Vingroup’s investment of VND 10 trillion to establish VinMetal Corporation is more than just an expansion into basic materials. It’s a strategic, long-term move to close the supply chain loop—from steel and batteries to components and electric vehicle production. This aims to boost localization rates, optimize costs, and reduce reliance on imports. As Vietnam targets the development of foundational material industries and electric vehicle supply chains, this initiative marks a pivotal strategic shift.

Closing the Supply Chain Loop: Vingroup’s Ambitious Vision

For years, Vingroup has been shaping a closed industrial ecosystem. Starting with electric vehicle production, it expanded into batteries via VinES, then invested in charging stations, GSM electric taxis, and now metallurgy with VinMetal. The conglomerate aims to control critical inputs in the production chain—a strategy mirroring global industrial giants like Hyundai and Toyota to cut costs and enhance autonomy.

Globally, the “vertically integrated” model has proven successful for many automotive conglomerates. Hyundai Motor Group, for instance, owns Hyundai Steel, which supplies high-strength steel sheets for vehicle production. By controlling material sourcing, Hyundai reduces intermediary costs, ensures stable supply, and maintains strong international competitiveness.

According to a 2023 McKinsey & Company report, materials account for 47–52% of an electric vehicle’s total production cost, with steel and alloys alone comprising nearly 20%. Securing a reliable supply of high-quality automotive steel could significantly reduce VinFast’s production costs.

Automotive steel differs from standard construction steel, requiring high strength, impact resistance, and corrosion protection. Vietnam currently imports most of its automotive steel from Japan, South Korea, or China. Producing this material domestically would be a major leap for Vietnam’s automotive industry.

Domestic Steel Production: Cost-Effective or Not?

