Illustrative image

Global cocoa prices have plummeted to their lowest point in 20 months, marking the end of a two-year rally that had pushed the market to record highs and placed significant pressure on chocolate manufacturers worldwide.

On the New York exchange, cocoa is currently trading around $6,150 per ton, a sharp decline from the peak of over $12,000 per ton in December last year. In London, cocoa prices have also dropped by approximately 58% from their high of $4,262 per ton in April 2024.

Experts attribute the decline to a combination of weak consumer demand due to high chocolate prices, improved supply prospects from favorable weather conditions, and a mass exodus of speculators from the market.

“We saw prices that were unsustainably high,” noted Oran van Dort, a commodities analyst at Rabobank. He added that prices have been on a clear downward trend since mid-August.

The current sell-off contrasts sharply with the severe supply shortages experienced in 2022 in Ivory Coast and Ghana, which together account for about 60% of global cocoa production. At that time, droughts, diseases, and a lack of investment left farmers unable to afford fertilizers or new plantings, driving cocoa prices to record levels.

Conditions have improved this year as rainfall returned after an unusually dry season, reducing the risk of crop failure. Forecasts suggest the 2025–2026 season, starting October 1, may see a slight surplus in supply relative to demand.

Governments in Ivory Coast and Ghana have also significantly raised their guaranteed purchase prices for farmers, to around $5,000 per ton and $4,600 per ton, respectively, to encourage production. These higher prices are expected to incentivize farmers to sell through official channels, prune trees, and reinvest in new plantings, boosting output in the medium to long term.

However, consumer demand remains weak. According to Marex Brokers, global cocoa grindings—a key indicator of demand—have fallen by about 500,000 tons compared to 2022, with the largest declines in Asia, Europe, and West Africa. “The current surplus is not due to increased production but rather to falling demand,” said Jonathan Parkman of Marex.

In consumer markets, chocolate prices remain high. In the Netherlands, the price of a 100g chocolate bar in September was over 35% higher than the same period last year, according to Rabobank. Analysts predict that consumers may have to wait at least another six months before seeing retail prices drop.

Despite the sharp decline, analysts believe prices are unlikely to return to the $2,000–$3,000 per ton range seen before 2023, due to persistent structural issues: aging trees, diseases, and climate change. A study presented at the European Cocoa Forum in Malta revealed that 35% of Ivory Coast’s cocoa production could disappear by 2050, with 25% lost to climate change and 10% to the swollen shoot virus.

Source: FT

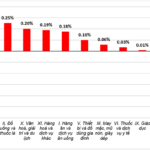

9 Commodity Groups and Services that Increased CPI by 0.11% in July

The housing, utilities, fuel, and construction materials group witnessed the highest increase, with a 0.36% surge, contributing to a 0.07 percentage point rise in the overall CPI.