Experts at the macroeconomic update session on the afternoon of October 7th.

|

An Impressive Growth Landscape

Dr. Jochen Schmitmann – Chief of Mission for the International Monetary Fund (IMF) in Vietnam, Cambodia, and Laos expressed admiration for Vietnam’s reform pace over the past year. The country’s economic growth in the first nine months of 2025 reached 7.8%, the highest since 2011. This momentum stems from diverse factors, including robust growth in manufacturing and exports despite tariffs, sustained high levels of FDI, domestic demand recovery, tourism resurgence, and public spending boosts for administrative reforms.

Monetary and fiscal policies have supported this growth. The State Bank of Vietnam (SBV) maintained suitable interest rates, with credit growth projected at 18-20% this year. Fiscal policy has also been expansionary, bolstering economic demand.

Government institutional reforms, such as ministry mergers, reduced local government tiers, fewer provinces, and a target to streamline 100,000 public sector jobs, have been well-received. However, beneath these impressive figures lie potential risks.

Headwinds and Hidden Risks

In its latest report, the IMF highlights three key risks to Vietnam’s growth model:

First, financial risk is the most pressing concern. Vietnam’s credit-to-GDP ratio is nearing 140%, far exceeding the 40% average for emerging markets. Projected credit growth of 18-20% this year could lead to asset quality issues. Additionally, Vietnam’s banking system has one of the region’s lowest capital adequacy ratios (CAR).

Second, export success brings trade dependency risks. Vietnam’s massive bilateral trade surplus with the U.S. (second only to China and Mexico) leaves the economy vulnerable to shifts in the global trade environment.

Third, the cryptocurrency market poses risks. The IMF notes Vietnam as one of the world’s most active crypto markets. Large cross-border crypto-related flows may explain some unrecorded capital movements.

IMF analysis reveals that Vietnam’s productivity growth has been “nearly zero” over the past 20 years, meaning growth relies heavily on capital and labor increases. Key causes include inefficient capital allocation in financial markets, higher borrowing costs for private firms compared to state-owned enterprises, labor skill mismatches, and limited linkages between FDI and domestic firms.

Outlook and Market Perspectives

Mr. Phạm Vũ Thăng Long – Director of Macroeconomic Research at HSC Securities forecasts that due to countervailing tariffs, 2026 exports and imports will slow to 5% and 5.5% growth (from this year’s estimated 11% and 13%), before rebounding in 2027.

HSC believes Vietnam remains competitive because its post-tariff average rate of 18% is still lower than most ASEAN peers and significantly below China (38%) and India (37%). However, sectors like textiles (37.5%), footwear (30%), and metals (36%) face higher tariffs. Despite this, Vietnam retains advantages in key categories like machinery, electronics, and furniture.

IMF warns that considering transshipment risks, Vietnam’s average tariff could rise from 18% to over 25%. This risk is acute for low domestic value-added goods reliant on Chinese inputs, such as electronics, textiles, footwear, and machinery.

Mirroring trade projections, HSC expects FDI commitments and disbursements to slow in 2026 before recovering in 2027. Yet, in the first nine months of 2025, FDI disbursements rose 8.5%, and commitments increased 15.2%, reflecting investor optimism as tariff clarity improves.

Vietnam maintains long-term FDI attractiveness with competitive energy prices (second-lowest electricity costs regionally) and a vast FTA network (17 signed, second only to Singapore). However, challenges remain, including underutilized FTA opportunities and trade imbalances with China.

Key FDI enhancements include infrastructure development, legal framework improvements, and administrative procedure simplification.

Mr. Michael Kokalari – Chief Economist at VinaCapital offers a more optimistic view. He predicts tariff reductions due to U.S. inflation concerns and forecasts domestic consumption returning to 8% growth as pandemic-depleted savings are replenished.

Comprehensive Reforms Needed

IMF experts argue that while monetary policy has limited easing room, fiscal policy remains flexible due to a low debt-to-GDP ratio (around 32%). Comprehensive reforms could add 2 percentage points to annual growth.

Priorities include improving credit allocation to high-productivity sectors and achieving investment-grade credit ratings to attract international infrastructure funding, requiring policy reforms and enhanced transparency.

Addressing Vietnam’s record trade surplus and FDI inflows alongside currency pressures, Dr. Schmitmann recommends: (1) enhancing capital flow monitoring (including crypto); (2) reevaluating low-interest rates given U.S. rate differentials; and (3) fostering a more attractive investment climate to retain capital and develop financial markets like the bond market.

– 08:42 08/10/2025

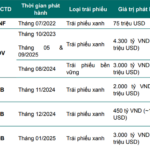

Green Bonds Struggle to Gain Traction Amid High Issuance Costs, Experts Warn

Vietnam’s sustainable bond market remains nascent, accounting for a mere 1.6% of total corporate bond debt—significantly lagging behind the global average of 4% and Asia’s 8%. Experts attribute this sluggish growth to prohibitive issuance costs, a lack of incentives, and an underdeveloped, fragmented support ecosystem.

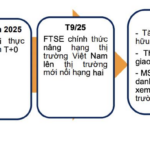

A Bumpy Ride to Brilliance: Vietnam’s Decade-Long Ascent to Emerging Market Status

Vietnam’s dream of upgrading its status has officially come true, marking a significant milestone as the nation sheds its constraints and steps into the secondary emerging market classification. This new chapter places Vietnam alongside countries renowned for their remarkable economic growth trajectories.

Investors Remain Unfazed by Local Currency Depreciation Amid Strong Stock Market Performance

VinaCapital’s experts forecast a 4-5% depreciation of the Vietnamese Dong this year, with a similar outlook for next year. According to Mr. Kokalari, if the economy and stock market perform well, investors are unlikely to be overly concerned about this modest devaluation. Nonetheless, it remains a point worth monitoring.

Sun Group and Hilton Forge Strategic Partnership to Develop Accommodation Infrastructure for APEC 2027

On the morning of October 7, 2025, Hilton’s senior leadership arrived in Phu Quoc to sign a strategic partnership with Sun Group, aiming to develop five luxury hotels with over 2,000 rooms across Quang Ninh, Da Nang, and Phu Quoc. This milestone marks the debut of Conrad Hotels & Resorts and LXR Hotels & Resorts in Vietnam, while also preparing premium accommodations to support the upcoming APEC 2027.