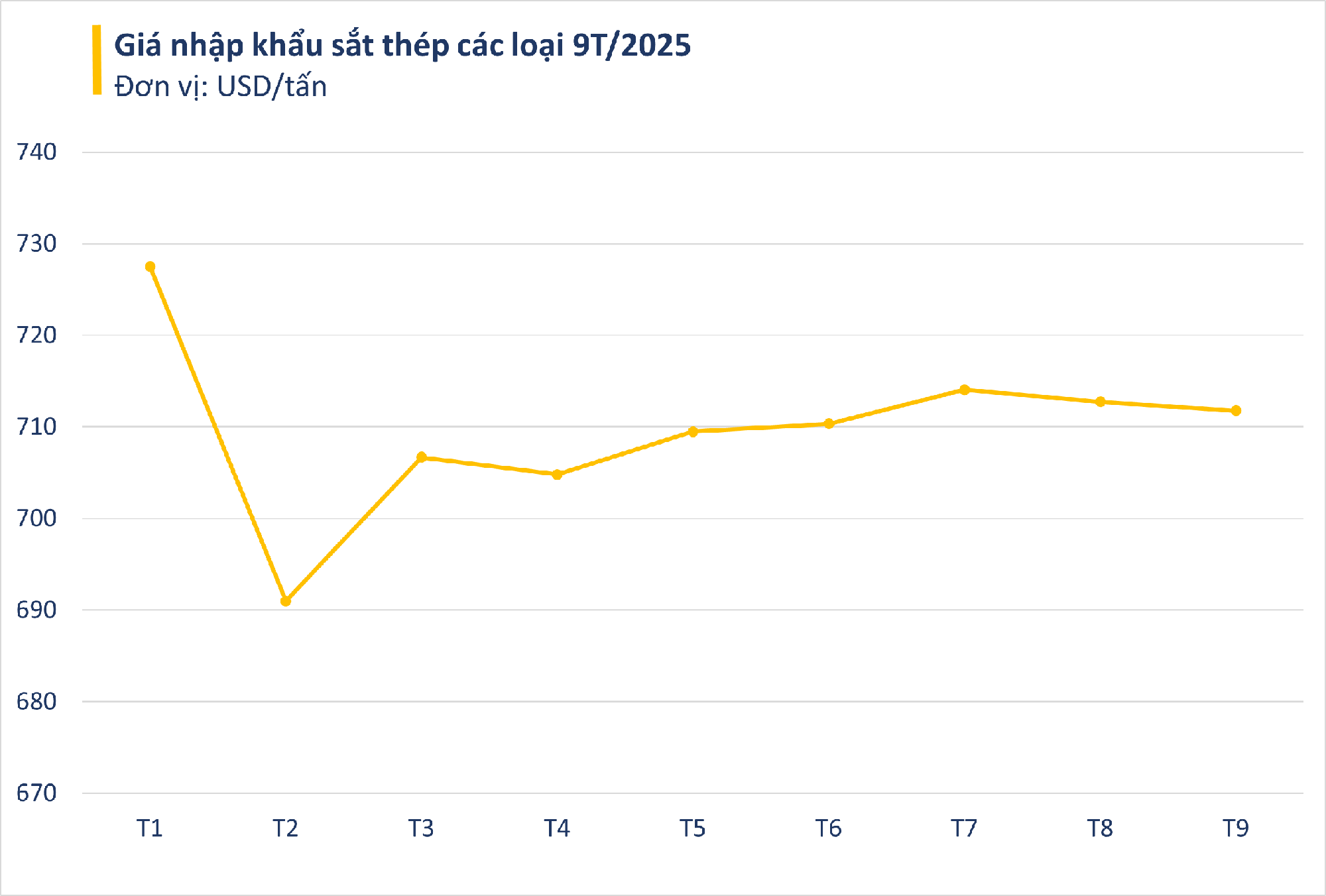

The question remains: Can domestic steel production truly reduce costs compared to imports? The answer depends on factors like plant scale, raw material sourcing, energy costs, and technological efficiency. According to the OECD Steel Market Outlook 2024, average steel production costs in Asia range from USD 400–500 per ton for traditional blast furnace plants. In contrast, imported steel into Vietnam averages USD 600–740 per ton (Vietnam Customs data).

If VinMetal adopts modern metallurgical technologies (e.g., electric arc furnaces) and leverages renewable energy within Vingroup’s ecosystem, production costs could drop by 10–15% compared to imports, while meeting environmental standards. Additionally, reducing dependence on foreign supply chains enhances supply stability and mitigates risks from transportation disruptions or geopolitical volatility, as seen during the 2021–2022 steel price surge.

In June, VinFast announced plans to localize hot-stamped steel components—a critical material in modern automotive manufacturing, especially with growing demands for safety, lightweight design, and fuel efficiency.

“We’ve searched across Vietnam but haven’t found a partner capable of producing hot-stamped steel to our standards. Even a renowned company like Formosa hasn’t met these requirements yet,” said Thái Thị Thanh Hải, Vice Chairwoman of Vingroup and Deputy CEO of VinFast Global. This highlights the challenge VinMetal faces in producing automotive-grade steel.

Toward a Sustainable Value Chain and Higher Localization Rates

If successful, VinMetal’s impact will extend beyond VinFast. Establishing a domestic automotive steel producer could create a ripple effect across Vietnam’s mechanical, material, and electronics industries, which form the backbone of its supporting industries.

During a forum on electric vehicle localization, VinFast representatives stated that their electric vehicles already achieve over 60% localization, including critical components like body panels, motors, roofs, and suspension systems.

The company is also expanding domestic production of high-value components such as seats, wiring systems, lights, wheels, braking systems, and interior/exterior parts.

Vingroup’s establishment of VinMetal is a long-term strategy to strengthen the domestic supply chain, benefiting not only VinFast but also aiming to increase localization rates in the broader future. Once VinMetal operates smoothly, Vietnam will have the foundational materials to develop a sustainable electric vehicle industry, reduce import dependence, enhance industrial autonomy, and boost domestic production value.

Proposed Construction of a Cross-Sea Bridge Connecting Can Gio and Vung Tau

Investors have recently proposed a feasibility study for a groundbreaking sea-crossing route connecting Cần Giờ to Bà Rịa Vũng Tàu, to be developed under a Build-Transfer (BT) model.

Vingroup Proposes Construction of Can Gio – Vung Tau Cross-Sea Highway

Vingroup Corporation has proposed a groundbreaking initiative to invest in the research and development of a trans-sea route connecting Cần Giờ and Bà Rịa Vũng Tàu. This ambitious project is envisioned to be executed under a Build-Transfer (BT) model, leveraging innovative infrastructure solutions to enhance regional connectivity and economic growth.

Market Pulse 07/10: A Divided Market with Cautious Capital Flows

The vibrant red hue intensified, exerting significant pressure on the index. By the close of the morning session, the index settled at 1,694.87 points, experiencing a slight decline of 0.6 points. Meanwhile, the HNX-Index dipped by 0.2 points, concluding near the 275-point mark.