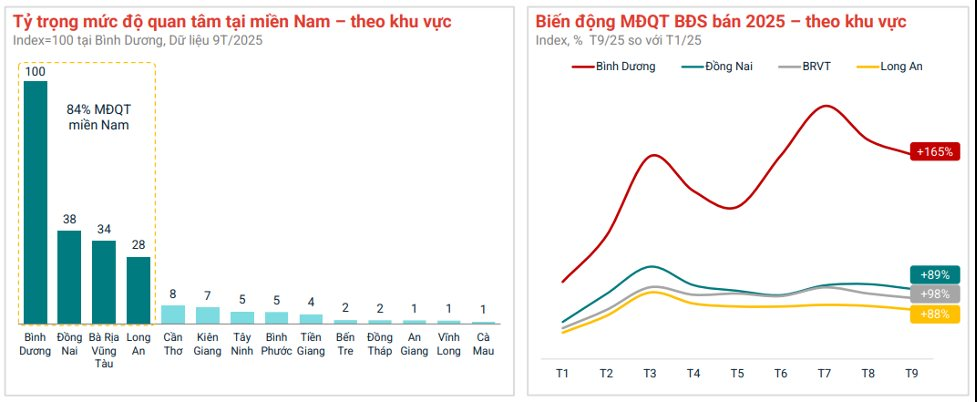

Former Binh Duong Leads the Market Surge

According to Batdongsan.com.vn, interest in real estate in former Binh Duong has skyrocketed by 165% compared to the beginning of the year, outpacing other regions. Binh Duong now accounts for 84% of total interest in the Southern region, topping the chart with an index of 100. Other provinces like Dong Nai (38), Ba Ria – Vung Tau (34), and Long An (28) also feature in the top attractions, forming a vibrant “satellite belt” around Ho Chi Minh City.

This surge reflects a significant shift of investment capital away from Ho Chi Minh City toward areas with increasingly developed infrastructure, ample land reserves, and prices with room for growth. These factors cater well to both genuine residential needs and long-term investment opportunities.

Soaring interest in real estate in former Binh Duong (now part of Ho Chi Minh City). Source: Batdongsan.com.vn

Batdongsan.com.vn’s Q3 data reveals continued positive movement in the apartment segment. Interest in former Ho Chi Minh City and Binh Duong rose by 19% and 48%, respectively, indicating a return of both genuine demand and investment interest. Conversely, Ba Ria – Vung Tau, despite slight price increases, has yet to attract new demand, highlighting a clear divide among satellite localities.

In former Binh Duong (now part of Ho Chi Minh City), several apartment projects just entering the market have already garnered significant interest, particularly those near key infrastructure, with solid legal frameworks, and well-developed amenities.

For instance, An Gia’s recent release of the final 700 units in the East Wind Tower of The Gio Riverside project (Dong Hoa Ward, Ho Chi Minh City) has shown positive signs. This is especially notable as the developer has consistently invested in educational facilities, including the Blue Sky Kindergarten and the Pathway School (primary and secondary levels) within the project, which have attracted buyer interest. Blue Sky Kindergarten employs a “project-based learning” approach, fostering creativity and exploratory thinking in children through play-based learning. Pathway School, spanning 7,000 m², features an open design integrating learning, play, and experiential spaces.

This phase also introduces a $1 million (26 billion VND) scholarship fund for residents of The Gio Riverside. Each scholarship is valued at 30 million VND for apartment owners. Additionally, Blue Sky Kindergarten offers 100 scholarships and tuition discounts of 20-30% for children of The Gio Riverside residents.

Similarly, in Di An Ward (Ho Chi Minh City), Phu Dong Group’s Phu Dong SkyOne and Phu Dong Sky Garden projects have attracted attention due to their competitive pricing and payment policies, including a 5 million VND/month payment plan over 5 years at a fixed interest rate of 5.5%/year, plus a 400 million VND interior package. Another project, TT AVIO, is also generating positive market interest with its final batch of a few hundred units, demonstrating strong liquidity in its sales phases.

As the year-end approaches, developers are ramping up their launches. With new supply scarce in former Ho Chi Minh City, former Binh Duong has emerged as a key market leader, offering diverse products ranging from mid-range to luxury apartments. Competition in pricing, sales policies, and amenity investments is intensifying, benefiting buyers and creating a level playing field for developers in this new market context.

Prices Entering a Rapid Growth Phase

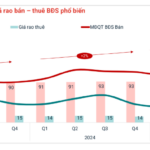

According to Batdongsan.com.vn representatives, Ho Chi Minh City’s real estate market is entering a clear recovery phase, with growth evident in both selling prices and investor interest.

Q3/2025 data shows that following the announcement of administrative unit mergers, the new Ho Chi Minh City has witnessed a strong rebound, with average asking prices reaching 99 million VND/m²—the highest in two years. Concurrently, the interest index for real estate sales has hit a new peak, reflecting optimism and expectations of a new growth cycle.

Specifically, in former Ho Chi Minh City, average prices in Q2/2025 reached 72 million VND/m², up 35% from early 2023; in former Binh Duong, prices surged 30%, averaging 41 million VND/m². Interest in these areas rose by 19% and 48%, respectively, indicating a return of both genuine demand and investment. Conversely, Ba Ria – Vung Tau, despite slight price increases, has yet to attract new demand, highlighting a clear divide among satellite localities.

Ho Chi Minh City’s real estate market is entering a clear recovery phase, evident in both selling prices and investor interest. Illustrative image

In provinces bordering former Ho Chi Minh City, former Binh Duong and Ba Ria – Vung Tau have also seen notable shifts. Apartment prices in Vung Tau rose 12% to 45 million VND/m², while Thuan An and Di An saw increases of 6–8%. Notably, Thu Dau Mot recorded the highest rental yield in the region at 5.1%, double that of former Ho Chi Minh City. This trend indicates that investment capital for rentals is gradually shifting to neighboring areas with softer prices and more attractive real yields.

Data from DKRA Consulting also shows that post-merger, real estate prices in former Ho Chi Minh City and Binh Duong have surged dramatically, with increases of 30-60% and even localized land price spikes.

Looking ahead, satellite areas around Ho Chi Minh City will remain key suppliers. Thuan An and Di An lead with over 13,000 new apartments each, priced between 40–60 million VND/m²; Thu Duc City offers around 11,800 units but at higher prices, ranging from 80–120 million VND/m².

According to Dinh Minh Tuan, Director of Batdongsan.com.vn’s Southern Region, Ho Chi Minh City’s real estate market is rebounding strongly, with improved supply and liquidity driven by both investment and genuine residential demand. The concentration of supply along strategic transport routes like Ring Road 3, Ring Road 4, the Tan Van junction, and metro lines underscores the ongoing urbanization and satellite city development trends.

“Dĩ An (Old) and Thuận An (Old) Apartments in High Demand: Investment Capital Shifts Away from Ho Chi Minh City Center”

Data from Batdongsan.com.vn reveals that due to soaring prices in central Ho Chi Minh City, investment capital is increasingly shifting toward areas with greater growth potential and more affordable pricing, such as former Thu Duc, Di An, and Thuan An districts.

Urban Airport Apartments Boosting Can Tho Real Estate Appeal

Amidst the shifting tides of real estate investment, Can Tho City has emerged as a focal point of interest, offering ample room for profitable ventures. Stella Icon, a luxury apartment project, stands as a new living icon in the Western Capital, enhancing the market’s allure and unlocking numerous opportunities for investors.