On July 1, 2025, Decree No. 94/2025/NĐ-CP issued by the Government of Vietnam on the Controlled Pilot Mechanism in the banking sector officially took effect. This marks a significant milestone in establishing a legal framework to support innovation within the financial and banking industries.

To implement peer-to-peer (P2P) lending solutions as outlined in the aforementioned Decree, the State Bank of Vietnam (SBV) has issued two pivotal decisions aimed at creating a conducive environment and conditions for pilot testing.

The first is Decision No. 2866/QĐ-NHNN dated July 22, 2025, which sets the maximum outstanding debt per borrower on a single P2P lending platform at 100 million VND. Additionally, it caps the total outstanding debt of each borrower across all participating P2P lending platforms at 400 million VND.

The second is Decision No. 2970/QĐ-NHNN dated August 11, 2025, which provides guidelines for connecting, reporting, and verifying credit information between P2P lending companies and the National Credit Information Center of Vietnam (CIC). This decision specifies the technical requirements for connecting with the CIC, the list of indicators, reporting deadlines, and frequencies, as well as the rights and obligations of participating companies when connecting with the CIC.

To gain deeper insights into the new legal framework for P2P Lending in Vietnam, we spoke with Mr. Nguyen Quang Huy – CEO of the Faculty of Finance and Banking, Nguyen Trai University.

Mr. Nguyen Quang Huy – CEO of the Faculty of Finance and Banking, Nguyen Trai University

|

Transparency or Growth Hindrance?

In your opinion, what opportunities and risks does the 400 million VND debt limit per borrower present for P2P companies?

Mr. Nguyen Quang Huy: The debt limit outlined in Decision 2866/QĐ-NHNN serves as both a “safety framework” and a “growth brake.”

On the positive side, the 100 million VND limit per platform and 400 million VND per borrower act as crucial boundaries to prevent widespread credit risk. This creates a safety zone for the system, reduces cross-borrowing, and bolsters investor confidence by mitigating capital loss risks.

However, this limit has a latent impact, acting as a brake that narrows the market space. Micro-enterprises or individual business households with average to large capital needs may find it challenging to access P2P channels. Consequently, a segment of potential borrowers may shift to informal credit channels.

To balance compliance and growth, P2P companies need flexible strategies, designing smaller loan products within the legal framework instead of large single loans.

Additionally, they should proactively propose mechanisms to the SBV for increasing limits based on credit criteria (e.g., borrowers with 12-24 months of good repayment history could qualify for higher limits).

What benefits and challenges does the mandatory connection and data reporting to the National Credit Information Center (CIC) under Decision 2970/QĐ-NHNN bring?

This is seen as a “mirror of transparency,” marking a significant step in transforming P2P from a “technology pilot model” into a “formal player in the financial ecosystem.”

The biggest advantage is that the CIC becomes a centralized data source, helping P2P platforms filter out duplicate borrowers, improve credit scoring model accuracy, and demonstrate transparency to investors.

The accompanying challenge is that secure connections, data standardization, and personal information protection require high technology costs and professional operational capabilities, which may pose significant barriers for smaller companies.

To turn challenges into opportunities, companies can participate in shared infrastructure to reduce costs. Simultaneously, they can create competitive advantages by combining official CIC data with alternative data (telecom history, e-commerce, digital wallets) to build more accurate hybrid credit scoring models.

What is the biggest opportunity the controlled pilot mechanism offers for innovation and investment attraction?

The Sandbox under Decree 94/2025/NĐ-CP acts as both a “launchpad” and a “filter” for the market.

In terms of opportunity, the Sandbox provides a supervised testing space with minimal legal risk, allowing P2P platforms to demonstrate risk management capabilities, business model effectiveness, and the ability to meet legitimate credit demands. Moreover, the Sandbox serves as a crucial “gateway,” becoming a “reputation stamp” to attract investment.

In terms of challenges, upon completing the pilot phase and entering the formal market, companies must adhere to stricter legal frameworks regarding capital, governance, and risk provisioning. Without early preparation, many companies will face difficulties. Additionally, the entry of large organizations like banks and technology corporations will intensify competition.

What should companies prepare to participate in P2P lending pilot testing?

Companies need to develop a strategic roadmap to leverage the Sandbox.

