the entire securities industry in recent years, aligning with the directives of the Party and the State to develop a transparent, modern, and efficient stock market that meets the highest international standards.