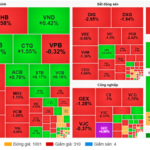

Vietnam’s stock market opened on a high note following FTSE’s announcement of an upgrade. However, by the end of the morning session, several sectors unexpectedly weakened, pulling the VN-Index below the reference mark before recovering.

Closing the session on October 8th, the VN-Index rose by 12.53 points to 1,697.83. The trading value on HoSE exceeded 31.3 trillion VND, an improvement over previous sessions.

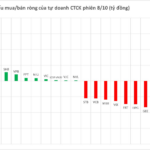

Amid the euphoria of Vietnamese investors, foreign investors unexpectedly returned to net buying approximately 156 billion VND across the market. Specifically:

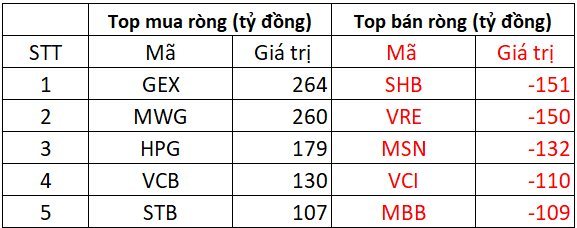

On HoSE, foreign investors net bought approximately 234 billion VND

On the buying side, GEX and MWG stocks saw the strongest net inflows in the market, with values exceeding 260 billion VND each. Following were Bluechip stocks with net buys of over 100 billion VND, including: HPG (+179 billion); VCB (+130 billion); STB (+107 billion).

Conversely, foreign investors heavily sold SHB and VRE, with values of 150-151 billion VND per stock; MSN was also among the top net-sold stocks today, with a value of approximately 132 billion VND. Additionally, VCI and MBB were net sold for 109-110 billion VND.

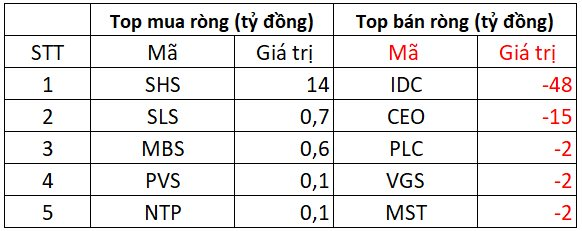

On HNX, foreign investors net sold approximately 61 billion VND

On the buying side, foreign investors most strongly net bought SHS stocks, with a value of 14 billion VND, while also injecting a few hundred million VND into SLS, MBS, PVS, and NTP.

Conversely, IDC and CEO stocks were heavily net sold, with values of 48 billion and 15 billion VND, respectively. PLC, VGS, and MST were also net sold for 2 billion VND each.

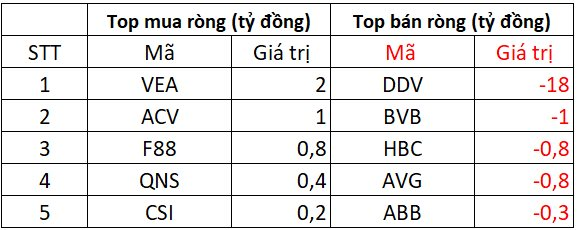

On UPCOM, foreign investors net sold approximately 16 billion VND

On the buying side, VEA and ACV stocks were net bought for around 1-2 billion VND; F88, QNS, and CSI were also net bought for a few hundred million VND.

Conversely, DDV stocks were net sold for 18 billion VND, BVB for 1 billion VND, while HBC, AVF, and ABB saw negligible net selling.

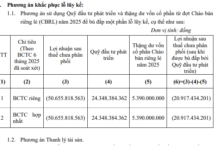

Proprietary Trading Firms Unexpectedly Turn Net Sellers, Offloading Over VND 1 Trillion in the October 8th Session

In the latest market analysis, proprietary trading firms have significantly offloaded shares, with VHM leading the sell-off. The stock witnessed the most substantial net selling pressure, amounting to a staggering -148 billion VND. This data highlights VHM as the most actively sold stock by securities companies’ proprietary trading desks.

Market Pulse 08/10: Foreign Investors Halt Net Selling Streak

At the close of trading, the VN-Index surged by 12.53 points (+0.74%), reaching 1,697.83 points, while the HNX-Index climbed 0.47 points (+0.17%) to 273.34 points. Market breadth favored the bulls, with 389 advancing stocks outpacing 285 decliners. Similarly, the VN30 basket saw green dominate, as 19 constituents rose, 7 fell, and 4 remained unchanged.

Vietstock Daily 09/10/2025: Ready to Break New Highs?

The VN-Index rallied following a session of tug-of-war trading, forming a Long Lower Shadow candlestick pattern. The MACD indicator has issued a fresh buy signal as it crossed above the Signal line, while the Stochastic Oscillator continues its upward trajectory, reinforcing the recovery momentum. Should these signals persist, the likelihood of surpassing the September 2025 peak (around 1,700-1,711 points) will strengthen in upcoming sessions.

What Scenarios Await the Stock Market Before and After the Upgrade Announcement?

The VN-Index briefly touched the 1,700-point milestone before retreating, as trading liquidity dwindled amid investor caution ahead of the highly anticipated market upgrade announcement.