Sun Group Corporation (SGC) – a leading enterprise within the Sun Group ecosystem – has released its financial report for the first half of 2025, showcasing robust business performance. The report highlights a substantial capital base, improved liquidity, and steady profit growth.

According to the report submitted to the Hanoi Stock Exchange (HNX), as of June 30, 2025, SGC’s equity reached over VND 15,286 billion, with undistributed post-tax profits nearing VND 2,568 billion—a 15% increase compared to the same period last year.

These figures underscore the company’s strong financial foundation, positioning it for its next phase of growth.

Rendering of Sun Group’s urban development project in Quang Tri

The company’s capital structure is deemed secure and aligned with the real estate industry’s requirements. The debt-to-total-assets ratio stands at 0.71, while the debt-to-equity ratio is 2.49—a prudent level for leveraging financial strategies in project development.

Notably, all bond principal and interest payments were made on time, reinforcing the company’s financial credibility and capability.

A key highlight is the significant improvement in short-term liquidity, rising to 1.64 times from 1.47 times in the same period last year. The interest coverage ratio reached 1.37, indicating that operating profits adequately cover financial expenses and ensure stable cash flow.

In the first half of 2025, SGC achieved a post-tax profit of VND 241 billion, elevating the return on equity (ROE) to 1.69% and return on assets (ROA) to 0.5%—both showing marked improvement over the previous year.

As a key player in the Sun Group ecosystem, SGC’s stable financial foundation, secure liquidity ratios, and growing profits position it for ambitious expansion and development in the coming years.

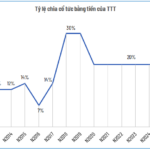

TTT Sustains 5 Consecutive Years of 20% Cash Dividend Payouts

Tay Ninh Tourism and Trading Joint Stock Company (HNX: TTT) has announced the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for October 28, with the payment expected to commence on November 25.

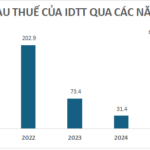

Cà Mau Fertilizer (DCM): Q3 Profit Surges 2.6x YoY, 9-Month Earnings Surpass Full-Year Target

Alongside the promising business results for the first nine months of 2025, the leadership of Cà Mau Fertilizer has highlighted challenges related to the supply of input gas.