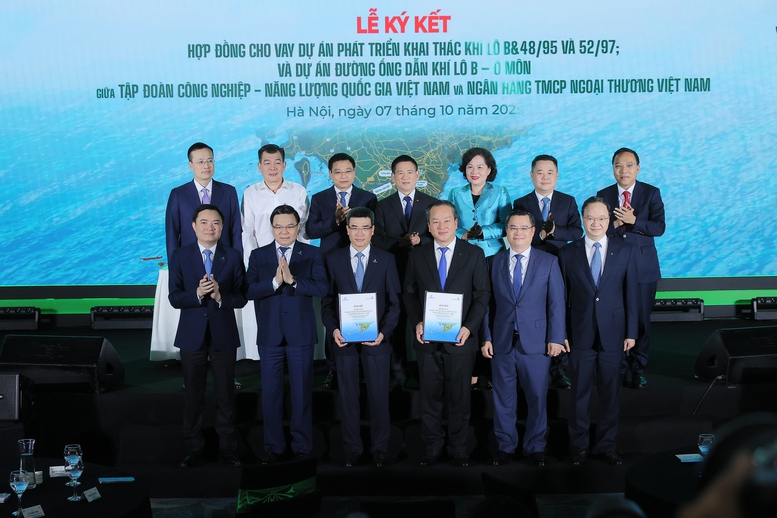

On the afternoon of October 7th, a credit agreement exceeding $1 billion was signed for the Block B – O Mon gas-power project chain between the Vietnam National Oil and Gas Group (PetroVietnam) and the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank).

The Block B – O Mon gas-power project chain marks a groundbreaking initiative, aligning with Resolution No. 70 of the Politburo on ensuring national energy security by 2030, with a vision extending to 2045.

The agreement between PetroVietnam and Vietcombank stands as one of the largest credit contracts in the energy sector, dedicated to Vietnam’s most extensive gas project to date.

Under the signed credit agreement, Vietcombank will provide medium to long-term credit for PetroVietnam to execute two upstream and midstream projects within the Block B – O Mon gas-power chain.

Speaking at the signing ceremony, PetroVietnam Chairman Le Manh Hung highlighted that the Block B – O Mon gas-power chain encompasses the development and exploitation of gas in Block B&48/95 and Block 52/97 upstream, the Block B – O Mon gas pipeline midstream, and four O Mon thermal power plants downstream, with a total investment of over $12 billion.

The gas from Block B is anticipated to provide a stable, long-term supply for gas-fired power plants in the Mekong Delta, reducing reliance on fuel imports, enhancing the autonomy and operational flexibility of Vietnam’s national power grid, and aligning with the adjusted Power Master Plan VIII. This initiative also fulfills Vietnam’s government commitments to energy transition and emission reduction, as per COP26.

Vietcombank Chairman Nguyen Thanh Tung emphasized that this event signifies a shift from dependence on foreign capital to proactively building governance structures and effectively mobilizing domestic resources, operating under market mechanisms. It also marks a transition from the mindset of “power waiting for gas, and projects waiting for capital” to the synchronized implementation of the entire project chain, proactive risk management, and the establishment of a self-reliant value chain for Vietnamese enterprises.

State Bank of Vietnam (SBV) Governor Nguyen Thi Hong urged Vietcombank to strictly adhere to SBV directives on foreign exchange balancing, risk management, and timely disbursement in accordance with the signed loan agreement. PetroVietnam is expected to utilize the loan for its intended purposes, ensuring safety, efficiency, and full compliance with legal regulations and commitments.

According to the Governor, moving forward, the SBV will continue to collaborate with relevant ministries and sectors to refine the legal framework for credit and foreign exchange. It will also direct credit institutions to prioritize capital for key sectors and large-scale projects, including loans in VND and foreign currencies. The SBV will work with ministries, sectors, and localities to promote medium and long-term capital for sustainable development.

The Block B – O Mon gas-power project chain is a pivotal national energy initiative led by PetroVietnam, with participation from the Vietnam Petroleum Exploration and Production Corporation (PVEP), Mitsui Oil Exploration Company (MOECO – Japan), and PTT Exploration and Production Public Company Limited (PTTEP – Thailand).

In the capital structure, Vietnamese entities hold 70%, while foreign partners hold 30%, jointly investing under a Product Sharing Contract (PSC) model upstream. Upon completion, the project is expected to significantly contribute to economic growth and the national budget, with an estimated total value of approximately $30 billion over its lifecycle.

Vietcombank Grants Largest Energy Sector Credit Facility in Vietnam’s History to Petrovietnam

On the afternoon of October 7, 2025, the Vietnam Oil and Gas Group (Petrovietnam) and the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) signed two credit agreements totaling over $1 billion. These agreements will fund the development and exploitation of gas fields in Block B&48/95 and Block 52/97, as well as the construction of the Block B – O Mon gas pipeline project.

Two Leading National Enterprises Partner to Launch Groundbreaking Project Under Resolution 70-NQ/TW

On the afternoon of October 7th, Deputy Prime Minister Hồ Đức Phớc attended and delivered a speech at the signing ceremony of a credit agreement exceeding $1 billion for the development and exploitation of gas fields in Blocks B&48/95 and 52/97, along with the B-Ô Môn gas pipeline project. The agreement was signed between the Vietnam National Oil and Gas Group (PetroVietnam) and the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank).

PetroVietnam Races to Complete $1.3 Billion Thermal Power Plant by 2027

After a period of interruption, the Long Phú 1 thermal power project is now receiving focused resources from Petrovietnam, aiming to commence operations of its turbines by 2027.