The FTSE Russell Index Advisory Board has recognized Vietnam’s fulfillment of all necessary criteria for an upgrade to Secondary Emerging Market status under the FTSE Equity Country Classification framework. However, the FTSE Russell Advisory Committee expressed lingering concerns regarding foreign brokerages’ access to Vietnam’s market. While not a mandatory condition for Secondary Emerging Market status, FTSE Russell emphasized that enhancing foreign investor access is crucial for index replication and meeting global investor demands. Consequently, Vietnam will undergo a reassessment in March 2026 to evaluate progress in addressing this issue. If positive results are achieved, FTSE Russell will formally confirm the upgrade and announce the implementation plan in March 2026.

VinaCapital believes that Vietnam’s market regulators can proactively resolve this issue, enabling the country to achieve the upgrade by September 2026 as planned.

Phased Upgrade Roadmap

|

Chart 1: Timeline for Vietnam’s Upgrade from Frontier to Secondary Emerging Market

|

Considering market liquidity and securities firms’ capacity to provide non-margin services for foreign institutional investors, index-tracking funds will execute purchases in multiple phases. Given the size of Vietnam’s stock market, VinaCapital anticipates the buying process will be evenly split into two phases.

This upgrade acknowledges the Vietnamese government’s robust efforts, particularly over the past two years, in implementing comprehensive reforms. These initiatives include investing in technological infrastructure, introducing new financial products, enhancing legal frameworks, improving corporate governance transparency, and expanding market access for foreign investors. Over the past three years, Vietnam has witnessed significant foreign capital outflows, totaling $8.5 billion. However, VinaCapital is confident that this upgrade will mark a turning point, opening opportunities for the market to attract foreign capital from emerging market-focused funds.

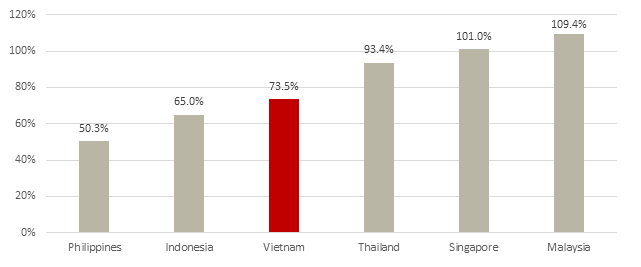

This achievement is not the final goal but a new starting point, setting urgent requirements and challenges for future development—with the strategic objective of expanding Vietnam’s stock market to 120% of GDP by 2030, up from the current 75%.

|

Total Market Capitalization as a Percentage of GDP

Source: Bloomberg, data as of October 7, 2025

|

Foreign Capital Flow Analysis

Estimates suggest that the FTSE Russell’s emerging market upgrade could inject $5–6 billion into Vietnam’s stock market. Following the upgrade, Vietnam will be included in the FTSE EM All Cap Index (with approximately $100 billion in assets under management). VinaCapital projects Vietnam could account for around 0.3% of this index (equivalent to $300 million in passive inflows for the FTSE EM All Cap Index), with approximately 30 stocks included.

Overall, when considering other emerging market index funds, Vietnam is expected to receive approximately $5–6 billion in foreign capital, comprising $1 billion in passive inflows and $4–5 billion in active investments. While this figure is not substantial, it represents a significant and positive shift for Vietnam, especially after three consecutive years of net foreign outflows. The return of foreign capital is anticipated to enhance liquidity, bolster investor confidence, and promote the sustainable development of Vietnam’s capital market.

Post-Secondary Emerging Market Upgrade

The upgrade to Secondary Emerging Market status is a pivotal milestone for Vietnam. However, the greater challenge lies in maintaining and strengthening this position long-term. To achieve this, Vietnam must implement further comprehensive reforms to deepen, modernize, and ensure the sustainable development of its capital market.

Establishment of a Central Counterparty System (CCP) by Late 2026

While the Non-Prefunding (NPF) trading model serves as a temporary solution to meet FTSE Russell’s upgrade criteria, the CCP system offers a more sustainable and long-term solution. According to the government’s roadmap, Vietnam will establish a CCP subsidiary under the Vietnam Securities Depository and Clearing Corporation (VSDC), aligning with MSCI standards. The necessary legal and institutional frameworks are expected to be finalized by late 2026, with the CCP system commencing operations in Q1 2027.

|

Implementation Roadmap for the Central Counterparty System (CCP) in Vietnam

Source: VinaCapital compilation

|

Enhancing Foreign Investor Access is Key

Relaxing foreign ownership limits is a critical step in improving market accessibility. Additionally, establishing a legal framework for currency hedging instruments is essential, enabling long-term institutional investors to effectively manage currency risks in emerging markets. Other issues, such as the lack of detailed English reports and standardized market data, also need addressing to increase foreign investor interest.

