Domestic Demand Boosts Retail Stocks

SSI Research has released a report estimating the Q3/2025 business results of 42 companies within its research scope, noting a significant recovery in profit margins. Accordingly, the profits of these listed companies are forecasted to increase by 26.9% year-on-year, significantly higher than the 14% growth achieved in the first half of the year. Profit growth compared to Q2/2025 reached 2.1%.

In this context, the retail and consumer sector has emerged as a bright spot, directly benefiting from stimulus policies and increased household spending.

The government has reduced the VAT rate from 10% to 8% for essential goods, effective from July 2025 until the end of 2026, directly supporting consumer purchasing power. With domestic consumption accounting for over 60% of GDP, this move not only sustains short-term recovery but also lays the foundation for sustainable growth. Alongside policy factors, the shift from traditional markets to modern retail channels continues to be a long-term driver, helping businesses expand market share and improve profit margins.

Retail Companies: Achieving 90% of Annual Profit Plan After 9 Months

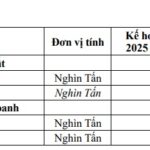

According to company reports, in the first 9 months of 2025, Masan (HOSE: MSN) is estimated to have achieved after-tax profit before minority interest (NPAT Pre-MI) exceeding 90% of its base-case profit plan for 2025. This result demonstrates that Masan is on track, with room to surge in Q4, the peak year-end consumption period, thereby consolidating the prospect of meeting and potentially exceeding its full-year target.

A key driver comes from WinCommerce (WCM) – a retail chain with over 4,200 stores nationwide, 75% of which are newly opened in rural areas. WCM recorded revenue of over 25,000 billion VND (+16.1% year-on-year) in the first 8 months, with August alone reaching 3,573 billion VND (+24.2%). These results reflect the strong rebound in domestic consumption and the effectiveness of the modern retail model.

Masan MEATLife (MML), a member company within the Masan ecosystem, also maintained positive growth after its restructuring phase. In August 2025, MML sold 14,007 tons of products (+12.9%), with revenue reaching 999 billion VND (+11.1%) and after-tax profit increasing by 60.5% to 35 billion VND. Both EBIT and EBITDA metrics improved, indicating enhanced operational efficiency and strengthening profit margins. This underscores the trend of consumers shifting towards branded, safe, and traceable products.

Additionally, Masan High-Tech Materials benefits from recovering tungsten prices, while Phúc Long continues to boost sales and enhance customer experience. Masan Consumer is expected to rebound strongly from 2026 as the FMCG market stabilizes.

Long-Term Outlook for the Retail Sector

According to the September 2025 update report, Bảo Việt Securities (BVSC) maintains an OUTPERFORM rating for MSN, significantly higher than its market price. BVSC assesses that MSN’s growth momentum stems from the synergy between WinCommerce, Masan MEATLife, Masan High-Tech Materials, and Phúc Long.

However, experts also highlight short-term challenges: intense competition in the retail sector, volatile raw material and operational costs, and new regulations such as electronic invoicing, which may pressure businesses. This requires companies to maintain expansion speed while optimizing operations to preserve profit margins.

Looking long-term, domestic demand, coupled with the shift to modern retail channels, is expected to remain a key growth driver. Therefore, retail stocks are still considered one of the attractive destinations for capital in the Vietnamese stock market during the late 2025 – early 2026 period.

Masan Group Corporation (HoSE: MSN) is one of Vietnam’s leading consumer and retail companies, aiming to provide essential, high-quality products and services to domestic and international consumers. Masan’s ecosystem spans multiple high-growth sectors: fast-moving consumer goods (Masan Consumer with Chin-Su, Nam Ngư, Omachi, Kokomi, Wake-Up 247), branded meat (Masan MEATLife with MEATDeli, Ponnie, Heo Cao Bồi), retail (WinCommerce with WinMart, WinMart+), tea and coffee (Phúc Long Heritage), and high-tech materials (Masan High-Tech Materials).

VN30-Listed Firm Projects 90% Annual Profit Target Achievement in Q3

Leading securities firms SSI, BVSC, VDSC, and VCBS have released their Q3/2025 earnings forecasts for a range of companies. Notably, several businesses are projected to achieve double-digit growth. In the retail and consumer sector, Masan Group Corporation (HOSE: MSN) stands out with an estimated profit of VND 1,700 billion, marking a 31% year-on-year increase. The company itself anticipates even higher figures, driven by sustained growth across multiple business segments.

Mooncake Madness: Grab 3 for Just 100,000 VND – Limited Time Offer!

As the Mid-Autumn Festival approaches, many mooncake stalls in Hanoi remain surprisingly quiet, with some vendors resorting to promotions and discounts to boost sales.

VN30-Listed Company Projected to Report Over 80% Profit Surge in Q3

Vietnam’s consumer market is experiencing a robust recovery, with double-digit retail growth recorded in August 2025. This trend not only highlights the strengthening domestic purchasing power but also provides a solid foundation for leading enterprises like Masan Group to accelerate their expansion strategies and enhance business efficiency in the remaining months of the year.