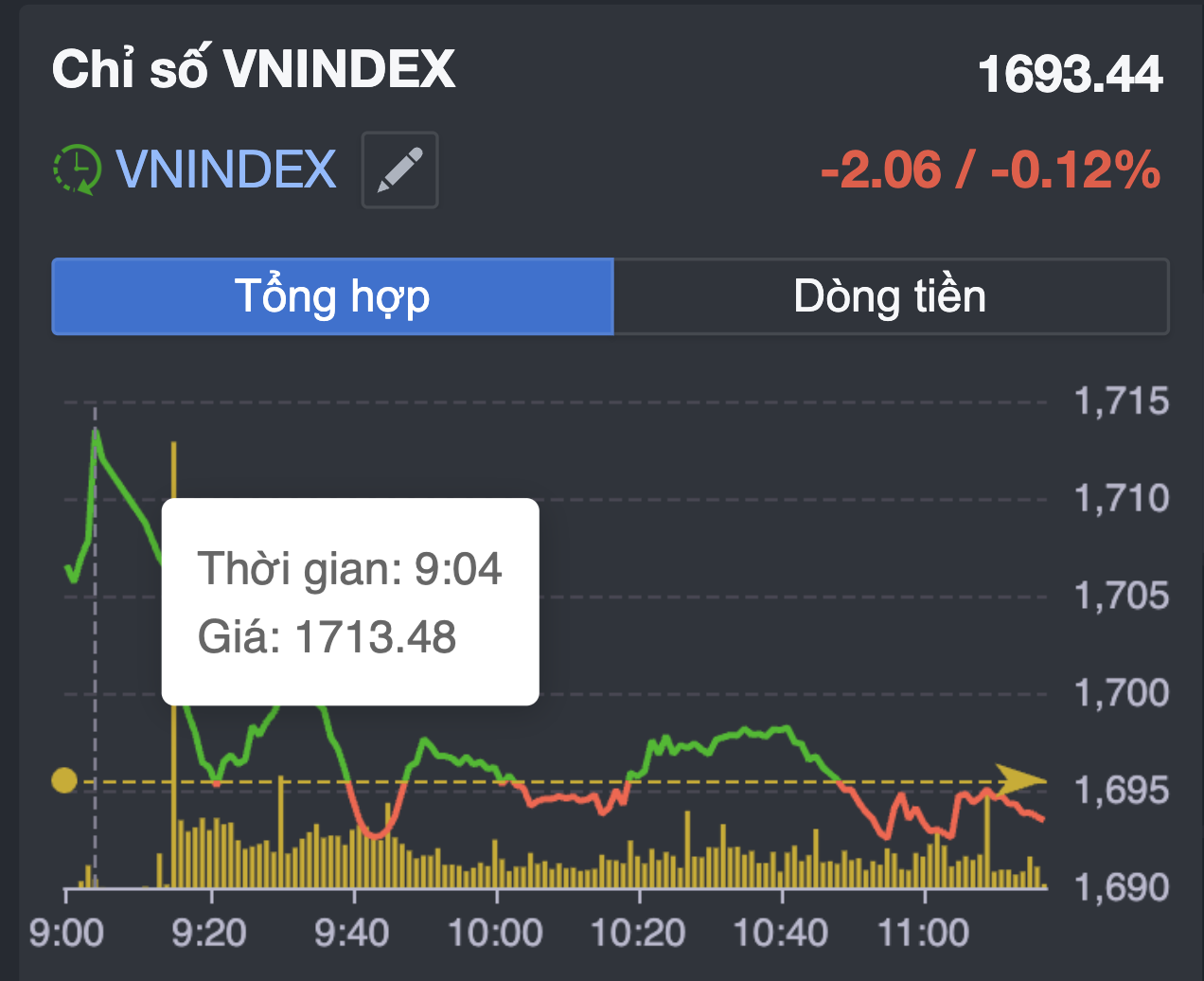

Following a near 50-point surge on October 6th, Vietnam’s stock market resumed a cautious stance on the morning of October 7th, as investors awaited FTSE Russell’s imminent decision on upgrading the country’s market status, expected within hours.

