| VN-Index Closes Above 1,700 Points for the First Time |

|

Source: VietstockFinance

|

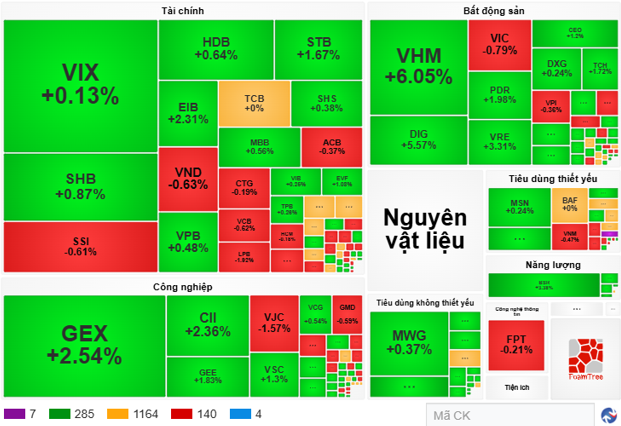

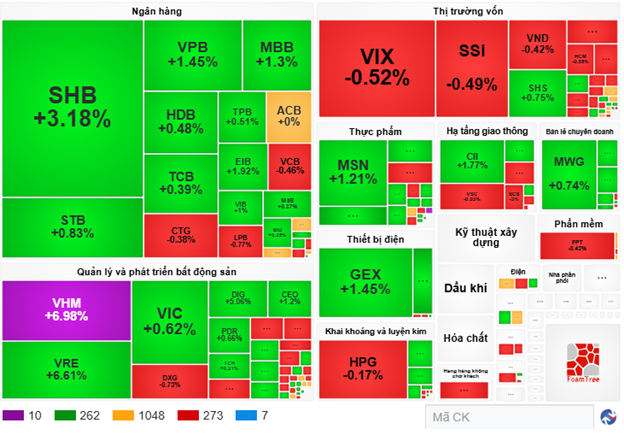

During the afternoon session, the market showed significantly more positive developments compared to the morning. Specifically, green stocks outnumbered red ones, with 342 green stocks and 20 purple ceiling stocks, slightly more than the 320 red stocks and 12 floor-dropping stocks.

With the return of green stocks, the pressure to “carry” the index points was no longer solely on the shoulders of a few pillar stocks as in the morning session, notably the Vingroup ecosystem stocks (VIC, VHM, VRE, VPL).

Instead of the aforementioned “big four” holding the majority of the VN-Index gains in the morning, the picture became more diversified by the end of the afternoon session.

|

Green stocks dominate the afternoon session

Source: VietstockFinance

|

15 out of 23 sectors, as per VS-SECTOR, saw gains today. Leading the pack were energy (up 3.61%), personal and household care products (up 2.52%), and real estate (up 2.46%), followed by industrial goods (up 1.09%) and essential air commerce (up 1.06%). Among the sectors with gains below 1%, banking, insurance, and raw materials were notable.

On the declining side, hardware and equipment dropped by 2.08%, outpacing the rest. Other notable sectors experiencing declines today included software and services, and financial services (primarily securities).

|

Most sectors gained today

Source: VietstockFinance

|

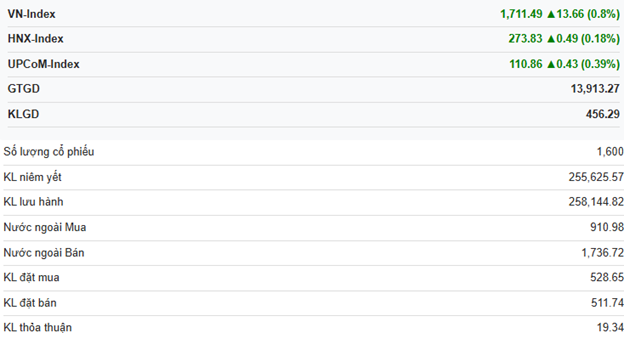

The entire market recorded a trading value of nearly 36.8 trillion VND, with the VN-Index alone accounting for over 33.9 trillion VND, a slight increase from the previous session, continuing the recent improvement trend.

