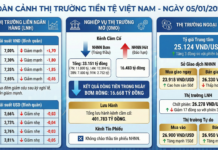

With the return of capital inflows, large-cap stocks took the lead, driving a broad market rally as the VN-Index surged back toward the 1,700-point mark. 29 out of 30 VN30 constituents closed in the green, signaling a shift in market leadership beyond the Vingroup ecosystem. VCB, VPB, VIC, HPG, VHM, CTG, TCB, BID, MBB, and ACB emerged as the top performers, significantly contributing to the day’s gains.

Among these, banking stocks dominated both in numbers and influence. VCB alone added over 4 points to the benchmark index, with other sector peers contributing 1-3 points each. Except for LPB, which bucked the trend, all 26 banking stocks advanced. Notable gainers included TPB, STB, EIB, HDB, SHB, and VIB, each rising more than 4%.

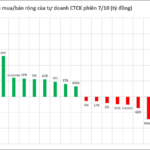

Securities stocks rallied en masse, with many hitting the ceiling.

A notable development occurred in the securities sector, where VCI, CTS, TCI, SSI, HCM, VIX, VND, VDS, AGR, and ORS all hit their upper limits. Many of these stocks saw no sell orders, while buy orders piled up at ceiling prices, as observed in SSI, VIX, and VND.

This week marks a critical juncture for Vietnam’s stock market as FTSE Russell announces its decision on the market’s upgrade status. Securities stocks are often considered highly sensitive to market news and fluctuations.

Meanwhile, real estate stocks such as DIG, HDG, PDR, and VRE also hit their daily limits. Sectors like construction, steel, and energy were awash with green. Conversely, Bamboo Capital’s BDG and TCD continued their freefall, hitting the floor. Both companies have submitted explanations to regulators regarding their stocks’ transition from restricted to suspended trading status. Reasons cited include personnel changes, debt restructuring challenges, and slower-than-expected progress.

Bamboo Capital stated that it has directed subsidiaries to collaborate with auditors to finalize the 2024 consolidated financial report, slated for release in October.

The company attributed the delay in financial reporting to technical issues, emphasizing that it does not impact ongoing operations or financial health. Key segments such as renewable energy, real estate, and infrastructure investment remain operational, with debt obligations being met as scheduled.

Tracodi, a Bamboo Capital subsidiary, also confirmed that it is urging auditors to complete and submit the audit report by October for market release.

At the close, the VN-Index climbed 46.6 points (3.02%) to 1,695.5. The HNX-Index rose 8.94 points (3.36%) to 274.69, while the UPCoM-Index inched up 0.14 points (0.13%) to 109.16. Liquidity surged, with HoSE trading volume exceeding VND 31.784 trillion.

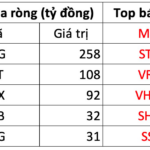

Foreign Investors Extend Sell-Off Streak, Net Selling Over $43 Million, While Countering with $11 Million Buy on Blue-Chip Stock

Foreign investors’ net selling activities have significantly impacted the market, with a substantial net outflow of 1.393 trillion VND across the board.

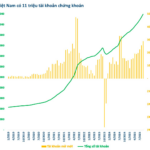

Vietnamese Stock Accounts Surpass 11 Million, Exceeding 2030 Target

As of September 2025, Vietnam’s stock market has surpassed expectations, boasting over 11 million trading accounts—a milestone originally targeted for 2030 under the government-approved Securities Market Development Strategy unveiled in late 2023, according to data from the Vietnam Securities Depository and Clearing Corporation (VSDC).

Is the “King” Stock Still a Magnet in the Final Quarter?

Despite bank stocks no longer being as undervalued as they were earlier this year, securities firms maintain that current price levels remain reasonably attractive.