Need for Sector Diversification and High-Quality IPOs

Currently, Vietnam’s stock market remains heavily reliant on two key sectors: Finance (37%) and Real Estate (19%). A more diversified sector composition would better reflect the overall economy and reduce excessive dependence on Banking and Real Estate. Meanwhile, the upcoming IPO wave will boost market capitalization and help rebalance the sector structure. This diversification will enhance market liquidity and attract a broader range of investors with varying strategies and risk appetites. Long-term, a diversified market will drive sustainable growth, strengthen investor confidence, and support continuous capital market development.

Vietnam’s Capital Market—An Ambitious Journey Ahead

Year-to-date, Vietnam’s stock market has achieved over 34% growth in VND terms, with market liquidity leading the ASEAN region—averaging approximately $1 billion per trading session.

However, the overall size of Vietnam’s stock market (over $300 billion across three exchanges) remains modest. Under the Vietnam Securities Market Development Strategy to 2030 (Decision No. 1726/QĐ-TTg dated December 29, 2023), the goal is to expand the market to 120% of GDP by 2030—up from the current 75%—and develop the bond market to at least 58% of GDP, nearly double the current 32%. Corporate bonds are expected to account for at least 25% of GDP by 2030, up from less than 10% currently. Vietnam is also striving to meet the requirements for inclusion in the MSCI Emerging Markets Index, which could attract significant capital inflows.

Beyond scale expansion, VinaCapital believes the government’s ultimate goal is to establish a foundation for national financial autonomy—strengthening the intrinsic capabilities of Vietnamese enterprises, enhancing corporate governance transparency, and enabling businesses to compete and integrate globally.

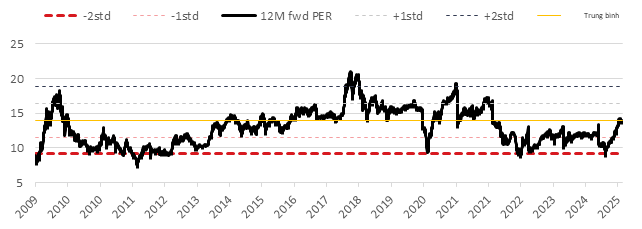

VinaCapital remains optimistic about the stock market’s prospects. Long-term, economic growth remains the primary driver of stock market performance. Vietnam’s stock market is currently trading at a reasonable valuation of approximately 13 times forward P/E. In the context of the market upgrade, the VN-Index’s valuation is expected to increase by 15–20% over the next 12–18 months. This reflects Vietnam’s positive economic outlook, supportive government policies, anticipated 15% corporate earnings growth over the next 1–2 years, and the VN-Index’s potential re-rating following its emerging market upgrade.

|

Forward P/E Ratio of the VN-Index

Source: Bloomberg, data as of October 7, 2025

|

– 15:00 08/10/2025

Vietnam’s State Securities Commission: Market Upgrade Marks the Beginning of a New Development Phase

According to the State Securities Commission (SSC), this event marks a significant milestone, showcasing the robust growth of Vietnam’s stock market. It reflects the comprehensive reform efforts undertaken by the entire securities industry in recent years, aligning with the directives of the Party and the State to develop a transparent, modern, and efficient stock market that meets the highest international standards.

Electric Honda Motorcycles on Sale: Compact Design, Spacious Storage, Under 30 Million VND

The electric motorcycle model, despite being a recent market entrant, has swiftly captured significant consumer attention.

Vietnam’s Ascent to Global Financial Hub Status

Aspiring to establish Vietnam as a compelling and sustainable global financial hub not only unlocks opportunities to attract international capital but also serves as a critical test of its institutional framework, infrastructure, and capacity to foster an environment that is truly livable, workable, and investable.

VN-Index Surges Nearly 50 Points as Stocks Race to Hit Ceiling

The week’s opening trading session (October 6th) concluded with a widespread green trend, as the VN-Index surged by nearly 50 points, breaking free from previous adjustment and tug-of-war sessions. The securities group took center stage, with over 10 stocks hitting their ceiling prices.