AI-Generated Image

Vingroup has announced the establishment of VinMetal Joint Stock Company, officially entering the metallurgy industry. This move expands the conglomerate’s existing Industrial – Technology pillar. VinMetal aims to meet the internal demands of Vingroup’s ecosystem while contributing to the development of heavy industry in Vietnam.

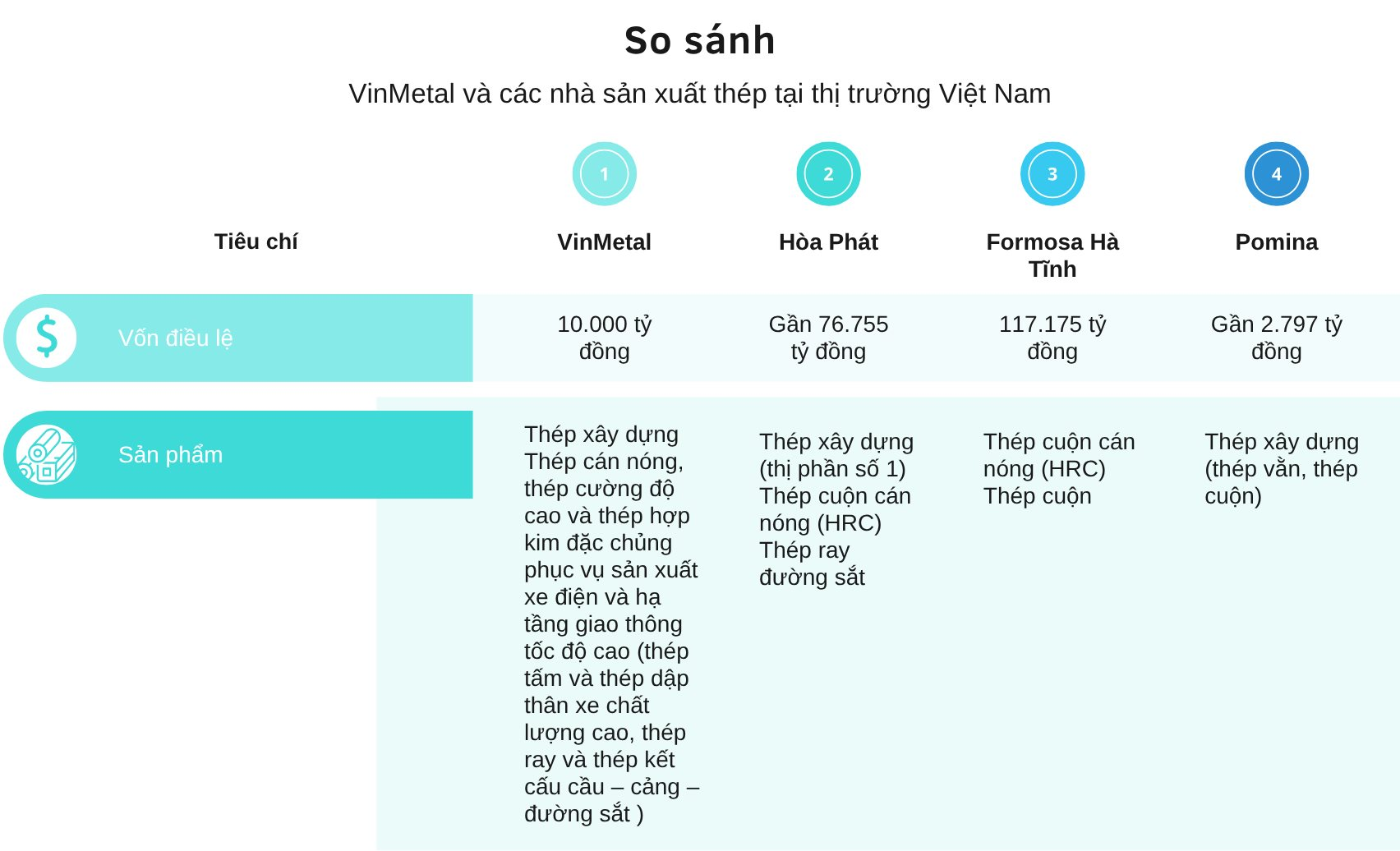

With a chartered capital of VND 10 trillion, VinMetal plans to construct a high-tech industrial steel complex in Vung Ang, Ha Tinh, targeting an initial annual capacity of 5 million tons.