In this context, foreign investors returned to net selling, offloading nearly 1.8 trillion VND. Seven stocks were net sold by hundreds of billions of VND today, led by HPG with over 216 billion VND, SSI with nearly 188 billion VND, and VRE with over 157 billion VND.

On the flip side, three stocks were net bought by hundreds of billions, with TCB leading the way at nearly 148 billion VND.

| Top Stocks Net Bought/Sold by Foreign Investors in the Session of 09/10 |

Morning Session: Pressure Mounts, but VN-Index Remains Resilient

VN-Index closed the morning session at 1,708.46, up 10.63 points. Green was also present on the HNX-Index and UPCoM-Index, with slight increases to 273.71 and 110.74, respectively. Despite the market maintaining a fairly steady gain, the joy was not shared by the majority of investors.

Specifically, the number of gaining stocks showed little progress compared to the start of the morning session, reaching 262, while the number of declining stocks continued to rise, currently at 325. The remaining 1,013 stocks remained unchanged.

The fact that the joy was not shared by the majority of investors was also reflected in the market map or capitalization scale.

In terms of capitalization, Large Cap increased by 0.68% and became a major driving force for the market’s gain, while in other groups, Mid Cap decreased by 0.1% and Small Cap only increased slightly by 0.03%.

On the market map, red areas appeared more frequently, particularly in the securities group (VIX, SSI, VND, VCI, HCM, MBS…), alongside the real estate group (DXG, KBC, IDC…) and some pillar stocks like HPG, FPT. It’s evident that despite the market’s gain, pressures still exist and have even increased.

Looking back at market developments, despite maintaining a good gain, some pressure did occur after the 10 a.m. period, narrowing the gain. During the morning session, the market once surpassed 1,717 points.

|

Market begins to narrow gains from 10 a.m.

Source: VietstockFinance

|

Liquidity improved compared to the previous session, reaching over 19.7 trillion VND, corresponding to more than 630 million shares changing hands. In this context, foreign investors only narrowed their buying, while selling remained quite aggressive, resulting in a net sell of nearly 1.2 trillion VND in the morning session.

Market Pulse 09/10: Vingroup’s “Big Four” Pull the Index

The market continued to show impressive performance, but the joy was not shared by all. Most of the gains came from a few stocks, while the number of declining stocks showed signs of increasing.