Create a two-tier roadmap: Develop a lean model for Sandbox testing while simultaneously preparing resources (capital, governance) for the formal operation phase.

Proactively seek strategic partners (banks, investment funds) during the Sandbox phase to be ready to accelerate upon exiting the pilot mechanism.

Utilize the Sandbox as a “capital attraction window”: Use actual operational data (non-performing loan ratios, repayment rates) to prove effectiveness and convince investors.

Market Filtering and Promotion

How do the new SBV regulations impact the interests and risks of lenders and borrowers?

Investors (lenders) will be better protected as debt limits reduce concentration risk, and CIC data enhances transparency. However, profits may slightly decrease as P2P companies incur additional compliance costs, making returns less “exceptionally high” compared to the early stages.

Borrowers are protected from over-indebtedness. Those with good credit histories will have access to loans at more reasonable interest rates. Conversely, individuals and businesses with large capital needs may find P2P less attractive, risking a shift to informal credit channels.

The key lies in the SBV designing a roadmap to gradually increase credit limits and encourage open data. If achieved, P2P Lending will ensure safety while maintaining flexibility to compete with traditional financial channels.

How will the conditions for participating in the pilot mechanism reshape the Vietnamese P2P Lending market?

The participation conditions for the Sandbox regarding legal entities, governance, and risk frameworks will positively “filter” the market, eliminating companies with weak capabilities. This will enhance user and investor confidence in choosing reputable platforms, integrating P2P into the formal financial system.

However, a potential risk is that if these conditions are too stringent, many small but innovative companies may be excluded, leading to market concentration and reduced competition. Consequently, the risk of small-scale credit activities moving outside regulatory control is very real.

Overall, the new legal framework for P2P Lending is a double-edged sword. On one hand, it establishes a foundation for a transparent, safe, and sustainable market, becoming a vital supplement to the formal financial system. On the other hand, it may narrow the scope for innovation if both businesses and regulators do not adopt flexible adjustments.

For P2P companies, this is an opportunity to evolve from pure technology startups into semi-formal financial organizations with compliance capabilities, risk management, and data exploitation for sustainable competitive advantages.

For regulators, the challenge is to balance risk control and innovation encouragement. This can be achieved by developing a tiered legal framework with a roadmap for relaxing conditions and supporting shared infrastructure.

If both roles are effectively fulfilled, Vietnam can establish a P2P Lending market that is both transparent and safe, dynamic and innovative, capable of competing regionally.

Thank you, Mr. Huy.

– 12:00 09/10/2025

Vintage iPhones Surge in Value: A Collective Price Hike

The latest iPhone 15 and 16 series models have seen a price hike in the Vietnamese market following the launch of the iPhone 17.

Green Bonds Struggle to Gain Traction Amid High Issuance Costs, Experts Warn

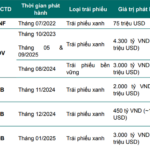

Vietnam’s sustainable bond market remains nascent, accounting for a mere 1.6% of total corporate bond debt—significantly lagging behind the global average of 4% and Asia’s 8%. Experts attribute this sluggish growth to prohibitive issuance costs, a lack of incentives, and an underdeveloped, fragmented support ecosystem.

A Bumpy Ride to Brilliance: Vietnam’s Decade-Long Ascent to Emerging Market Status

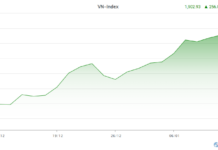

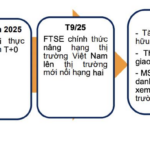

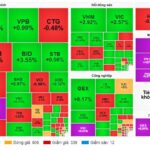

Vietnam’s dream of upgrading its status has officially come true, marking a significant milestone as the nation sheds its constraints and steps into the secondary emerging market classification. This new chapter places Vietnam alongside countries renowned for their remarkable economic growth trajectories.

Sun Group and Hilton Forge Strategic Partnership to Develop Accommodation Infrastructure for APEC 2027

On the morning of October 7, 2025, Hilton’s senior leadership arrived in Phu Quoc to sign a strategic partnership with Sun Group, aiming to develop five luxury hotels with over 2,000 rooms across Quang Ninh, Da Nang, and Phu Quoc. This milestone marks the debut of Conrad Hotels & Resorts and LXR Hotels & Resorts in Vietnam, while also preparing premium accommodations to support the upcoming APEC 2027.