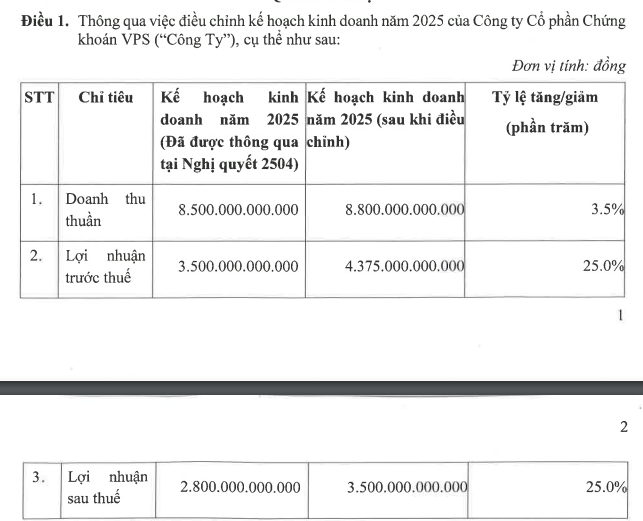

VPS Securities Corporation (VPS) has announced an adjusted business plan for 2025, targeting significant growth in revenue and profitability.

The revised plan sets an annual revenue goal of VND 8,800 billion, with pre-tax and post-tax profits of VND 4,375 billion and VND 3,500 billion, respectively.

Compared to the plan approved at the 2025 Annual General Meeting of Shareholders, VPS has increased its revenue target by 3.5% and profit target by 25%. If achieved, this would mark a record-high profit for the securities company.

Source: VPS

In the first half of the year, VPS reported VND 3,192 billion in operating revenue, a 3% decrease year-over-year. However, cost-cutting measures resulted in pre-tax and post-tax profits of VND 1,797 billion and VND 1,438 billion, respectively, both up 40% compared to the first half of 2024. This performance represents 51% of the pre-adjusted plan.

According to the latest announcement from the Ho Chi Minh City Stock Exchange (HoSE), VPS maintained its leading position in brokerage market share in Q3/2025, capturing 17.05%, a 1.68% increase from the previous quarter. This is also VPS’s highest market share in the last four quarters.

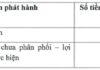

In other developments, VPS will finalize its shareholder list on October 10 for the allocation of bonus shares to increase charter capital from owner’s equity.

VPS plans to issue 710 million bonus shares from owner’s equity, with a rights ratio of 1:1.245, meaning shareholders will receive 1.245 new shares for every 1 share held.

The capital for this issuance is sourced from the 2025 mid-year financial report, including VND 85.4 billion from the supplementary capital reserve fund, VND 103 billion from the financial and business risk reserve fund, and VND 6,911 billion from undistributed after-tax profits.

The issuance aims to enhance operational capital and financial capacity, supporting margin lending and advance payment activities.

The issued shares will be unrestricted for transfer. Upon completion, VPS’s charter capital will increase from VND 5,700 billion to VND 12,800 billion.

This is one of three capital increase plans approved at the Extraordinary General Meeting of Shareholders on September 29. Following the bonus share issuance, VPS will proceed with an IPO of up to 202.3 million shares.

Phú Bài Fiber’s Pre-Tax Profit Surges 72% in 9 Months

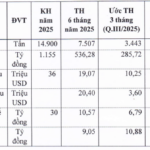

On September 24, 2025, the Board of Directors of Phu Bai Fiber Joint Stock Company (UPCoM: SPB) approved the estimated business results for the first nine months of 2025. The company reported net revenue of VND 822 billion and pre-tax profit exceeding VND 17 billion. While revenue decreased by 12%, profit surged by nearly 72% compared to the same period last year.

The Real Estate Tycoon of Hai Phong: 200 Million Shares Offered at a Bargain Price of 10,000 VND Each

“A bold and enticing offer of VND 10,000 per share is on the table, an irresistible invitation that undercuts the current market price by almost half. TCH ended its trading day on August 7th with a share price of VND 24,150, setting the stage for a potential windfall.”