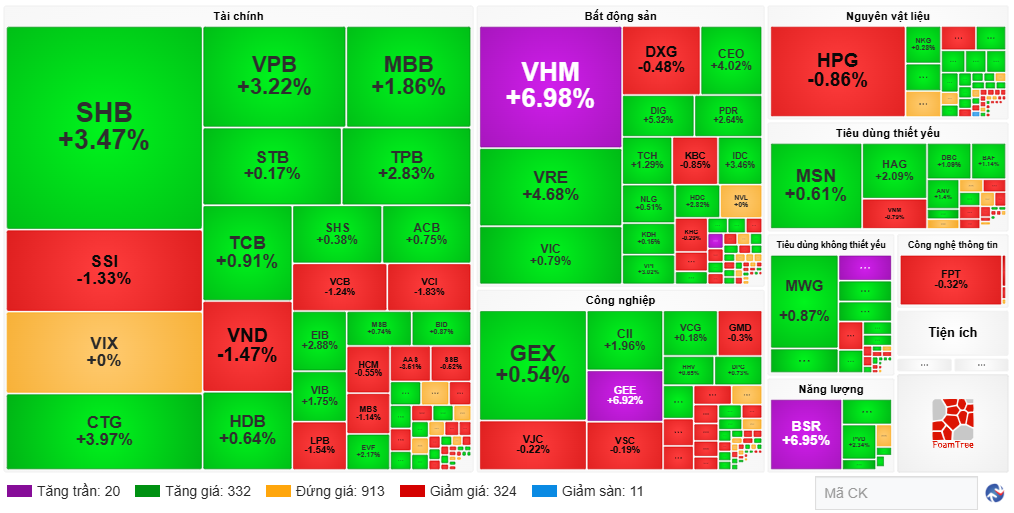

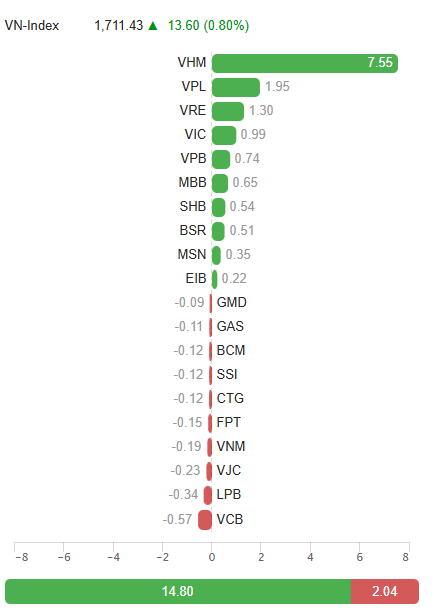

As of 10:30 a.m., VN-Index increased by 13.66 points to 1,711.49, HNX-Index rose by 0.49 points to 273.83, and UPCoM-Index gained 0.43 points to 110.86.

However, the number of gaining and declining stocks became more balanced compared to the start of the morning session, with 272 gaining stocks losing their advantage to 280 declining stocks.

In terms of capitalization scale, Large Cap increased impressively by 1.01%, while Mid Cap and Small Cap only moved sideways and inched up by 0.2%, respectively.

The market map clearly illustrates this, with the duo VHM and VRE both hitting the purple ceiling and increasing nearly to the ceiling, directly contributing 7.55 points and 1.30 points to the VN-Index. Additionally, two other Vingroup members, VPL (consumer services group) and VIC, also directly contributed 1.95 points and 0.99 points, forming the “big four pillars” for the index as of 10:30 a.m.

With these developments, consumer services and real estate also became the two sectors with the strongest market gains, increasing by 4.81% and 2.44%, respectively.

The increase in the number of red stocks while the market continues to be “pulled” indicates a significant driving force from the group of pillar stocks. However, from another perspective, the increase in the number of red stocks includes the presence of the banking and securities groups, which are causing considerable concern.

In the securities group, VIX, SSI, VND, HCM… all declined, creating widespread redness. As for banking, although green still dominates, the decline of pillars like VCB or CTG also creates considerable pressure.

Exciting Opening, in Sync with the World

At the start of the 09/10 session, the Vietnamese stock market showed excitement, continuing from the previous afternoon session. As of 9:30 a.m., VN-Index increased by 7.17 points to 1,705, HNX-Index rose by 0.79 points to 274.13, and UPCoM-Index gained 0.69 points to 111.12.

The entire market recorded 292 gaining stocks, including 7 ceiling stocks, gaining an advantage over 144 declining stocks, which included 4 floor stocks. The remaining 1,164 stocks remained unchanged. Green was present across many key sectors, particularly real estate, with VHM, DIG quickly increasing around 6%, and VRE rising over 3.3%.

Liquidity showed no significant highlights, with over 116 million shares changing hands, corresponding to a trading value of over 3.7 trillion VND.

|

Green spreads early across the market at the start of the 09/10 session

Source: VietstockFinance

|

Asian markets also opened positively, with Nikkei 225 up 1.36%, Shanghai Composite up 0.77%, Hang Seng up 0.08%, and All Ordinaries up 0.27%.

On Wall Street overnight, the S&P 500 advanced 0.58% to 6,753.72 points, supported by gains in information technology, utilities, and industrials. All three sectors reached new record highs. The Nasdaq Composite rose 1.12% to 23,043.38 points, while the Dow Jones fell to 46,601.78 points.

– 15:35 09/10/2025

Peer-to-Peer Lending in Vietnam: A Legal Turning Point Reshaping the Market

The new legal framework for peer-to-peer lending (P2P Lending) in Vietnam is reshaping the industry landscape, presenting both opportunities and challenges for businesses within the sector. These regulations establish a clear legal corridor, significantly influencing operational strategies, risk management, and the overall growth potential of the market.

Green Bonds Struggle to Gain Traction Amid High Issuance Costs, Experts Warn

Vietnam’s sustainable bond market remains nascent, accounting for a mere 1.6% of total corporate bond debt—significantly lagging behind the global average of 4% and Asia’s 8%. Experts attribute this sluggish growth to prohibitive issuance costs, a lack of incentives, and an underdeveloped, fragmented support ecosystem.