The company will focus on producing civil steel for construction, hot-rolled steel, high-strength steel, and specialty alloy steel for electric vehicles and high-speed transportation infrastructure.

Key products include high-quality sheet steel and stamped vehicle body parts, railway steel, and structural steel for bridges, ports, and railways, all meeting international standards. These products aim to replace imports and gradually penetrate regional export markets.

VinMetal’s establishment primarily addresses the material needs of Vingroup’s core sectors, such as Vinhomes real estate and VinFast electric vehicle production.

Additionally, Vingroup seeks to secure a stable supply of high-quality steel for proposed industrial, energy, and transportation projects, including the North-South high-speed railway, the Ho Chi Minh City – Can Gio route, and the Hanoi – Quang Ninh route.

In terms of capital, VinMetal’s VND 10 trillion investment is modest compared to Vietnam’s leading steel companies like Hoa Phat (VND 77 trillion) and Formosa Ha Tinh (VND 117 trillion), but surpasses Pomina (VND 2.8 trillion).

Among Vietnamese steel producers, Hoa Phat is VinMetal’s closest competitor in terms of product overlap.

Hoa Phat, the market leader in construction steel, is the only Vietnamese company, alongside the FDI firm Formosa Ha Tinh, capable of producing hot-rolled coil (HRC).

HPG is investing VND 14 trillion in a railway and structural steel mill in Dung Quat (Quang Ngai). Scheduled for completion in Q1 2027 after 20 months of construction, the mill will produce specialty railway steel for high-speed and urban railways, bridge steel, and high-quality structural steel (U, I, H, V).

Hoa Phat Chairman Tran Dinh Long stated that the project aims to optimize the group’s production chain and fulfill commitments to the government in supplying strategic steel products for national infrastructure projects, notably the North-South high-speed railway with an investment of approximately USD 67 billion.

VinMetal focuses on civil steel for construction, hot-rolled steel, high-strength steel, and specialty alloy steel for electric vehicles and high-speed transportation infrastructure.

While smaller in scale than Hoa Phat, VinMetal leverages its position within the Vingroup ecosystem, supplying steel for Vinhomes real estate projects and VinFast electric vehicle production.

VinMetal also competes with Hoa Phat in providing high-quality steel for transportation projects like the North-South high-speed railway, the Ho Chi Minh City – Can Gio route, and the Hanoi – Quang Ninh route.

Formosa Ha Tinh primarily produces hot-rolled coil and steel coil, while Pomina specializes in construction steel, including ribbed and coil steel.

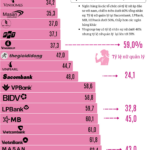

“Phạm Nhật Vượng’s Empire: Only 37.3% Female Staff, Yet Women Leaders Dominate at 59%—Banks Emerge as Female Strongholds, Except Sacombank”

The “women empowerment” narrative at Vingroup transcends mere statistics; it’s deeply embedded in the founder’s philosophy of talent utilization. Surrounding Chairman Phạm Nhật Vượng, the most senior leadership roles—spanning finance, business, and legal—are predominantly held by formidable women leaders.

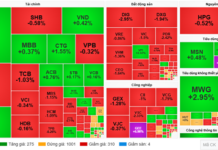

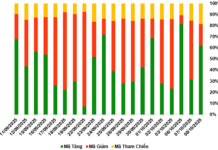

Hot News: FTSE Russell Upgrades Vietnam to Emerging Market Status

After more than seven years of anticipation, investors have finally witnessed a historic moment as FTSE Russell officially upgraded Vietnam to emerging market status.

Elevating Market Status: A Catalyst for Vietnam’s Stock Market Ascendancy

According to Tran Hoang Son, Director of Stock Market Strategy at VPBank (VPBankS), FTSE Russell’s confirmation of Vietnam’s stock market upgrade to Secondary Emerging status brings significant benefits. These include increased foreign investment inflows, enhanced market liquidity and efficiency, elevated economic reputation and standing in the region, and accelerated economic and corporate growth.

Vietnam’s State Securities Commission: Market Upgrade Marks the Beginning of a New Development Phase

According to the State Securities Commission (SSC), this event marks a significant milestone, showcasing the robust growth of Vietnam’s stock market. It reflects the comprehensive reform efforts undertaken by the entire securities industry in recent years, aligning with the directives of the Party and the State to develop a transparent, modern, and efficient stock market that meets the highest international standards.