Investor Caution Prevails

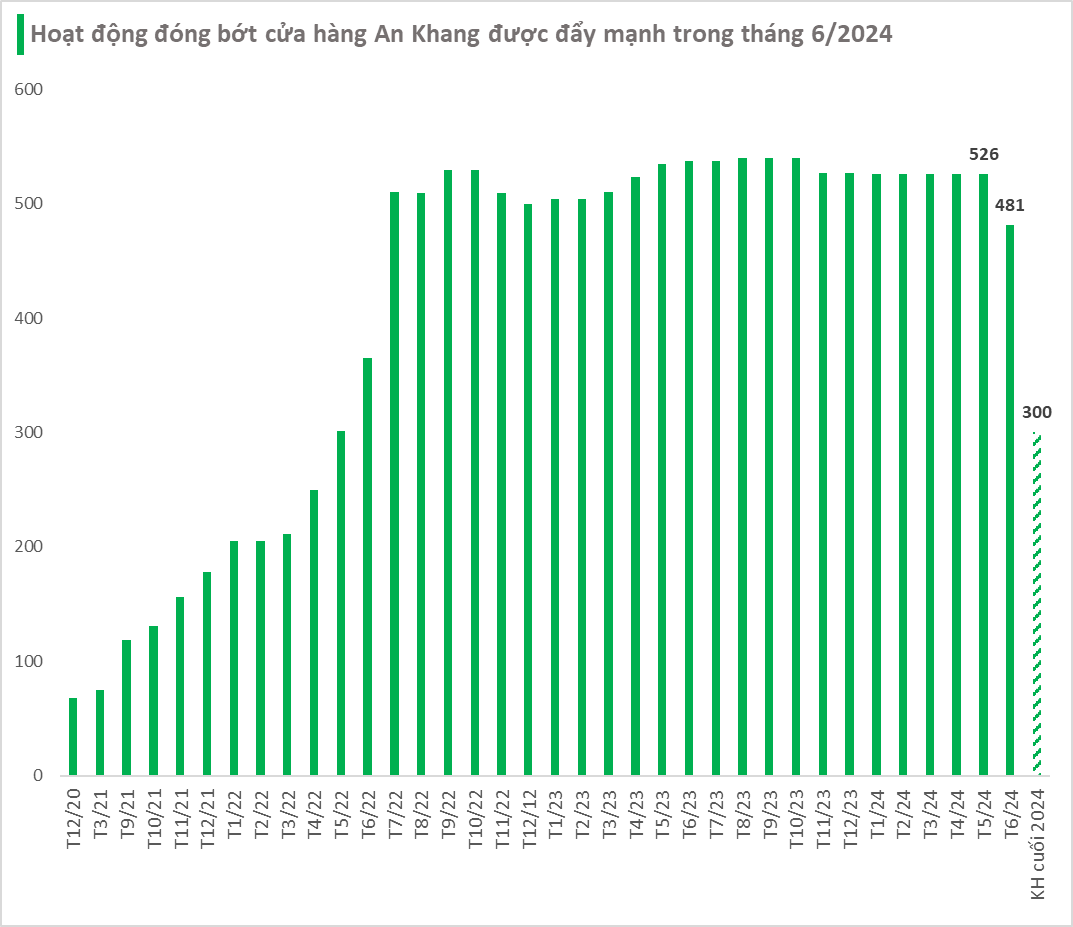

During the October 7th morning session, initial excitement faded quickly after a brief rally. The VN-Index briefly surpassed 1,700 points before retreating as investors locked in profits, wary of a potential market reversal.

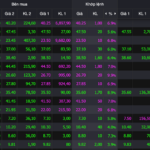

The morning session closed with mild volatility, dominated by red across sectors. The VN-Index dipped slightly below 1,694.9 points, despite robust liquidity exceeding VND 12 trillion. This indicates sustained investor interest, albeit tempered by caution following last week’s technical rebound.

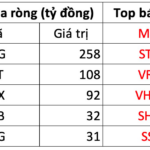

The VN30 basket showed mixed performance, gaining 2.27 points, supported by blue-chips like VRE, MWG, FPT, and HPG. VRE led with a 3% surge, buoying real estate, while MWG and HPG rose 2%. Conversely, banking stocks (VCB, CTG, BID, TCB) saw minor declines, limiting overall gains.

Afternoon trading on October 7th is expected to remain range-bound, with investors awaiting clearer signals from market leaders.

Online forums reveal investor hesitation. “While most predict an upgrade, I’ll await the official announcement and market reaction before committing further,” said Nhat Truong, a Ho Chi Minh City investor.

New historical peak of 1,713 points reached in the morning session.

Upgrade Scenarios

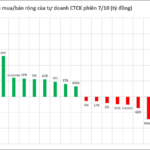

VPS Securities highlights the October 6th session’s strong liquidity, driven by large-caps and the VN30 basket. The index is poised to resume its uptrend, targeting 1,720–1,740, with 1,800 possible if liquidity holds.

Key question: Will an upgrade trigger a sustained rally or merely a short-term psychological boost?

Le Tran Khang of Phu Hung Securities notes, “The upgrade acts as a catalyst, not a trend driver. Despite recent foreign outflows, domestic absorption remains strong, reflecting local confidence. An upgrade could reverse foreign flows, easing market pressure.”

Market volatility intensifies in today’s morning session.

Rong Viet Securities (VDSC) emphasizes Q3/2025 earnings as the primary pricing driver. Listed profits are projected to rise 22% YoY, surpassing earlier 15% estimates. “The upgrade likely bolsters sentiment rather than intrinsic value,” VDSC analysts state.

Khang advises focusing on fundamentally strong, sector-leading firms, especially those attracting foreign capital post-upgrade. “Key sectors include securities, banking, and large-caps. Infrastructure and policy-benefiting stocks also warrant attention,” he adds.

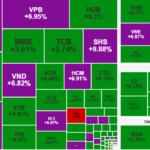

VN-Index Surges Nearly 50 Points as Stocks Race to Hit Ceiling

The week’s opening trading session (October 6th) concluded with a widespread green trend, as the VN-Index surged by nearly 50 points, breaking free from previous adjustment and tug-of-war sessions. The securities group took center stage, with over 10 stocks hitting their ceiling prices.

Vietnamese Stock Accounts Surpass 11 Million, Exceeding 2030 Target

As of September 2025, Vietnam’s stock market has surpassed expectations, boasting over 11 million trading accounts—a milestone originally targeted for 2030 under the government-approved Securities Market Development Strategy unveiled in late 2023, according to data from the Vietnam Securities Depository and Clearing Corporation (VSDC).