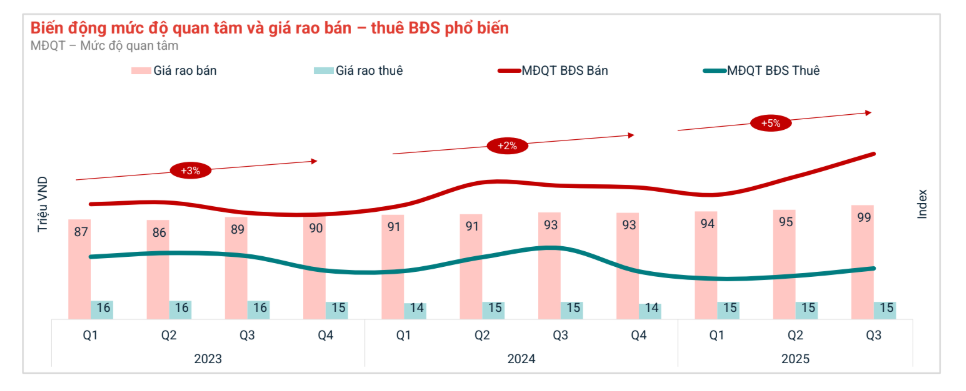

According to Mr. Đinh Minh Tuấn, Regional Director of Batdongsan.com.vn in the Southern region, recent events have highlighted a significant surge in Ho Chi Minh City’s real estate market. Following the announcement of administrative unit mergers, the city witnessed a robust rebound, with average asking prices soaring to 99 million VND per square meter—the highest in two years. Concurrently, the interest index for property sales reached a new peak, reflecting optimism and anticipation for a new growth cycle in the market.

