Newly Released Q3/2025 Financial Reports as of October 9th:

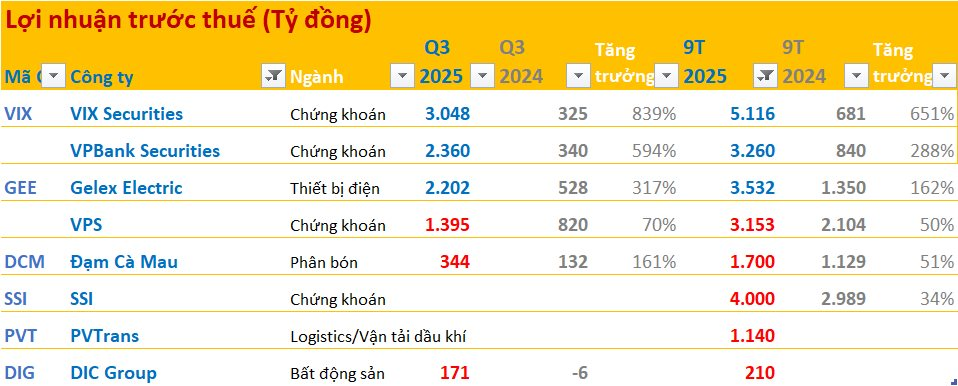

According to the latest reports, GELEX Electric (GEE) recorded a consolidated net revenue of over 6.444 trillion VND in Q3/2025, a 14.7% increase compared to the same period in 2024. Semi-finished product sales accounted for 97% of this revenue, totaling 6.246 trillion VND, up nearly 15% year-over-year. Consolidated pre-tax profit for Q3/2025 reached 2.202 trillion VND, a 317% surge from Q3/2024.

For the first nine months, GELEX Electric achieved 18.235 trillion VND in revenue, a 25% increase year-over-year. Pre-tax profit stood at 3.532 trillion VND, up 162%. Core business pre-tax profit for the period was 2.059 trillion VND, a 93% increase from the same period last year (1.067 trillion VND).

.png)

VIX Securities reported a Q3/2025 total operating revenue of 3.222 trillion VND, nearly six times higher than Q3/2024. After expenses, VIX’s Q3/2025 pre-tax profit reached 3.048 trillion VND, 9.4 times higher than Q3/2024, marking a record quarterly profit for the company.

In the first nine months of 2025, VIX’s operating revenue hit 6.178 trillion VND, up 378% year-over-year. Pre-tax profit reached 5.116 trillion VND, a 651% increase.

VPBankS reported a Q3/2025 pre-tax profit of 2.360 trillion VND, a 594% increase year-over-year. Nine-month pre-tax profit reached 3.260 trillion VND, nearly four times higher than the same period last year.

SSI Securities (SSI) announced that its nine-month pre-tax profit for 2025 is estimated at around 4.000 trillion VND, a 33.8% increase year-over-year.

At its October 3rd, 2025 meeting, the Board of Directors of Dabaco Vietnam Group (DBC) approved estimated Q3 and nine-month 2025 business results. Q3 after-tax profit is estimated at 342 billion VND, with nine-month cumulative profit projected at 1.357 trillion VND.

VPS’s Q3/2025 pre-tax profit is estimated at 1.395 trillion VND, a 70.1% increase from Q3/2024. This brings nine-month pre-tax profit to 3.153 trillion VND, surpassing 2024’s full-year profit by 1.2%.

In the fertilizer sector, PetroVietnam Fertilizer and Chemicals Corporation (DCM) reported nine-month consolidated revenue of 13.250 trillion VND, up 40%, with pre-tax profit at 1.700 trillion VND, a 50% increase. Q3 revenue was 3.400 trillion VND, with pre-tax profit of 344 billion VND, three times higher than Q3/2024.

In the transportation sector, PVTrans (PVT) recorded nine-month consolidated revenue of 11.000 trillion VND, a 30% increase, with consolidated pre-tax profit at 1.140 trillion VND, down 5% year-over-year.

In real estate, Hodeco (HDC) announced at its September 30th extraordinary shareholders’ meeting that Q3 pre-tax profit is estimated at 666 billion VND, 35 times higher than Q3/2024.

DIC Group (DIG) reported nine-month revenue and other income of 1.900 trillion VND, with pre-tax profit at 210 billion VND, nearly five times higher than the same period last year. Q3 pre-tax profit was 171 billion VND, compared to a 6 billion VND loss in Q3/2024, driven by the transfer of the Lam Ha Center Point project in Ha Nam, which generated over 1.300 trillion VND in revenue.

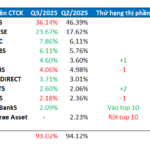

Derivatives Market: VPS Securities Loses Ground as DNSE Surges Ahead

The Hanoi Stock Exchange has unveiled the top 10 brokerage market shares for derivatives in Q3/2025. The data highlights a notable shift in market share, with VPS Securities relinquishing its dominance to other brokerage firms.

82.5% of Manufacturing Businesses Anticipate Improved Business Conditions in Q4 2025

In the fourth quarter of 2025, a survey on business trends within the manufacturing and processing industry reveals optimistic projections. Approximately 40.8% of businesses anticipate an improvement in trends compared to the third quarter of 2025, while 41.7% expect stable production and operations. Conversely, 17.5% of enterprises foresee more challenging conditions ahead.