One of the most notable highlights in Q3 was the robust surge in the apartment segment, particularly in former Ho Chi Minh City (HCMC) and Thu Duc City. The average asking price for apartments in HCMC reached 99 million VND/m², the highest in the past two years. This reflects a more positive market sentiment, especially after the announcement of administrative unit mergers, sparking expectations of a new growth cycle.

In former Thu Duc City, dubbed the “city within a city,” apartment prices have risen by 32–48% since the beginning of 2023. Areas like District 2, former District 9, and central Thu Duc have become strategic destinations for both homebuyers and long-term investors. Modern infrastructure, meticulous planning, and its role as a technology, education, and logistics hub have solidified Thu Duc’s position as the “locomotive” of Eastern Saigon.

In the city center, luxury apartments in former District 1 continue to command the highest prices, around 222 million VND/m², a 39% increase over two years. However, due to the high prices, investment is shifting to areas with greater growth potential and more affordable prices, such as former Thu Duc, Di An, and Thuan An.

Satellite Areas Binh Duong and Long An Accelerate

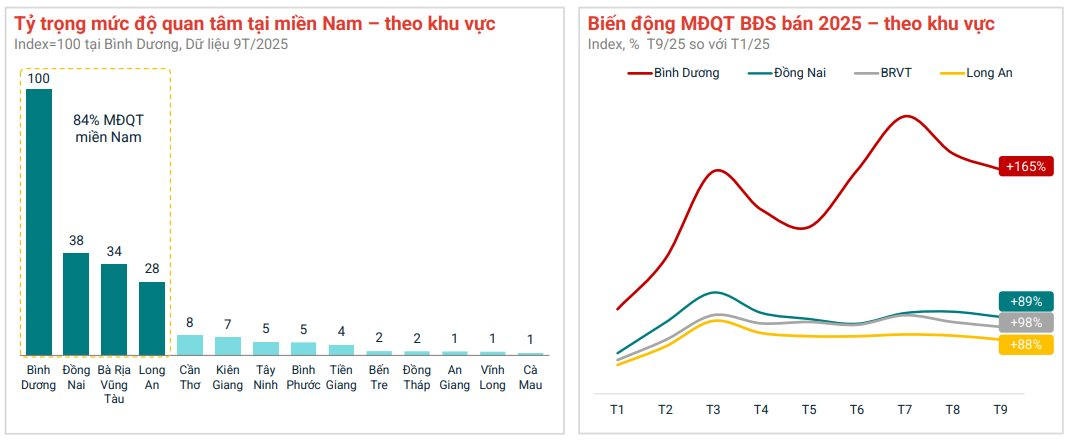

Not only the city center but also neighboring provinces like former Binh Duong and Long An have seen significant growth. In Binh Duong, the average apartment price has reached 41 million VND/m², a 30% increase since the start of 2023. Interest has surged by 48%, reflecting the market’s appeal due to its well-developed infrastructure and relatively affordable prices.

In the South, real estate activity is concentrated around former HCMC and Binh Duong.

Former Thu Dau Mot City, the administrative and service center of the province, is emerging as a “bright spot” for investment with a rental yield of 5.1%, the highest in the Southern region, surpassing HCMC. With its attractive yield, vast land reserves, and rapid urbanization, Binh Duong is quickly reclaiming its status as the fastest-growing satellite area around HCMC.

Similarly, former Long An has seen impressive growth: apartment prices have risen by 8%, and land prices by 7%, particularly in areas near HCMC such as Ben Luc and Duc Hoa, which are directly connected to Ring Road 3 and major highways.

Land Plots “Warm Up” but Remain Selective

After a period of stagnation, the land plot segment in former HCMC and its surrounding areas has begun to recover. Average land prices in HCMC have increased by about 6%, reaching 69 million VND/m². Meanwhile, Binh Duong has seen a 5% increase, reaching 21 million VND/m².

However, not all areas are thriving. Former Ba Ria – Vung Tau remains quiet, with land prices dropping by 10% and interest declining by 13%. This indicates that investment is becoming more selective, favoring areas with well-developed infrastructure and clearer price growth potential in the near future.

A survey by Batdongsan.com.vn reveals that over 60% of real estate agents in HCMC believe the market will continue to grow in Q4/2025, with 17% expecting strong growth. Apartments remain the most promising segment, followed by private houses and land plots.

New apartment projects continue to concentrate in the outskirts of HCMC, such as former Thu Duc, Thuan An, and Di An, with a total supply of tens of thousands of units. Prices range from 40–60 million VND/m² in peripheral areas and 80–120 million VND/m² in Thu Duc, highlighting clear segmentation based on location and product quality.

According to Dinh Minh Tuan, Regional Director of Batdongsan.com.vn in the South, increased public investment, the completion of Ring Road 3, the HCMC – Moc Bai Expressway, and administrative merger announcements are creating strong momentum for HCMC and its surrounding areas.

“After a period of observation, HCMC is rebounding strongly, with improved supply and liquidity. The return of buyers will be a crucial factor in sustaining the market’s recovery in the coming quarters,” Tuan commented.

Billions Spent by Ho Chi Minh City to Inspect Nearly 200 Aging Apartment Buildings

To assess the quality of residential buildings in the area in accordance with regulations, the Department of Construction has proposed that the Ho Chi-Minh City People’s Committee approve the initiative to conduct inspections and evaluations of 186 aging apartment complexes.

Dutch Conglomerate Invests Hundreds of Millions to Acquire CJ and Masan Plants, Plans to Relocate Asia Headquarters to Ho Chi Minh City

A positive signal for Ho Chi Minh City’s investment environment emerges as De Heus, a global leader in animal feed production, expresses its intention to establish its regional headquarters in the city. This announcement was made during a meeting between the corporation’s leadership and Mr. Nguyen Van Duoc, Chairman of the Ho Chi Minh City People’s Committee, on October 2nd.

Stunning Surge: Provincial Apartment Prices Skyrocket to 80 Million VND/m²

Discover the latest buzz in Bac Ninh’s real estate market, where a new condominium project is making waves. Real estate agents are touting prices nearing 70-80 million VND per square meter, leaving many potential buyers astonished. This unexpected surge in pricing has sparked curiosity and debate among industry insiders and prospective homeowners alike.

Condo Prices Outpace Townhouse Sales in the Real Estate Market

In the first eight months of the year, property prices in Eastern Saigon saw a notable surge, with private houses increasing by an average of 15%. However, the real standout was the apartment market, which experienced a remarkable 30% growth, doubling the rate of house price increases. Meanwhile, in Southern Saigon, apartments continued to outperform, with prices soaring by an average of 35%, while private houses saw a more modest 10% rise.