|

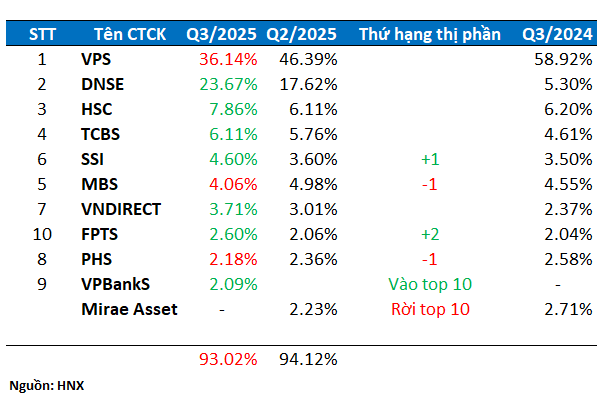

Top 10 Derivatives Brokerage Market Share in Q3/2025

|

In Q3, VPS’s derivatives brokerage market share dropped to just over 36%, a significant decline of more than 10 percentage points compared to the previous quarter. Once dominating nearly 60% of the market, VPS has seen its derivatives market share steadily erode throughout 2025.

Conversely, most other firms in the top 10 experienced market share gains. Notably, DNSE Securities stood out with a 23.67% market share, a surge of over 6 percentage points from the previous quarter. In just two years since launching its derivatives product, DNSE has demonstrated remarkable growth in this arena. In Q1/2024, the company first entered the top 10 with a 5th place ranking (4.01% share). Within a year, DNSE climbed to 2nd place in Q1/2025 (16.7%) and has continued to expand its market share since.

Remarkably, in the HNX’s base brokerage rankings, DNSE Securities also achieved an impressive breakthrough by entering the top 6 with a 4.63% market share, right behind industry giants VPS, TCBS, SSI, MBS, and VNDIRECT.

Returning to the derivatives market, SSI, HSC, VNDIRECT, and FPTS all recorded market share increases in Q3.

VPBankS entered the top 10 with a 2.09% market share, while Mirae Asset exited the rankings.

– 14:46 08/10/2025

GELEX Electric Achieves Full-Year Profit Target by Q3/2025

In Q3/2025, amidst clear signs of macroeconomic recovery, GELEX Electric (HOSE: GEE) demonstrated robust business performance.

VPS Securities Raises 2025 Profit Target by 25%

On October 6th, the Board of Directors of VPS Securities JSC adopted a resolution to adjust the 2025 business plan, targeting a 3.5% increase in revenue and a 25% rise in profit.

82.5% of Manufacturing Businesses Anticipate Improved Business Conditions in Q4 2025

In the fourth quarter of 2025, a survey on business trends within the manufacturing and processing industry reveals optimistic projections. Approximately 40.8% of businesses anticipate an improvement in trends compared to the third quarter of 2025, while 41.7% expect stable production and operations. Conversely, 17.5% of enterprises foresee more challenging conditions ahead.