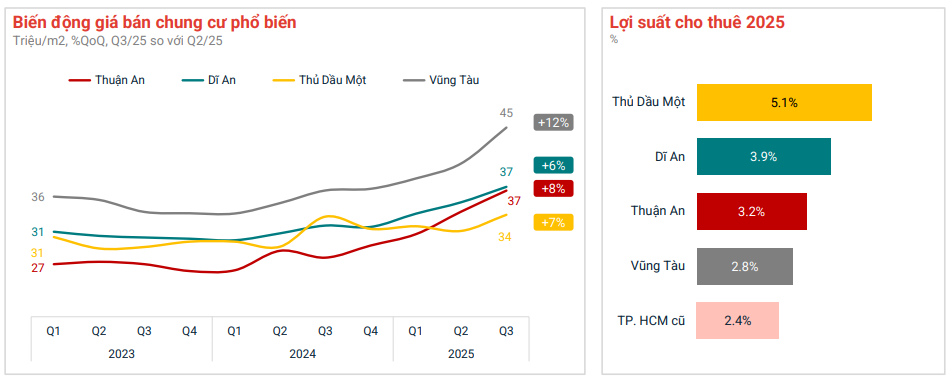

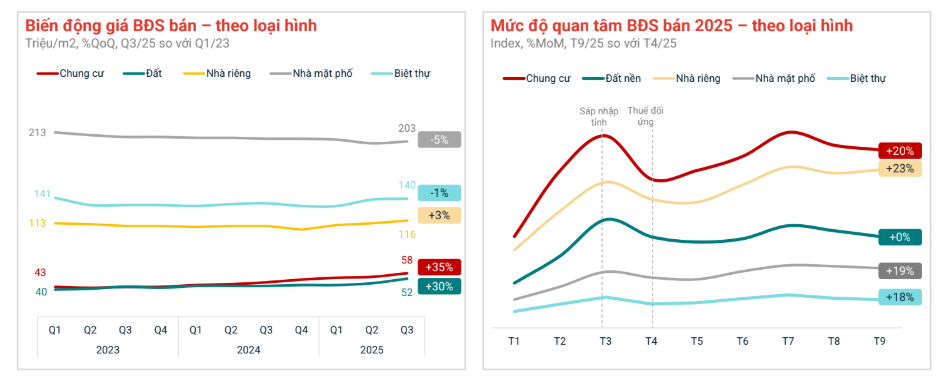

In Q3 2025, the apartment segment demonstrated positive momentum. In the former Ho Chi Minh City area, the average selling price reached 72 million VND per square meter, a 35% increase from early 2023. Similarly, the former Binh Duong area saw a 30% rise to 41 million VND per square meter. Interest levels in these areas grew by 19% and 48%, respectively, indicating a resurgence in both real demand and investment. Conversely, the former Ba Ria – Vung Tau area, despite slight price increases, failed to attract new demand, highlighting a stark contrast among satellite localities.

Within Ho Chi Minh City’s urban core, high-end apartments in District 1 maintained the highest prices at approximately 222 million VND per square meter, a 39% increase over two years. Notably, Thu Duc City emerged as a bright spot, with apartment prices rising 32–48% since early 2023, particularly in Districts 2, 9, and central Thu Duc. Its integrated infrastructure, modern urban planning, and role as a “city within a city” have positioned Thu Duc as a new growth hub, attracting substantial mid- to long-term investment.

In the former Binh Duong and Ba Ria – Vung Tau areas, notable shifts were observed. Apartment prices in Vung Tau rose 12% to 45 million VND per square meter, while Thuan An and Di An saw increases of 6–8%. Notably, Thu Dau Mot recorded the highest rental yield in the region at 5.1%, double that of the former Ho Chi Minh City. This trend suggests that investment capital for rental properties is gradually shifting to neighboring areas with softer prices and more attractive real returns.

Regarding the total supply of apartments in ongoing projects, outlying areas remain the primary drivers. Thuan An and Di An lead with over 13,000 new units each, priced between 40–60 million VND per square meter. Thu Duc City offers approximately 11,800 units, with higher prices ranging from 80–120 million VND per square meter. The concentration of supply along strategic transportation routes such as Ring Road 3, Ring Road 4, and metro lines underscores the trend of urban decentralization and satellite city development.

Meanwhile, the land plot segment in the former Ho Chi Minh City and Binh Duong areas has rebounded after several stagnant quarters. Average land prices in the former Ho Chi Minh City rose by 6% to 69 million VND per square meter, while the former Binh Duong area saw a 5% increase to 21 million VND per square meter compared to Q2 2025.

Land plots and apartments show strong price growth.

In contrast, the former Ba Ria – Vung Tau area remains relatively quiet, with prices dropping 10% and interest declining by 13%. This disparity highlights a preference for areas with ample land reserves, completed infrastructure, and convenient connectivity to city centers. The former Binh Duong area stands out as the fastest-recovering satellite, benefiting directly from Ring Road 3.

Mr. Đinh Minh Tuấn observes that Ho Chi Minh City’s market, after a period of observation, is rebounding strongly. Improved supply and rising liquidity reflect both investment capital and genuine housing demand.

Citigrand: The Perfect Living Radius – Where Real Estate Transcends Property

The heart of Ho Chi Minh City is saturated with ultra-luxury projects, while the outskirts are flooded with heavily promoted developments that often lack genuine value. This stark contrast has led to a clear polarization in the real estate market.

Stunning Surge: Provincial Apartment Prices Skyrocket to 80 Million VND/m²

Discover the latest buzz in Bac Ninh’s real estate market, where a new condominium project is making waves. Real estate agents are touting prices nearing 70-80 million VND per square meter, leaving many potential buyers astonished. This unexpected surge in pricing has sparked curiosity and debate among industry insiders and prospective homeowners alike.

Condo Prices Outpace Townhouse Sales in the Real Estate Market

In the first eight months of the year, property prices in Eastern Saigon saw a notable surge, with private houses increasing by an average of 15%. However, the real standout was the apartment market, which experienced a remarkable 30% growth, doubling the rate of house price increases. Meanwhile, in Southern Saigon, apartments continued to outperform, with prices soaring by an average of 35%, while private houses saw a more modest 10% rise.