Source: VietstockFinance

|

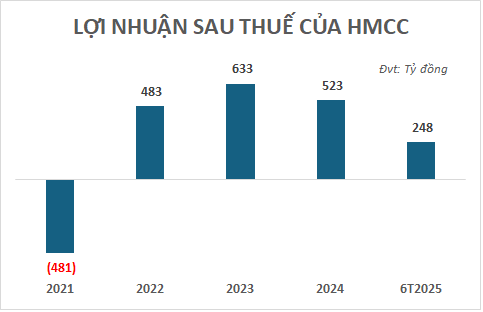

As of June 30, 2025, HMCC’s total assets stood at over 7.859 trillion VND, marking a 32% increase compared to the previous year.

Total liabilities rose by nearly 41%, reaching approximately 5.401 trillion VND. This includes bank loans of nearly 2.515 trillion VND, bond issuance debt of 1.400 trillion VND, and other payable liabilities totaling around 1.486 trillion VND.

Notably, HMCC’s bond debt stems from the HMGH1825001 issuance in 2018, with a corresponding value and an annual interest rate of 6.74%. The company successfully redeemed this bond tranche on October 5, 2025.

Previously, in 2023, HMCC fully settled the HMGH1823001 bond tranche worth 930 billion VND on October 5, 2023.

Established in 2007, Hoan My Medical Corporation, also known as Hoan My Medical Group, operates a network of 13 hospitals (including Hoan My Sai Gon, Hoan My International Eye Hospital, Hanh Phuc International, Hoan My Binh Duong, Hoan My Thu Duc International, Hoan My Van Phuc, Hoan My Binh Phuoc, Hoan My Da Nang, and Hoan My Vinh) and 3 clinics, with a total capacity of over 2,900 beds. Ms. Nguyen Thi Chau Loan serves as the CEO and legal representative.

In March 2025, the company significantly increased its capital from over 392 billion VND to nearly 1.393 trillion VND. Foreign entities hold 99.984% of the chartered capital, with three major shareholders: Hoan My SPV3 Limited (British Virgin Islands, 44.375%), Hoan My SPV2 Limited (Cayman Islands, 16.062%), and Hoan My SPV1 Pte.Ltd (Singapore, 39.511%). All three authorize Leroy James Langeve LD to represent their capital in HMCC.

– 3:17 PM, October 9, 2025

Solar Power Trung Nam Thuan Nam Still Accumulates Nearly VND 723 Billion in Losses, Debt Surpasses VND 9 Trillion

Trung Nam Thuan Nam Solar Power Company Limited has submitted its financial report for the first half of 2025 to the Hanoi Stock Exchange (HNX). The report reveals a post-tax profit of nearly VND 126.5 billion, a slight decrease compared to the VND 128 billion recorded in the same period last year.

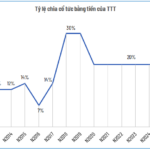

TTT Sustains 5 Consecutive Years of 20% Cash Dividend Payouts

Tay Ninh Tourism and Trading Joint Stock Company (HNX: TTT) has announced the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for October 28, with the payment expected to commence on November 25.

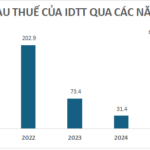

Industrial Park Investor Thu Thua Raises $100 Billion Through Bond Issuance

On September 30, 2025, Thu Thua Industrial and Urban Development Joint Stock Company (IDTT) issued a bond tranche IDT12501 with a total value of 100 billion VND.