The “Vietnam 100 2025” report, published by Brand Finance—a London-based brand valuation consultancy—reveals that the combined brand value of Vietnam’s top 100 brands has declined by 14% compared to last year, reflecting economic challenges. Despite this, SHB has maintained its growth trajectory, with its brand value reaching 264 million USD and climbing one position from 2024. Since the ranking’s inception in 2015, SHB has consistently featured in the Top 35, underscoring its robust financial strength, reputation, and market standing.

Brand Finance evaluates brands using metrics such as Brand Strength Index (BSI), brand impact, royalty rates, and projected revenue. SHB’s ranking highlights its effective business performance, enhanced customer satisfaction, and impactful brand campaigns.

Community-Centric Campaigns

SHB’s brand value and recognition growth is further validated by independent metrics like YouGov BrandIndex. Brand awareness has risen from 25.1 to 28 points in the latest quarter (for the 18+ demographic across Vietnam), reflecting the success of recent brand initiatives.

In a vibrant market filled with high-profile sponsorships and events, SHB has carved a distinct path—quiet yet persistent, focusing on cultural and spiritual values. The bank nurtures initiatives that celebrate Vietnamese identity, fostering national pride through authentic and inspiring efforts.

During the AFF Cup 2024, SHB’s “Fuel the Vietnam National Team” campaign sent 600 fans to Thailand, showcasing Vietnamese spirit beyond borders. This initiative not only supported sports but also symbolized unity and patriotism through concrete actions.

In March 2025, SHB partnered with T&T Group for the “Cultural Festival,” uniting 15,000 people in a record-breaking rendition of the national anthem. This event not only set a national record but also deepened pride and connection among individuals and the nation, bridging past, present, and future. It honored employees while signaling SHB’s ambition for a new era of national advancement.

Most recently, the “Pride of Being Vietnamese” campaign for the 80th National Day (September 2, 2025) celebrated Vietnamese identity. SHB believes every Vietnamese, regardless of location, takes pride in contributing to the nation’s progress. This campaign added a unique touch to the National Day celebrations, resonating across Vietnam.

SHB’s campaigns have garnered widespread engagement on media and social platforms, uniting the nation through emotion, love, and Vietnamese spirit. The bank’s approach emphasizes cultural depth and sustained trust over superficial glamour.

SHB’s distinct culture and achievements have enhanced its employer brand. The bank has earned accolades such as “Best Place to Work in Asia” from HR Asia (four times), “Great Place to Work” certification, and “Bank of the Year for Humanity” at the Better Choice Awards 2024, making it a top career destination for talent.

Brand Leadership and Customer Satisfaction

Centering on customers and market needs, SHB has developed tailored products, earning awards like “Best Bank for Public Sector Customers in Vietnam” (FinanceAsia), “Best Sustainable Finance Bank in Vietnam” (Global Finance), and “Best Payment Solutions Bank in Vietnam” (The Asian Banker).

Decision Lab’s 2025 report ranks SHB in the “Top 10 Banks with Highest Customer Satisfaction in Vietnam,” with the fastest satisfaction growth for two consecutive years. This reflects the bank’s commitment to service excellence.

Internationally, SHB is a preferred partner for institutions like the World Bank, JICA, ADB, and KFW, reinforcing its global brand presence.

Collaborating with state and private sector leaders, SHB is developing a comprehensive ecosystem for SMEs and individuals, solidifying its market leadership.

Market Leadership and Social Impact

As of June 30, 2025, SHB’s total assets reached nearly 826 trillion VND, with customer loans exceeding 594.5 trillion VND—a 14.4% increase year-to-date and 28.9% year-on-year. Its charter capital of 45.942 trillion VND cements its position among Vietnam’s Top 5 private banks.

The bank aims for 832 trillion VND in assets this year and 1,000 trillion VND by 2026, marking steady growth in scale and market influence.

In the first half of 2025, SHB reported pre-tax profits of 8,946 billion VND, up 30% year-on-year, achieving 62% of its annual target. Recognized in Vietnam Report’s Top 10 Most Profitable Private Enterprises, SHB maintains high dividend payouts and significant contributions to the national budget.

SHB actively supports social welfare, exemplified by a 100 billion VND donation to Sóc Trăng and partnerships with the Ministry of Public Security to build 700 homes in Bạc Liêu and 150 homes plus a school in flood-affected provinces like Sơn La and Hà Giang. The bank received the Prime Minister’s Commendation for these efforts.

SHB’s brand value growth underscores its sustainable development strategy, blending scale and quality with social responsibility.

In its transformation strategy, SHB aims to lead in efficiency, digital banking, retail, and corporate finance, targeting a Top regional position by 2035 as a modern retail, green, and digital bank.

|

SHB has set October 16, 2025, as the record date for shareholders to approve a capital increase, enhancing its market position and financial foundation. This move supports business expansion and economic development, aligning with government growth goals. Strengthened capital will enable technology investments to improve customer experiences and credit operations, reinforcing SHB’s commitment to sustainable growth and shareholder value. |

– 11:20 09/10/2025

Peer-to-Peer Lending in Vietnam: A Legal Turning Point Reshaping the Market

The new legal framework for peer-to-peer lending (P2P Lending) in Vietnam is reshaping the industry landscape, presenting both opportunities and challenges for businesses within the sector. These regulations establish a clear legal corridor, significantly influencing operational strategies, risk management, and the overall growth potential of the market.

Unlocking Vast Growth Potential: IMF Experts Optimistic About Vietnam’s Economic Expansion

At the macroeconomic and financial update session hosted by the IMF on the afternoon of October 7th, experts painted a multifaceted picture of Vietnam’s economy. While acknowledging its impressive growth rate, they also highlighted the underlying risks it faces.

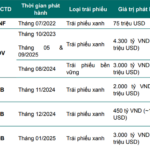

Green Bonds Struggle to Gain Traction Amid High Issuance Costs, Experts Warn

Vietnam’s sustainable bond market remains nascent, accounting for a mere 1.6% of total corporate bond debt—significantly lagging behind the global average of 4% and Asia’s 8%. Experts attribute this sluggish growth to prohibitive issuance costs, a lack of incentives, and an underdeveloped, fragmented support ecosystem.

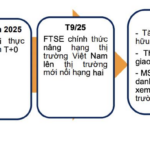

A Bumpy Ride to Brilliance: Vietnam’s Decade-Long Ascent to Emerging Market Status

Vietnam’s dream of upgrading its status has officially come true, marking a significant milestone as the nation sheds its constraints and steps into the secondary emerging market classification. This new chapter places Vietnam alongside countries renowned for their remarkable economic growth trajectories.